U.S. Navy's Surface Fleet Faces Worsening Sustainment Challenges

The U.S. Government Accountability Office (GAO) has pored over the U.S. Navy's ship repair records, and it has found significant long-term challenges for sustainment. For 10 key ship classes, mechanical casualty reports are up, maintenance delays are up, cannibalization is up and costs are up - all as the service faces increasing odds of a high-end fight in the Pacific.

The 10 classes reviewed in the study include the Nimitz-class carriers, plus landing dock ships, amphibs, destroyers, cruisers and both LCS classes. All vessels reviewed except for the recently-built America-class amphib have had challenges finding spare parts, resulting in increasing frequency of cannibalization - the practice of pulling used parts off of one ship to make another ship's systems run. It is generally done when a vessel has an operational need for a part and there is no other way to get it. "Parts obsolescence, diminishing manufacturing sources, and material shortages are common issues," GAO found.

As a measure of how often this happens, the average number of cannibalizations per ship hit about nine components per year in 2021, according to GAO, up from an average of three in 2015. (The Freedom-class LCS had an outsize share of responsibility for the upward trend, recording 18 cannibalizations per year in 2021.)

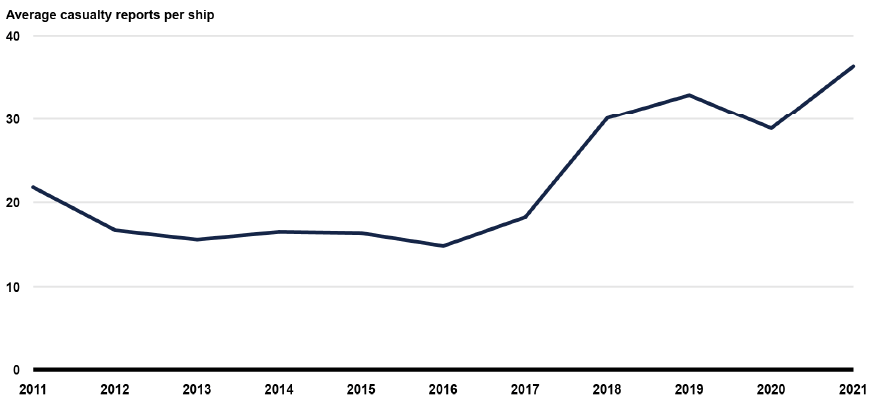

Serious (category 3 and 4) mechanical casualty reports are also up, rising from 21 per ship per year to 36. The Freedom-class was also an outlier in this category, and crews filed an average of 44 reports per ship per year in 2021. (The category system for casualty reports is subjective, GAO noted, and some may be "upgraded" in severity by the vessel's leadership in order to draw attention to a desired repair.)

Average of Category 3 and 4 casualty reports per ship per year for 10 select vessel classes (GAO)

When ships get back in port, their readiness does not necessarily improve as quickly as planned. Depot maintenance delays have risen from an average of about five days in 2011 to about 19 days as of 2021, and recent labor force challenges in the ship repair industry may make rapid turnarounds harder to accomplish going forward.

that matters most

Get the latest maritime news delivered to your inbox daily.

Over the 10-year period, operating costs per steaming hour rose by 17 percent and maintenance costs by 24 percent - partly because expenses are up, and partly because steaming hours are down. (The exact amount that hours under way have fallen for each vessel class is too sensitive to release, GAO said).

Part of the problem is deferred and delayed maintenance, according to GAO. "Over time this situation has resulted in worsening ship conditions and increased costs to repair and sustain ships," the office found.