With Credit Tight, Tanker Orders Fall

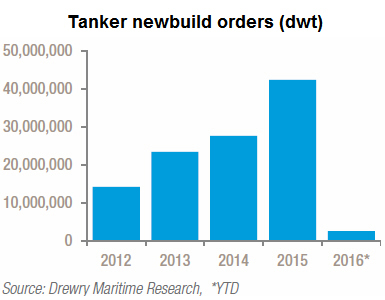

In its latest report on the tanker fleet, Drewry notes a marked slowing trend, with only 34 vessels ordered in the first quarter, down by a factor of ten from 368 ordered in the same period last year. When compared on the basis of tonnage, the fall is even steeper – only 2.6 million dwt these past three months, versus 45 million in Q1 of 2015.

Like other observers, Drewry says that the slowdown is due in part to difficulty in obtaining credit, but says that the restriction may end up helping the industry by limiting overcapacity. Even without further contracts, the total orderbook already represents about one fifth of the existing fleet, and about 80 percent of these newbuilds are due for delivery by early 2018 – including more than 200 crude tankers.

“The tanker market is expected to be oversupplied in the next two years due to hefty deliveries and relatively slow growth in the crude oil trade. If the [ordering] slowdown in ordering continues further it will keep fleet growth in check in the later years, which in turn will support tonnage utilisation in the tanker market,” said Rajesh Verma, Drewry’s lead analyst for tanker shipping.

The Wall Street Journal echoes his analysis, reporting that tanker owners see potential for an overcapacity problem similar to that in container and bulk shipping. "The tanker market has been fairly immune to the depression in the market until fairly recently,” said Tony Salgado of Blank Rome LLP, speaking to the Journal. But now, with so many newbuilds coming down the ways, the tanker industry "is in essence seeing the same thing and ratcheting back their orderbook.”

However, for firms signing new contracts now, the prices are favorable. “Newbulding prices declined during the quarter on account of the slowdown in tanker ordering, which coincided with weakness in newbuilding activity in other sectors as well, keeping prices under pressure. If ordering remains weak in the coming quarters, newbuilding prices could soften further,” Verma said.

In first quarter results Monday, Nordic American Tankers suggested that acquisition of existing vessels was an economical alternative: it will be taking the delivery of four older Suezmaxes, two built in 2004, one in 2003 and one in 2000, for a total of about $100 million. Noting that shipbuilding technology for tankers has not changed much over the interim, NAT said that it expects high quality and good value from these used ships. The transaction increases the firm's fleet to 30 vessels, and – in good news for rates – it won’t increase the global fleet at all.