Price Gap Between Low and High Sulfur Fuel Oil Boosts Scrubber ROI

Recently, ZEME and Zhejiang Energy Group Industrial Research Institute released a new report entitled "Analysis and Prediction of Oil Price between High and Low Sulfur Marine Fuel and Economic Analysis of Installing Desulfurization System." The report analyzes the trend of the oil price difference in the past three years, and forecasts the lowest ($150/tonne) and average ($170/tonne) of the fuel oil price difference in the next two years. At the same time, based on accumulated experience from multiple projects, the return of investment for fitting desulfurization systems for different ship types under different oil price differences is analyzed.

New sulfur emissions regulations for marine fuel oil have been implemented in 2020 by the International Maritime Organization (IMO) causing the industry to use low sulfur fuel oil or use high sulfur fuel oil paired with an exhaust gas cleaning system (EGCS). Pricing for high and low sulfur fuel has fluctuated in the last three years with the supply and demand of crude oil, the COVID-19 pandemic and the Russia-Ukraine war.

A China-based company, Zhejiang Energy Marine Environmental Technology (ZEME), has analyzed and forecasted the price difference between low and high sulfur oil as well as the marine market and future use of EGCS technologies. High-sulfur oil has three major uses: power generation, refinery processing and marine use. Since the implementation of the IMO 2020 sulfur content standard, low sulfur oil has become the main fuel source in the marine industry.

The pricing of high sulfur oil is mainly dependent on residual oil, while pricing of low sulfur oil is mainly anchored on marine diesel. In April 2020, the global pandemic caused a sharp drop in crude oil prices, which narrowed the price difference between low and high sulfur oil. As the economy recovered worldwide, the demand for crude oil and refined oil increased and the price difference expanded. The difference remained above $150/tonne, even as crude oil prices fell.

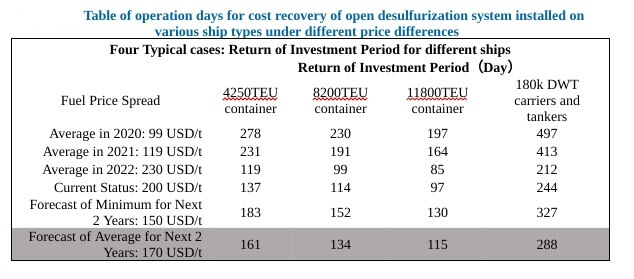

Due to the recovery of the global demand for crude oil and refined oil after the pandemic, coupled with a decline in refining capacity and a shortage of diesel fuel, ZEME has predicted that over the next two years, the average price difference will be around $170/tonne. There has been insufficient upstream investment causing the shortage for diesel fuel in particular. The price is not only dependent on supply and demand, but also the Russia-Ukraine conflict. With the sanctions placed on the price per barrel, it is unlikely that the prices will change drastically.

ZEME's customer base currently prefers the open loop system due to lower cost, simplicity, and shorter installation time. The medium and large ships are preferred for retrofitting because of the high fuel consumption for cost recovery purposes.

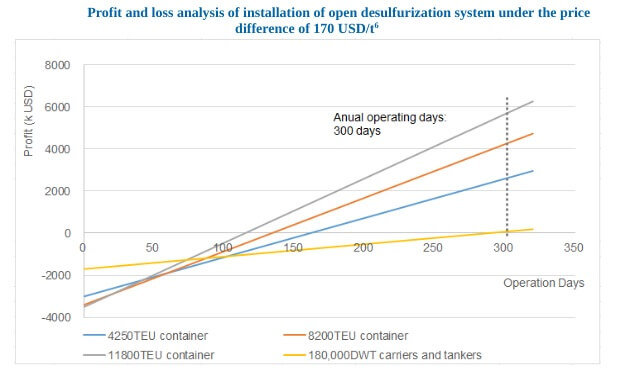

ZEME serves six typical types of ships and has selected a 180,000 DWT tanker/bulk carrier and three types of container ships for their analysis (above). The profit and loss analysis showed that installing open loop EGCS under a price difference of $170/tonne will yield considerable return on investment. The investment recovery days of each ship type were calculated under varying high and low sulfur oil price differences to study the impact on the payback period.

The International Energy Agency (IEA) predicts that the price difference between low and high sulfur oil will not be less than $150/tonne in the next two years, making the return on investment of installing an EGCS and using high sulfur oil significant.

This content is sponsored by ZEME. For more information or a copy of the full report, please feel free to contact marketing@zeme-china.

Image courtesy ZEME

The opinions expressed herein are the author's and not necessarily those of The Maritime Executive.