What is the Government’s Role in Stabilizing Supply Chains?

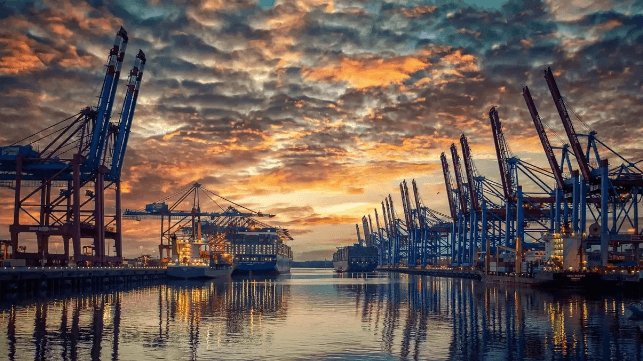

For the past two years, supply chains have drastically evolved from a fringe topic into a part of the everyday political discourse. In Washington, D.C., the attention on ports congestion on the West Coast has been sustained and intense, especially when compared with the limited prominence seaports had two years ago.

Starting by establishing a Supply Chain Disruptions Task Force and appointing a port envoy, the White House is seemingly on overdrive to fix container shipping. The 2022 U.S. Economic Report by the Council of Economic Advisers (CEA) - released last month - featured a whole chapter on the supply chain, a topic given a wide berth in previous reports.

The central argument in the report revolves around successive events that have caused supply chains to break. Indeed, modern supply chains have driven down consumer prices for many goods, but they have become more prone to disruption. This fragility has been exacerbated as firms have removed excess capacity - for example, extra inventory, or reserves of people with the time and skills to solve problems.

In addition, two major factors have increased attractiveness of offshoring and outsourcing within supply chains.

First is increased access to foreign suppliers, making offshoring cost-effective. Adoption of IT in logistics, reduction in trade barriers, containerization and widespread government subsidization of manufacturing industries are some of the reasons that goods can move quickly and consistently across national borders.

Second, the sole use of financial metrics in corporate decision-making has forced many firms’ executives to opt for offshoring, as savings in costs are measurable. For instance, 47 percent of S&P companies in 2021 tied CEOs compensation to financial measures such as earnings per share, stock prices and return on equity, compared to only 16 percent in 1970s. Such incentives have made managers to focus more on financial statement numbers than on less easily measurable metrics, like resilience.

“Financial metrics can be misleading. Although an outside or offshore supplier may offer a lower unit price, these savings may be eaten away by hidden costs, such as longer lead times, increased vulnerability to disruption, and reduced access to ideas for innovation due to linguistic and geographic distance,” suggests the report.

Given that the frequency and magnitude of supply chain disruptions is poised to increase, especially from climate-related events, what should be the response from private sector and government?

Since the pandemic began, companies have lost billions of dollars from broken supply chains. Production had to slow down due to lack of inputs, and this incentivizes investment in resilience.

It includes firms understanding the structure of their supply chains (visibility), investing in backup capacity (redundancy), and improving on the ability to solve problems and substitute inputs (agility). Unfortunately, the operational costs will increase. In this case, there is an important role for governments to play in incentivizing private sector decisions for long-term supply chains stability, notes the report.

Particularly, the government can promote robustness in supply chains through aggregating and disseminating information, as intended in the recent US government initiative called Freight Logistics Optimization Works (FLOW). Essentially, it is a digitized national freight data platform, connecting ports, shippers association, ocean carriers and freight forwarders, among others. The idea is to create a form of visibility and transparency on movement of cargo across national borders and anticipating disruptions downstream.

that matters most

Get the latest maritime news delivered to your inbox daily.

However, some analysts question the extent of government’s role in mending broken supply chains, as recommended by CEA.

“The report goes astray when it attempts to define an appropriate role for the government. This section underplays the complexity of modern supply chains; it highlights how the government resolved shortages by publishing data on hospitals’ stocks of personal protective equipment, but that does not have much to do with industries in which the absence of some obscure component made far down the chain forces the final manufacturer’s production line to shut down. The report praises stiffer requirements for domestic content in federal purchases — a Biden Administration priority — but offers no evidence to support its claim that this will make U.S. supply chains more resilient,” observed Marc Levinson, an economist and author of the book Outside the Box.

The opinions expressed herein are the author's and not necessarily those of The Maritime Executive.