Santos Acquires ConocoPhillips’ Northern Australia Interests

Santos has entered into an agreement for the acquisition of ConocoPhillips’ northern Australia business with operating interests in Darwin LNG, Bayu-Undan, Barossa and Poseidon. The deal is worth $1.39 billion plus a $75 million contingent payment subject to FID on Barossa, and it reduces Santos' forecast 2020 free cash flow breakeven oil price by $4 per barrel.

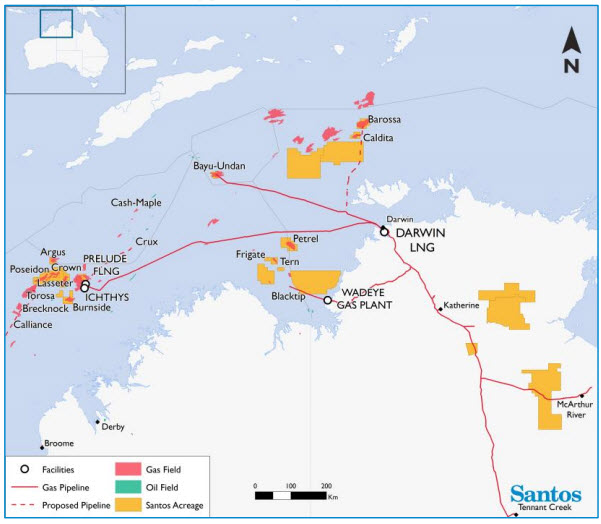

Santos says the acquisition delivers operatorship and control of strategic LNG infrastructure with growth potential, and it advances Santos’ goal of taking Barossa FID by early 2020. Santos is prepared to sell down equity in Barossa and Darwin LNG to a target ownership of 40-50 percent to achieve increased partner alignment.

Barossa partner SK E&S has signed a Letter of Intent to acquire a 25 percent interest in Bayu-Undan and Darwin LNG. Santos is also in discussions with existing Darwin LNG joint-venture partners for equity in Barossa and in advanced discussions with LNG buyers for Barossa offtake volumes, including with an existing partner in Darwin LNG. Santos was a founding partner with ConocoPhillips in Darwin LNG, which has been operating since 2006.

Wood Mackenzie senior analyst David Low said: "This is a logical and attractive transaction for a number of reasons. It consolidates existing equity participation across the Barossa, Bayu-Undan and Darwin LNG assets. The deal will now act as a catalyst for further alignment of equity across the three projects. South Korea’s SK E&S is expected to make the first move and acquire 25% in Bayu-Undan and Darwin LNG. Gaining equity alignment across the Barossa project and the Darwin LNG plant would remove a key hurdle for taking FID on the Barossa project.”

Low says that even though Barossa is attractive as a brownfield LNG backfill investment, it is also a large and complex project. With over $4 billion of CAPEX spend to first gas, executing the development on time and on budget will be a major test of Santos’s “big project” credentials.

“Acquiring control of the key infrastructure asset, Darwin LNG, offers Santos a future option for monetizing other stranded Northern Territory (NT) gas assets, such as Petrel, Tern and Frigate.

“The acquisition increases Santos's equity in Barossa from 25 percent to 62.5 percent. However, it will look to farm down its share to around 40-50 percent. This helps Santos with reaching its 100 mmboe production target by 2025.”

that matters most

Get the latest maritime news delivered to your inbox daily.

ConocoPhillips's sale of its NT portfolio does not come as a surprise, says Low. “We predicted in our August insight both a forthcoming M&A shake-up in Australia - particularly around LNG assets - and that ConocoPhillips will look to rationalize its Australian position. We now expect the U.S. company to redeploy this capital into its North American unconventional and Alaskan positions. ConocoPhillips already allocates around 70 percent of its capital into its U.S. operations, so this sale, following recent Timor Sunrise and U.K. divestments, is firmly in line with its strategy of reducing international exposure and increasing North American output.

“This will not be the last big deal in the Australian M&A scene, and we are confident there are more major transactions coming down the pipe. Watch this space.”