Container Volume Rebounds in Black Sea, Driven By Ukrainian Ports

The Black Sea container terminals of Bulgaria, Romania and Ukraine handled 1,313,392 TEU in 2024, including empty containers and transshipment.

This review examines the laden container volumes of these countries imported and exported by sea only, since waterborne container traffic in Ukraine is about 30% of the total. The total increase achieved by these three countries for the period was 12% compared to the same period last year and comprised 1,015,563 TEU.

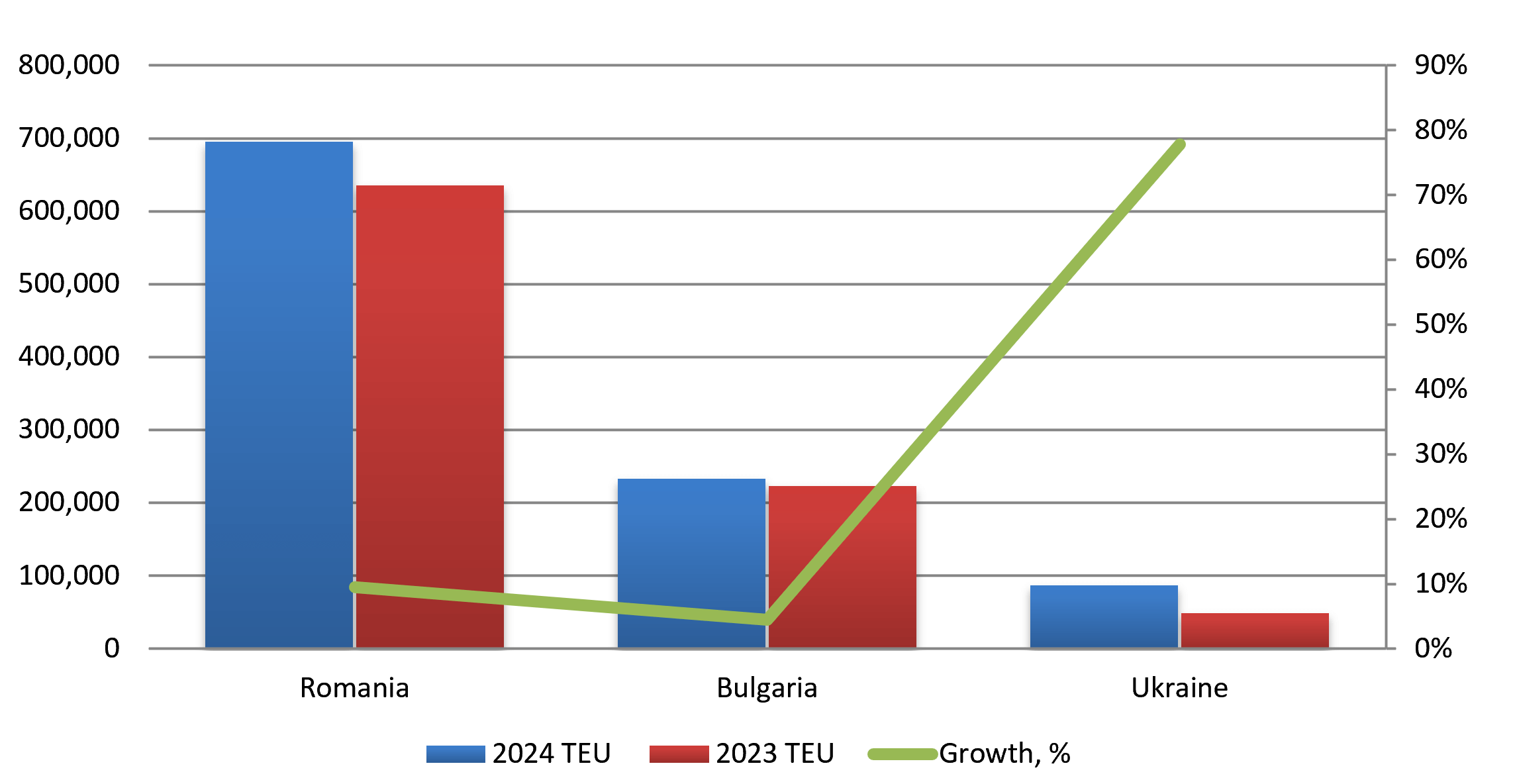

Black Sea region turnover, 2024 vs 2023, laden containers (TEU)

The laden container turnover increase was in all these countries. In 2024 the highest percentage growth was achieved by Ukraine – 78%.

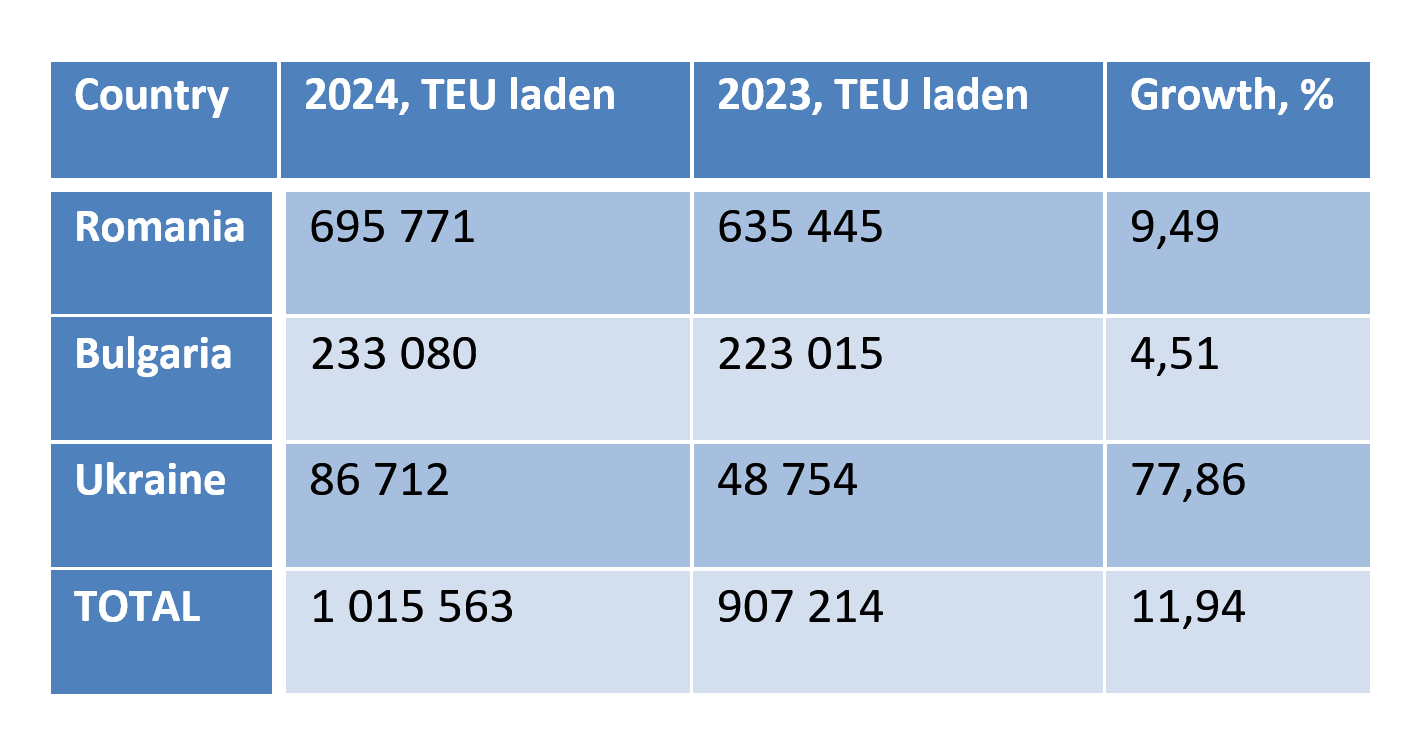

Laden container turnover by country, TEU

Laden container turnover by country, TEU

During this period, 54% of full containers handled were imported, with 46% of the volume being exported. It is estimated that laden containers share was 77% and empty containers share was 23%.

Import volumes to the aforementioned countries increased by 21% compared to 2023. The highest import volume increase was shown by Ukraine – 154%. In Romania there was an increase of 22%, while in Bulgaria there was an increase of 4%.

Exports from these countries increased by 3%, mainly because of Ukrainian and Bulgarian export volume growth of 47% and 5% (respectively). There was a slight decrease of laden export volume in Romania – 3%.

Thus, the percentage of laden volume handled by each country in 2024 distributed as follows: Romania – 67%, Bulgaria – 23%, and Ukraine – 10%. The top three container terminals in these countries were DPW (Constanta, Romania), VARNA (Bulgaria) and BURGAS (Bulgaria).

The remarkable rebound in Ukraine's container traffic was a key factor in the broader recovery of maritime trade within the Black Sea region. Notably, Ukraine's growth rate significantly outpaced its neighbors, demonstrating its crucial role in driving this regional recovery. This strong performance underscores Ukraine's strategic importance as a trading hub in the Black Sea and highlights the significance of supporting its maritime infrastructure for the benefit of the entire region's trade network.

The initial groundwork laid by a local forwarding company, followed by the significant commitment from global shipping giants like MSC and Maersk, showcases the resilience and inherent potential of Ukraine's maritime sector. While the challenges posed by the ongoing conflict undoubtedly persist, the tangible evidence of this robust trade recovery offers a strong indication of progress and underscores Ukraine's unwavering determination to rebuild its economy and actively re-engage with the global marketplace.

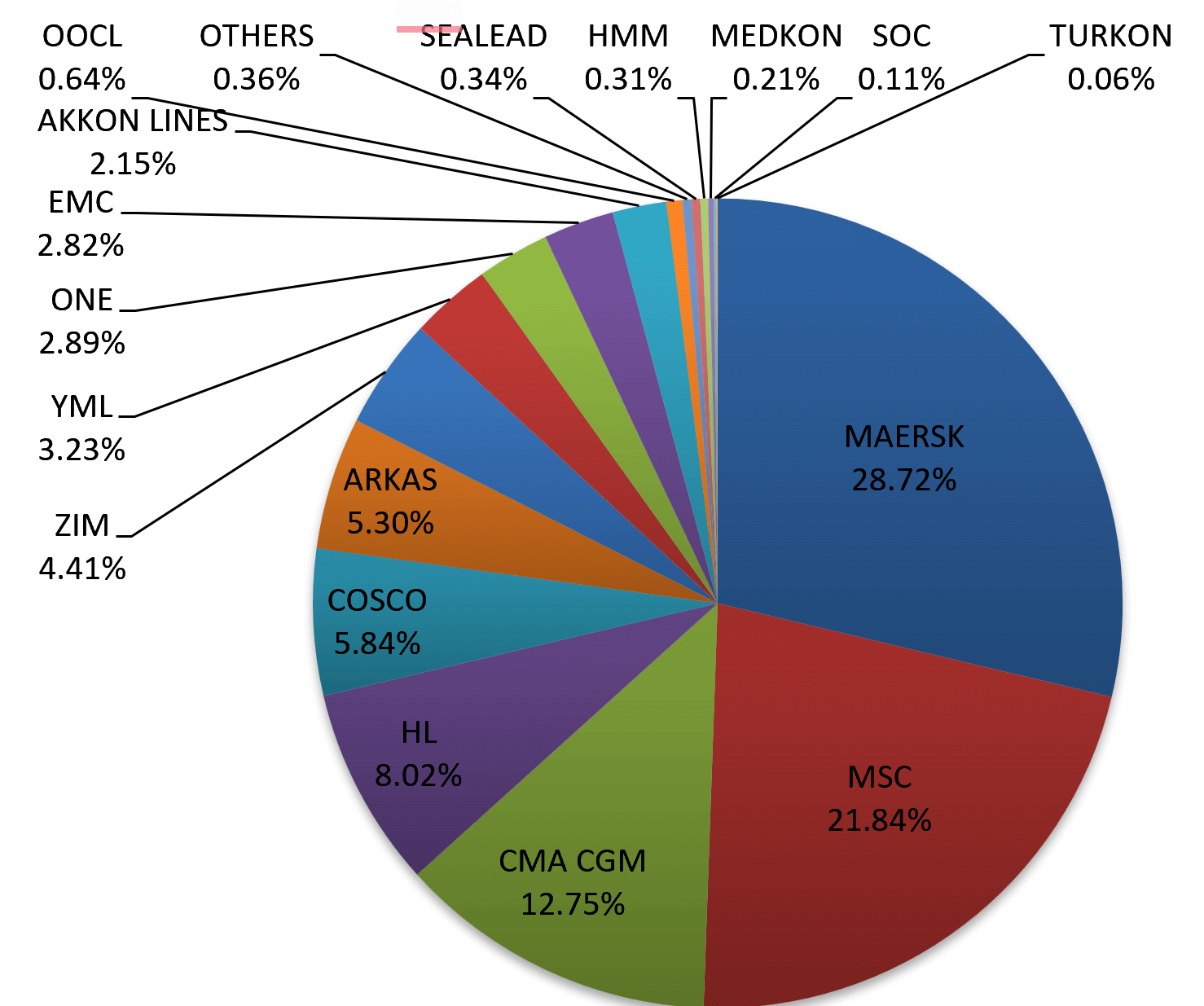

Bulgarian, Romanian and Ukrainian container carriers’ shares by total turnover, 2024

Bulgarian, Romanian and Ukrainian container carriers’ shares by total turnover, 2024

Historically Maersk, MSC and CMA CGM were leading carriers in the Black Sea region, and their total share of the market was more than 60% in recent years.

As for the other countries of the Black Sea, laden container turnover in Novorossiysk increased by 8% to 773,000 TEU. About 40% of this volume was transported by MSC and Turkish carriers in the Black Sea, while the other 60% was transported by local carriers in Russia. Georgia's total volume in 2024 reached 636,000 TEU.

The forecast of container turnover growth in the Black Sea region for 2025 shows that growth will amount to 8-10% and will exceed 3.2 million TEU in 2025. The major driver of that growth will be further restoration and expansion of direct container connection to Ukrainian ports.

Vassiliy Vesselovski is the CEO of Ukrainian shipping intelligence firm Informall BG. Daniil Melnychenko is a Data Analyst with the firm, and Alexander Khromov is a Project Manager.

The opinions expressed herein are the author's and not necessarily those of The Maritime Executive.