South Korea Hungry for Oil and Gas

South Korea relies on imports to meet about 97 per cent of its energy demand as a result of insufficient domestic resources, and the country is one of the world's leading energy importers. The U.S. Energy Information Administration (EIA) estimates that that in 2013, the country was the second-largest importer of LNG, the fourth-largest importer of coal, and the fifth-largest net importer of total petroleum and other liquids.

Despite its lack of domestic energy resources, South Korea is home to some of the largest and most advanced oil refineries in the world, and in an effort to improve the nation's energy security, oil and gas companies are aggressively seeking overseas exploration and production opportunities.

Although petroleum and other liquids accounted for the largest portion (41 per cent) of South Korea's primary energy consumption in 2012, its share has been declining since the mid-1990s, when it reached a peak of 66 per cent. This trend is attributed to the steady increase in natural gas, coal, and nuclear energy consumption.

Although petroleum and other liquids accounted for the largest portion (41 per cent) of South Korea's primary energy consumption in 2012, its share has been declining since the mid-1990s, when it reached a peak of 66 per cent. This trend is attributed to the steady increase in natural gas, coal, and nuclear energy consumption.

The government originally planned to increase the nuclear share of total energy consumption in the next 20 years as planned reactors come online, although the most recent energy policy, unveiled at the end of 2013, limits the country's reliance of nuclear energy in the power sector over the long term.

South Korea is attempting to diversify its fuel portfolio to meet higher energy consumption and to moderate its nuclear power generation targets following Japan's Fukushima disaster and South Korea's problems with false safety certifications of nuclear parts in late 2012. To help balance a more moderate nuclear generation growth goal and offset some fossil fuel imports, the government is also promoting greater demand-side management, energy efficiency tactics, and renewable energy supplies.

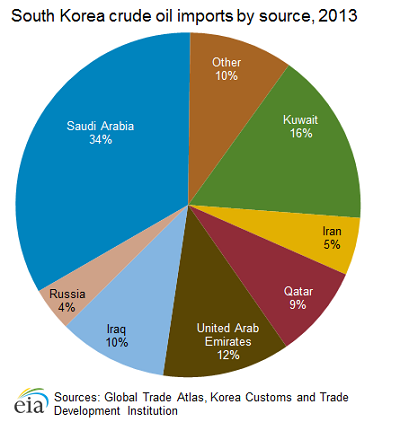

South Korea is highly dependent on the Middle East for its oil supply, and the region accounted for more than 87 per cent of South Korea's 2013 crude oil imports, according to Global Trade Atlas. Saudi Arabia was the leading supplier and the source of over a third of South Korea's imports, followed by Kuwait at 16 per cent of total crude oil imports.

South Korea reduced its crude oil purchases from Iran, from 10 per cent in 2011 to 5 per cent in 2013. The country halted shipments from Iran for two months in 2012 to comply with sanctions imposed by the United States that impeded Iran's ability to sell crude oil. After showing a good faith effort to reduce their volumes, South Korea was granted a waiver in mid-2012 and resumed imports from Iran, but at a lower level than before the sanctions. Negotiations between Iran and six global powers at the end of 2013 allowed South Korea and other buyers to maintain current import levels. Other Middle Eastern suppliers have made up for the lost imports from Iran.

Although new discoveries might improve domestic oil prospects, overseas E&P plays a more essential role in Korea's oil industry. The Korean government has encouraged private exploration and production overseas through tax benefits and the extension of credit lines to international oil companies by the Korea Export-Import bank, and also provided diplomatic aid in overseas negotiations.

As of February 2013, the national oil company KNOC was invested in 226 projects, 94 of which are in the production stage, in 24 countries. In the United States, KNOC has an interest in producing projects in Ankor and Northstar in the Gulf of Mexico, Old Home field in Alabama, and Parallel project in Texas and New Mexico.

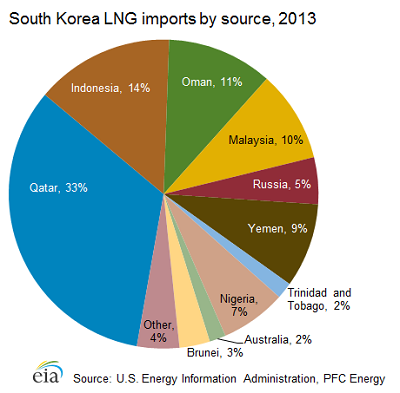

South Korea relies on imports to satisfy nearly all of its natural gas consumption, which has nearly doubled over the previous decade. While the country possessed discovered proven reserves of 203 billion cubic feet (Bcf) as of January 2014, according to Oil and Gas Journal, domestic gas production is negligible and accounts for less than 2 per cent of total consumption. South Korea does not have any international gas pipeline connections and must therefore import all gas via LNG tankers. As a result, although South Korea is not among the group of top gas-consuming nations, it is the second-largest importer of LNG in the world after Japan.

South Korea relies on imports to satisfy nearly all of its natural gas consumption, which has nearly doubled over the previous decade. While the country possessed discovered proven reserves of 203 billion cubic feet (Bcf) as of January 2014, according to Oil and Gas Journal, domestic gas production is negligible and accounts for less than 2 per cent of total consumption. South Korea does not have any international gas pipeline connections and must therefore import all gas via LNG tankers. As a result, although South Korea is not among the group of top gas-consuming nations, it is the second-largest importer of LNG in the world after Japan.

KNOC and Woodside Energy (Australia) are jointly exploring deepwater blocks of the Ulleung Basin and began drilling in 2012. State-owned Gas Hydrate Research & Development is conducting studies of deposits of methane hydrates (methane trapped in high-pressure ice deposits on the sea floor) in the Sea of Japan, and the government is currently spending about $30 million per year on research and development. Although extracting this resource is technically challenging and requires high investment levels, Japan's successful extraction of gas from methane hydrates in early 2013 marks a breakthrough in the resource's viability.

South Korea holds equity shares in four production-stage projects, namely 50 per cent in Canada's Encana project, 3 per cent in Qatar's RasGas project, 8.9 per cent in Yemen's YLNG project, and 1.2 per cent in Oman's LNG project. It is KOGAS' mid-term goal to secure 25 per cent of gas imports from equity production sources by 2017.

Meanwhile, both KNOC and KOGAS have recently announced intentions to divest certain assets as a result of mounting debt levels, cost overruns at certain overseas projects, and pressure from the Korean government to reduce expenditures. These debt levels may slow future overseas purchases.

that matters most

Get the latest maritime news delivered to your inbox daily.

Map of South Korea's exploration activities