Top 100 U.S. Oil and Gas Fields

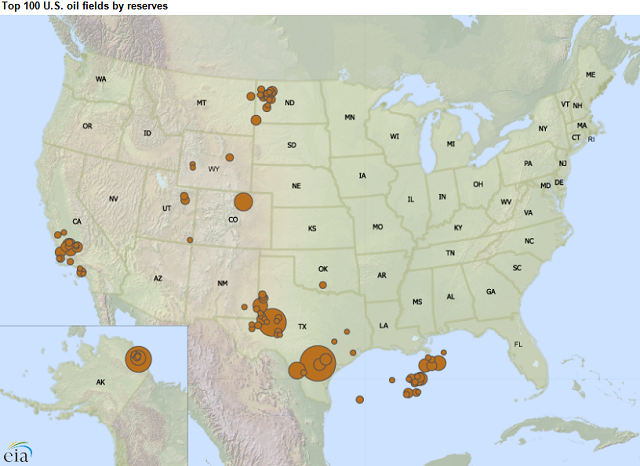

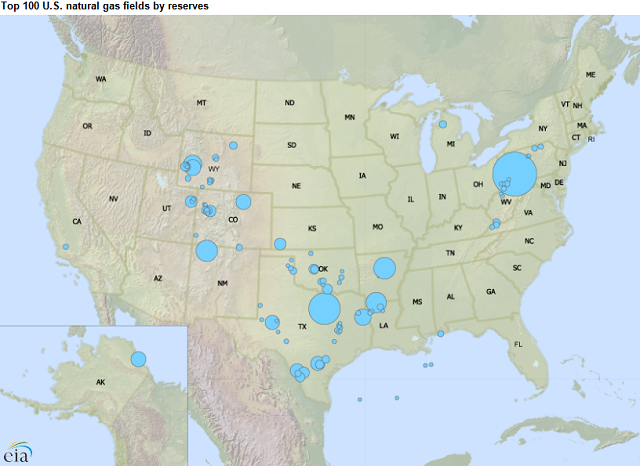

The U.S. Energy Information Administration has published its ranking of the top 100 oil and natural gas fields. Based on 2013 data, the top 100 oil fields in the U.S. accounted for 20.6 billion barrels of crude oil and lease condensate proved reserves, or 56 percent of the U.S. total for the year. The top 100 natural gas fields accounted for 239.7 trillion cubic feet of natural gas proved reserves, 68 percent of the U.S. total.

According to EIA's report on U.S. oil and natural gas reserves, both crude oil and natural gas reserves increased in 2013. Oil reserves increased for the fifth consecutive year, reaching 36.5 billion barrels, and natural gas reserves offset their 2012 decline and reached a record high of 354 trillion cubic feet. Because prices affect the economics of production, price changes can have a significant effect on companies' proved reserves.

EIA last published the rankings of the top 100 oil and natural gas fields in 2009. Since then, using 2013 data, oil fields in the Eagle Ford and Bakken shale plays and natural gas fields in the Marcellus Shale have become significant contributors to total U.S. reserves. Fields in the Marcellus and Eagle Ford plays appear at the top of the list in their respective categories, whereas in 2009 the Marcellus fields were ranked in the bottom half of the list, and Eagle Ford fields (discovered in 2008) did not appear in the top 100.

Alaska's Prudhoe Bay, previously the oil field with the largest amount of reserves, fell to third, behind fields in the Eagle Ford and Permian Basin.

The Securities and Exchange Commission (SEC) requires companies to assess proved reserves based on the average of the prices of a crude benchmark on the first day of each month for the year. Using, for example, front-month West Texas Intermediate (WTI) futures closing prices for the first trading day in each month of 2013, this value was $97.28 per barrel (bbl) for 2013. The comparable value for 2014, for which EIA is now collecting proved reserves data from operators, was slightly lower at $94.42/bbl.

However, prices that will be used for determining proved reserves for 2015 are forecast to be much lower. Nearly a third of the way through 2015, first-of-the-month average price for WTI for the first four months of the year is $50.49/bbl, a 47 percent decline from the 2014 price. This could result in reduced proved reserve additions and possibly some reduction in previously identified proved reserves for 2015 because some projects would become uneconomic.

More information can be found in EIA's report, Top 100 U.S. Oil and Gas Fields.