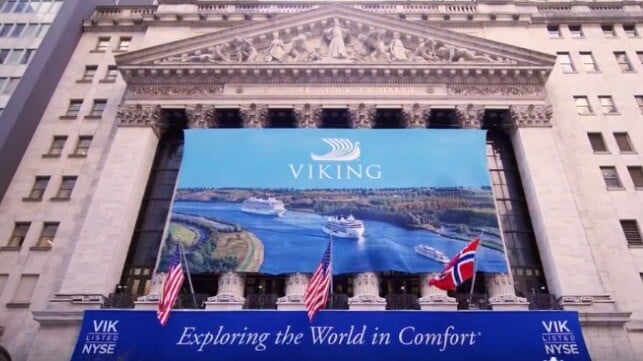

Viking Takes Wall Street by Storm with Best IPO of 2024

Viking, the luxury operator of ocean, river, and exploration cruises, roared onto Wall Street going public today, May 1, with what is being called the best deal of 2024. The company, which is a niche brand for aging baby boomers with lots of time and money to travel, became the third highest-valued cruise company with a market valuation of $10.4 billion in a heavily oversubscribed offering. By dollar amounts, it appears to be the second-largest initial offering of the year and comes after two years of largely no new deals.

The company filed for its offering in February in what analysts said was a well-time move to capture the strength of the stock market and the surging growth in the cruise business. The size of the deal was increased and priced today at $24 per share, at the high end of the projected $21 to $25 per share range.

The total offering raised about $1.5 billion after the number of shares was increased by two investment groups, TPG and Canada Pension Plan Investment Board, which had been long-term investors in Viking. They sold approximately 53 million shares and committed an additional nine million for the overallotment while Viking sold 11 million new shares raising $264 million for the company, while the investors realized nearly $1.3 billion.

Viking was started in 1997 by shipping industry executive Torstein Hagen (profiled in The Maritime Executive in 2018) who had previously run another luxury cruise line named Royal Viking Line. Hagen was intrigued by European river cruising and acquired four vessels to start this firm and three years later acquired a firm called KD River Cruises. The company entered ocean cruising in 2015 and exploration cruising in 2022. Today, Viking operates 92 ships, including 80 on rivers ranging from Europe to Egypt, Asia, and the Mississippi in the United States. They currently have two expedition cruise ships as well as 12 ocean cruise ships and more on order from Fincantieri.

Torstein Hagen started Viking in 1997 with just four river cruise ships and today the company became valued at $10.4 billion (Viking)

The cruise line became well known through its sponsorship of the TV series Masterpiece Theater on the U.S.’s Public Broadcasting System. Hagen is fond of calling his company a “thinking man’s cruise.” The product is for adult travelers, excluding children from the ships as well as not having casinos. Hagen and his daughter Karine retain control of the company with 87 percent of the voting power.

Last year, Viking had revenues of $4.7 billion but reported a net loss of $1.8 billion (EBITDA profit of $1.09 billion in 2023). The prior year the company had revenues of $3.2 billion and a profit of $399 million. In addition to the growth, investors are attracted by some of the highest revenues per passenger in the industry and a view that luxury travel will be the fastest-growing segment of the industry.

that matters most

Get the latest maritime news delivered to your inbox daily.

The market valuation of Viking leaped the company past Norwegian Cruise Line Holdings which has a market valuation of $8.1 billion. Norwegian reported strong earnings today but missed estimates and also reported cost increases while failing to excite investors with its outlook. Norwegian’s stock was down 14 percent. Viking with a market value of $10.4 billion is behind Carnival Corporation, the world’s largest cruise company, and both lag far behind Royal Caribbean Group which at nearly $36 billion market valuation is the first cruise company to regain its pre-pandemic valuation.

Viking’s stock was up more than $2 per share in trading today on the New York Stock Exchange.