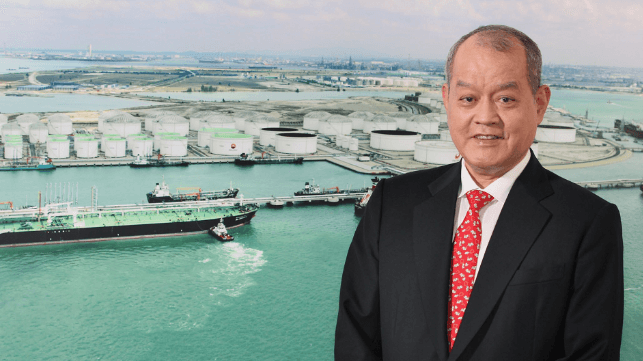

Singaporean Bunker Magnate OK Lim Sentenced to 17 Years for Fraud

Singaporean bunker trading tycoon OK Lim has been sentenced to more than 17 years in prison for his role in an accounting scandal that cost their creditors billions of dollars.

Lim, 82, faced 130 individual charges in connection with a fraud scheme at his now-defunct trading house, Hin Leong Trading Pte Ltd. The firm operated at a loss for years, and Lim concealed the fact that the company was in the red by obtaining extra trade financing for oil cargoes, sometimes multiple times for the same lot. He allegedly ordered a Hin Leong executive to forge sales orders in order to fraudulently apply for letters of credit and accounts receivable financing from his bankers; the scheme collapsed in 2020 after a large trading bet went bad, and the firm quickly went bust.

The charges included dozens of counts of conspiracy to commit forgery, cheating, and conspiracy to forge a valuable security. In his defense, Lim denied wrongdoing and said that he had delegated decisionmaking authority to his staff since 2010 due to advancing age - though he retained a 75 percent ownership stake. Prosecutors simplified the trial down to two individual transactions involving fraudulent trade financing from HSBC, and in May, Lim was convicted on three individual charges of cheating and forgery.

On Monday, Judge Toh Han Li of Singapore’s State Courts sentenced Lim to 17.5 years in prison as a "deterrent" to other would-be wrongdoers. He did not factor Lim's medical condition into account.

The sentence has already been appealed, and Lim will not begin to serve time until after the appeals process is completed.

With his company bankrupt and his fleet liquidated, creditors have pursued his family's assets as well. In 2021, a court in Singapore approved a prosecutor's request to freeze the assets of OK Lim and his family in connection with an ongoing civil fraud case brought by creditors. The freeze covers up to $3.5 billion, the amount of the firm's unpaid debts. In September, Lim and his two children consented to pay this sum without admitting to liability. They said that they lacked the funds to pay this amount, and filed for bankruptcy.

that matters most

Get the latest maritime news delivered to your inbox daily.

Lim rose from humble origins to become one of Singapore's most prominent energy traders, with a fleet of bunker tankers and an empire of onshore storage terminals. He was a legend in the industry, and his achievements are well-remembered in the business.

“While he has to face up to his wrongdoings and the collapse of his company, it doesn’t take away from the man’s legacy and the rags-to-riches story of what was once the country’s leading oil merchant," veteran oil trader John Driscoll told Bloomberg.