U.S. Imports in February Expected to be Lowest in Nearly Three Years

Import cargo volume at the U.S.’s major container ports is expected to drop to its lowest level in nearly three years during February, according to a new forecast from the National Retail Federation. The trade group for the nation’s retailers is once again lowering its forecast for imports seeing a decline from its already lowered expectations and a significant decline over the surge levels experienced a year ago.

Reporting the expectations from retailers the NRF has once again lowered the outlook for imports in its monthly Global Port Tracker report. Following the container volumes at the major ports along the East and West coasts as well as in the Gulf of Mexico, the NRF is delaying expectations of a possible rebound. The projection is now for a total of 8.9 million TEU during the first five months of the year versus last month’s forecast of imports totaling 9.23 million TEU, or a further decline of 3.6 percent versus last month’s forecast.

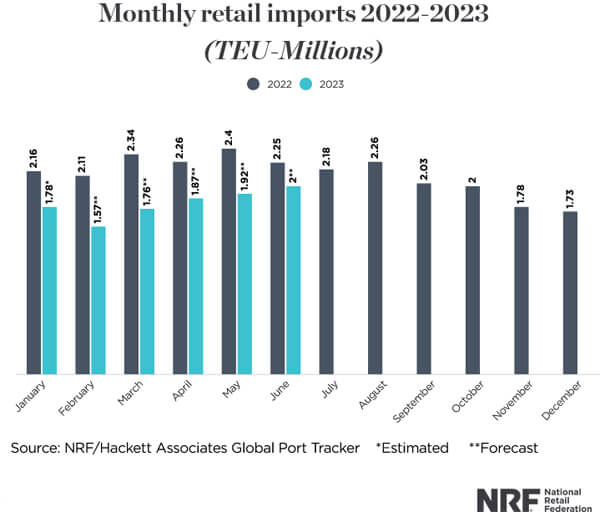

The NRF’s forecast for 8.9 million TEU is down 21 percent from the record import volumes for the first five months of 2022. They lowered the projections for January by 6.8 percent and February by a further 3.7 percent. The Global Port Tracker shows that since the beginning of the pandemic, only the 1.51 million TEU recorded in February 2020 and 1.37 million TEU in March 2020 have been lower than the projected 1.57 million TEU for February 2023.

“February is traditionally a slow month, but these are the lowest numbers we’ve seen in almost three years. Retailers are being cautious as they wait to see how the economy responds to efforts to bring inflation under control,” said Jonathan Gold, NRF Vice President for Supply Chain and Customs Policy. “With the U.S. economy slowing and consumers worried by rising interest rates and still-high inflation, retailers are importing less merchandise.”

Executives in all sectors of the shipping industry ranging from the major carriers to ports have all cited retail inventories and shipments as the key factor that will drive container volumes in 2023. Jeremy Nixon of Ocean Network Express for example pointed to retail stock remaining at high levels as contributing to the decline in results during the fourth quarter of 2022 and said recovery would depend on when retailers began moving new inventory from Asia. Many forecasts have said a recovery in volumes might not come till mid-2023 or later.

“In some ways, 2023 is reminiscent of 2020, when the world’s economies shut down because of the pandemic and no one had a clue where we were headed,” said Ben Hackett, Founder of Hackett Associates. “Cargo volumes are down, and the economy is in a contradiction of rising employment and wages that promise prosperity at the same time high inflation and rising interest rates threaten a recession. The economy is far from shut down, but the degree of uncertainty is very similar.”

that matters most

Get the latest maritime news delivered to your inbox daily.

U.S. ports covered by Global Port Tracker handled 1.73 million TEU in December, down 2.6 percent from November and down 17.1 percent from December 2021. That brought 2022 to an annual total of 25.5 million TEU, down 1.2 percent from the annual record of 25.8 million TEU set in 2021. Import volumes leveled off in July and August 2022 while the year-over-year declines in volumes began in September and built in size through the remainder of 2022.

The NRF is forecasting that monthly import volumes will remain below the comparable year-ago levels through at least the first six months of 2023. June 2023 is the first month of the year forecast at 2 million TEU, which would be the first time imports are expected to be that high since October. At their peak, monthly volumes reach 2.4 million TEU in May 2022. For the first six months of 2023, the NRF projects volumes will be at 10.9 million TEU, down 19.4 percent from the first half of 2022.