DONG Energy Mulls Oil and Gas Exit

DONG Energy may shed its oil and gas business, sharpening its focus on wind power and potentially opening the door to a deal with Danish peer A.P. Moller-Maersk, which is also seeking a new home for its energy assets.

DONG Energy has moved to the forefront of international offshore wind farm development, and that business became its biggest contributor to profits in the first half of this year.

Joining a list of firms that, hit by a two-year slump in oil prices due to oversupply, have looked at selling oil and gas assets to raise funds, DONG Energy said on Wednesday the operations were no longer of long-term strategic importance.

"(We are) reviewing strategic options regarding the future of the oil and gas business," it said in a statement, adding it had hired JP Morgan to conduct a market assessment of the assets, which Sydbank analyst Morten Imsgard said could be worth up to 14 billion Danish crowns ($2.05 billion).

If DONG Energy decided to sell, it would directly compete with billions of dollars of oil and gas assets already up for grabs, many in the North Sea where costs are relatively high due to the basin's maturity.

In September, Maersk said it was seeking alliances or a separate listing for its energy operations while bulking up its transport business.

Maersk held talks last year on possibly buying buy DONG Energy's oil and gas business but the companies failed to agree on a price, sources told Bloomberg last month.

Asked if Maersk was interested in buying the firm's oil and gas assets, a spokeswoman said the company did not comment on speculation, adding: "We consider suitable options for growth on a case-by-case basis."

Sydbank's Imsgard said he would not rule it out.

"It's an open question, what Maersk oil's strategy is, whether it is to buy itself bigger before floating or merging with an even bigger company," he said.

"It hasn't become less likely, that Maersk could acquire the division."

DONG Energy, which also said its financial outlook for 2016 was unchanged, was floated on the Danish stock market in June in Europe's biggest listing so far in 2016, raising 17 billion crowns ($2.6 billion).

In connection with its IPO, DONG Energy confirmed its intention to build a world-class clean energy company with a portfolio based on leading competences in offshore wind, bioenergy and green distribution and customer solutions. DONG Energy further said that it would manage its oil and gas business for cash, and that future cash flows from the oil and gas business would be used to fund DONG Energy’s investments in renewable energy.

Its wind farm business generated 42 percent of its earnings before interest, tax, depreciation and amortization (EBITDA) in the first half of 2016, overtaking oil and gas.

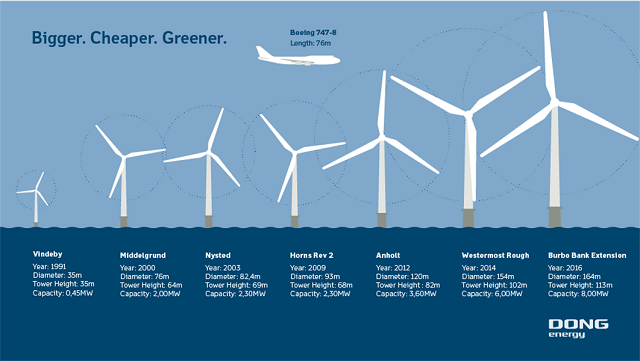

DONG Energy is the first company worldwide to have installed 1,000 offshore wind turbines, and its offshore wind power venture will continue unabated.

that matters most

Get the latest maritime news delivered to your inbox daily.

"In the space of only a few years, offshore wind has evolved from being a niche technology to being recognized as a reliable and clean energy source supplying power on utility scale and playing an important role in the green transformation of the energy sector,” says Senior Vice President Anders Lindberg, who is responsible for the construction of offshore wind farms at DONG Energy.

At the end of 2015, DONG Energy had installed offshore wind farms with a total capacity of 3GW. Towards 2020, DONG Energy is building a number of large offshore wind farms in the U.K. and Germany that will increase capacity to 6.7GW, equalling the electricity consumption of 17 million Europeans. As a result, in just four years, DONG Energy is building more offshore wind capacity than in the previous 25 years altogether.