UNCTAD: Container Lines Have Stronger Bargaining Power

The newly released 2018 edition of the UNCTAD Review of Maritime Transport highlights that consolidation activity in liner shipping has continued unabated, creating a complex dynamic with ports that sees alliances gaining bargaining power.

As of January 2018, the top 15 shipping lines accounted for 70.3 percent of all capacity. Their share has increased further with the completion of the operational integration of the new mergers in 2018, with the top 10 shipping lines controlling almost 70 percent of fleet capacity as of June 2018.

Growing consolidation can reinforce market power, potentially leading to decreased supply and service quality, and higher prices, notes the report. Some of these negative outcomes may already be in effect. For example, in 2017–2018, the number of operators decreased in several small island developing States and structurally weak developing countries.

Growing consolidation can reinforce market power, potentially leading to decreased supply and service quality, and higher prices, notes the report. Some of these negative outcomes may already be in effect. For example, in 2017–2018, the number of operators decreased in several small island developing States and structurally weak developing countries.

“There is a need to assess the implications of mergers and alliances and of vertical integration within the industry, and to address any potential negative effects,” said Shamika N. Sirimanne, Director of UNCTAD’s Division on Technology and Logistics. “This will require the commitment of all relevant parties, notably national competition authorities, container lines, shippers and ports.”

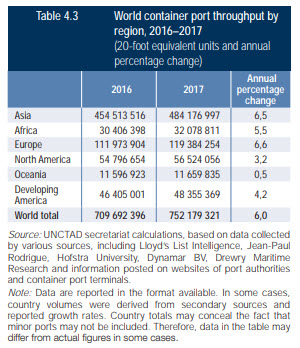

Port traffic volumes picked up speed: global port activity and cargo handling expanded rapidly in 2017, following two years of weak performance. UNCTAD estimates that 752 million TEUs were moved at container ports worldwide in 2017. The outlook for global port handling activity remains positive supported by projected economic growth and port infrastructure development plans.

Port operations, performance and bargaining power continued to be defined by mega-ship deployment and alliance restructuring, states the report. Liner shipping alliances and vessel upsizing have made the relationship between container shipping lines and ports more complex and triggered new dynamics where shipping lines have a stronger bargaining power and influence.

“Increases in the size of vessels and the rise of mega-alliances have heightened the requirements for ports to adapt. While liner shipping networks seem to have benefited from efficiency gains arising from consolidation and alliance restructuring, for ports, the benefits did not evolve at the same pace. This dynamic is further complicated by the shipping lines often being involved in port operations which in turn could redefine approaches to terminal concessions.”

The report says that global ports and terminals need to track and measure performance as port performance metrics enable sound strategic port planning, investment and decision-making.

that matters most

Get the latest maritime news delivered to your inbox daily.

Tables courtesy of the UNCTAD Review of Maritime Transport 2018.