U.S. Onshore Costs Making Deepwater Attractive

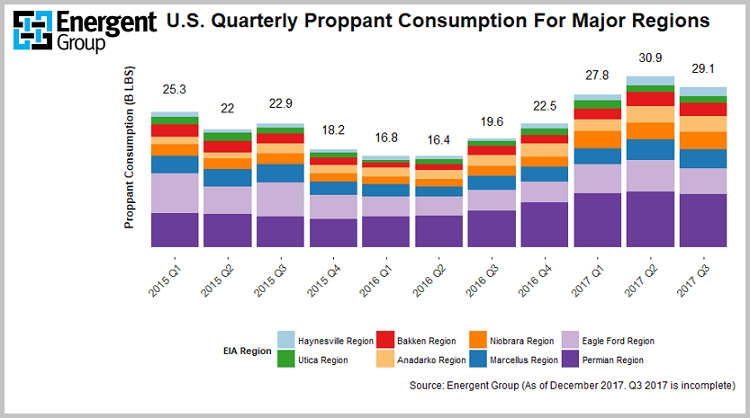

Offshore – dead and buried, thanks to onshore shale? Not quite. The oil field services world moves fast. Data from the Energent team in Houston indicates that consumption of sand for hydraulic fracturing in the onshore U.S. market hit new highs of over 30 billion pounds (13.6 billion kilograms) in Q2 last year, topping the previous peak in 2014, despite only half the number of land rigs working. The U.S. completions market is running in overdrive. But how does this impact the remainder of the oil field services business?

U.S. Proppant Consumption Source: Energent

Onshore U.S. contractors are scrambling to reactivate pressure pumping equipment, assemble crews and open new sand mines in order to keep up with demand. The supply chain is stretched. Insights from our Houston team suggest that the market is expecting “double-digit” price increases in 2018. This is expected to average circa 15 percent, however, in some segments, such as proppant, reported price inflation is currently significantly higher than this. The latest investor update from Hi-Crush this month reports annual price inflation of 38 percent for Q4 2017 versus Q4 2016.

Offshore, the market is also recovering. However, pricing pressure is absent. The industry simply built up too much capacity for the expected level of activity, leading to an oversupply of rigs, construction vessels and support vessels. This is good news for exploration and production companies that can now take advantage of rock-bottom pricing when sanctioning new developments.

Activity levels are certainly showing encouraging trends. A total of 17 floating production and storage units were ordered in 2017 (compared with zero orders in 2016), and a further 19 units are expected to be ordered this year, according to the latest online data in Westwood’s SECTORS.

Exploration and production companies are starting to report that some deepwater projects have more favorable project economics than shale, with Hess in recent weeks citing the example of Liza Phase 1 in Guyana requiring circa $35/bbl in order to break even, with a comparable onshore project in the Delaware Basin requiring $45/bbl. Guyana has proven a huge success for Exxon and its partners, with further encouraging discoveries (the sixth, Ranger, was announced this month) with total recoverable resources now estimated at over 3.2bn barrels of oil equivalent, excluding Ranger. A second FPSO for Liza, with a production capacity of up to 200 kbbl/d, is expected to be ordered in 2019.

that matters most

Get the latest maritime news delivered to your inbox daily.

Looking forward, Westwood is tracking 39 floating production and storage units currently under construction, and has identified nearly 100 further deployment prospects in the coming years. The summary is cautious optimism for the offshore sector as we enter 2018, and an opportune moment for exploration and production companies to be sanctioning projects.

Steve Robertson is Head of Oilfield Services at Westwood.

The opinions expressed herein are the author's and not necessarily those of The Maritime Executive.