South Africa Needs to Act on Container Trade Potential

Over the past few months, announcements have emanated from Brazil as well as from around Africa about plans to expand and develop ports to serve much larger container ships. It is time for South Africa to do the same.

In Brazil, there are plans to develop both Port of Pecem located north of Fortaleza as well as Port of Santos located near Brazil’s largest metropolis to serve some of the largest container ships of some 20,000 TEUs. The shortest sea route between these South America ports and major Asian ports passes by Cape Town, South Africa, where it may be possible to develop a terminal for such large ships.

African Port Development

.jpg) There have been announcements from Port of Accra that could be dredged to accept neo-Panamax size container ships and Port of Sierra Leone that will be dredged to accept Panamax size ships. In Mozambique, the Port of Maputo was recently dredged to a depth of 14 meters (46 feet) and able to serve Panamax size container ships.

There have been announcements from Port of Accra that could be dredged to accept neo-Panamax size container ships and Port of Sierra Leone that will be dredged to accept Panamax size ships. In Mozambique, the Port of Maputo was recently dredged to a depth of 14 meters (46 feet) and able to serve Panamax size container ships.

While plans have been announced to expand Africa’s busiest maritime terminal located at Durban, there has been the ongoing problem of sand and silt building up at the entrance to the Port of Durban but no announcement as to how to resolve that problem.

The entrance to Port of Durban points to the northeast, where waves carry sand toward Durban’s attractive beaches and the southbound ocean current carries some of that sand south and toward the entrance to the Port of Durban. Perhaps a breakwater around that entrance may redirect some of that current borne sand to another location away from the entrance.

The railway line that connects Durban to South Africa’s largest and most populous metropolis, Johannesburg, passes through multiple tunnels and despite operating near maximum capacity, there is a need to move additional containers over this route.

State vs Private Ports

South Africa is committed to maintaining state-ownership of its maritime ports and has imposed restrictions on foreign investment. Ports Dubai operates the container terminal at the recently upgraded Port of Maputo that can now berth Panamax size of ships and wider vessels of equivalent length and draft. The railway line between Maputo and South Africa’s largest metropolis promises to incur lower per container transportation costs than competing longer distance railway lines that connect to South Africa’s container ports.

Recent developments at Port of Maputo should illustrate to South Africa’s government the merit of private port development.

Accra – Ngqura Port Connection

The dredging of the entrance to the Port of Accra to 19 meters (62 feet) and the inner harbor to 16 meters (52 feet) provides future prospects for neo-Panamax size ships to sail to the container terminal at Accra. Ships sailing from Asia to Accra would sail the sea route via South Africa, with Port of Ngqura becoming a port-of-call where the Asia – Accra ship could interline with ships sailing to/from the ports of Mombasa and Dar es Salaam. Container traffic moving between Equatorial East Africa and Equatorial West Africa could be transferred between ships at South Africa’s Port of Ngqura.

The future logistics of containers moving to and from South Africa mega-metropolis could involve Panamax size or wider-than-Panamax size ships of Panamax length and draft sailing into Ports of Maputo and Durban with neo-Panamax ships sailing into Port of Ngqura. Future container logistics and wave-current-sand dynamics would determine whether to further dredge Port of Maputo and lengthen the container quay to transit and berth neo-Panamax ships. While it may be possible to build a breakwater around the entrance at Port of Durban to deflect sand, the inland/overland transportation problem from Durban would likely persist.

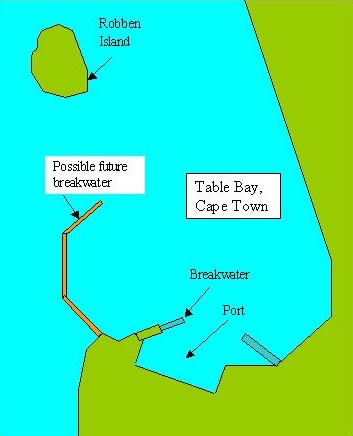

Mega Size Ships and Cape Town

Historically during winter, wild ocean waves have entered Table Bay and thrown ships on to the rocky beaches around that bay. Private investment could develop a seaward pointing curved breakwater that could extend north from Mouille Point toward Robben Island and withstand the severe winter wave conditions. Ships would sail between the breakwater and Robben Island into a year-round calm water zone where a multitude of ships could seek refuge or lay over. That investment could include developing container terminal quays to berth large container ships for which Cape Town may become a port-of-call.

Cape Town’s Maritime Situation

The deep water port for ore carriers at Saldanha Bay is located about 100 kilometers (62 miles) to the north of Port of Cape Town. Extended length trains carry iron ore for export from the mining town of Sishen to Saldanha Bay. Many other ore carriers could call at Saldanha Bay to deliver small amounts of certain ores. It would be possible to establish future manufacturing industries in the region between the ports of Cape Town and Saldanha Bay, with ores arriving at Saldanha Bay and most future output being exported through Port of Cape Town on board mega container ships.

Developing a large calm water zone at Cape Town could include reclaiming land to expand both the size of Robben Island and the tourist area at the redeveloped Victoria and Albert dock area, perhaps to include small islands connected by walkways and gondola canals. There may be scope to install a floating terminal in a future calm water zone protected by future breakwaters, at Cape Town where in the future, floating cranes could assist in transferring container to and from mega-size ships. Wave energy conversion technology could be installed in the energetic waters outside the calm water zone.

Conclusion

Overseas investment has funded the dredging of Port of Maputo that can now serve much large container ships at DP’s container port and help transfer container traffic to/from South Africa’s most populous region

South Africa’s inland mega-metropolis will depend on the combination of three ports (Durban, Maputo and Ngqura) to process the increasing volume of overseas container traffic

The capacity problem of the inland transportation link leading west from Durban and continued sand build up at the entrance to the Port of Durban enhance prospects for the ports of Maputo and Ngqura

Development of Port of Accra could see neo-Panamax ships stopping at Port of Ngqura

that matters most

Get the latest maritime news delivered to your inbox daily.

The development of two ports in Brazil to serve large container ships increases South Africa’s need to provide a port-of-call for these ships that will sail the Brazil – Asia service

There is much potential to further develop Port of Cape Town that could include inviting overseas investment to participate in or guide that development

The opinions expressed herein are the author's and not necessarily those of The Maritime Executive.