Retail Imports Expected to Drive US Port Volumes into Summer 2021

The unprecedented surge of imports at the major U.S. container ports that began last summer is expected to continue at least through the end of this summer as retailers work to meet increased consumer demand, according to new forecasts from the National Retail Federation. The retail trade association is forecasting the imports will be up nearly 27 percent in the first half of 2021 to a total of nearly 12 million TEUs.

“We’ve never seen imports at this high a level for such an extended period of time,” NRF Vice President for Supply Chain and Customs Policy Jonathan Gold said. “Records have been broken multiple times and near-record numbers are happening almost every month. Between federal stimulus checks and money saved by staying home for the better part of a year, consumers have money in their pockets, and they’re spending it with retailers as fast as retailers can stock their shelves.”

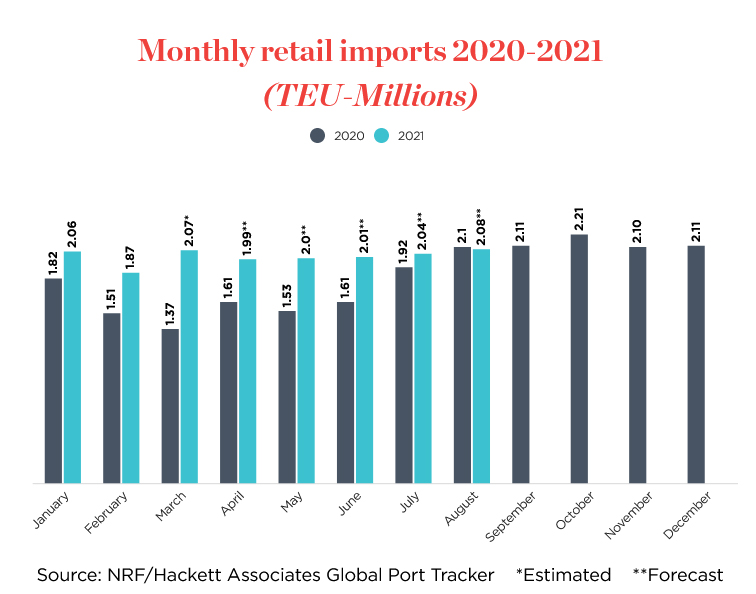

The total container import volume is expected to remain at or above the two million TEU mark for 11 out of 13 months by this August 2021, according to the monthly Global Port Tracker report released by the National Retail Federation and Hackett Associates. This compares with only one month, October 2018, which reached the total two million TEU mark for the dozen major U.S. container ports tracked by the index.

The data reported by the NRF mirrors the individual reports from the major U.S. container ports. The Global Port Tracker shows that imports hit their lowest point in four years in March 2020, 1.37 million TEUs, as the economic effects of the coronavirus pandemic began to impact the U.S. and global economies. Import levels, however, rebounded and hit a then-record 2.1 million TEU in August as the economy reopened and continued to rise peaking at 2.21 million TEU in October.

The surge resulted in months of backups at ports, which have faced labor shortages because of COVID-19 infections and equipment shortages because of the volume. The global supply chain continues to be strained by multiple disruptions, including the recent blockage of the Suez Canal, according to Hackett Associates which analyzes the port data.

“Congestion at U.S. ports is abating as container carriers and terminals adjust to the new normal,” said Ben Hackett. “We saw the busiest February on record as the ports worked to clear the backlog, and the number of ships at anchor in San Pedro Bay waiting to dock at Los Angeles and Long Beach is dropping. Only 17 ships were reported waiting off LA/Long Beach in recent days, compared with about 30 ships a month ago,” Hackett said.

that matters most

Get the latest maritime news delivered to your inbox daily.

While volumes were down between January and February, the Global Port Tracker still reported the busiest February since NRF began tracking imports in 2002, with a 23.7 percent year-over-year increase.

Rebounding from the lockdowns of March 2020, the NRF is forecasting a 50 percent rise in total volume during March that will continue with increases of between 23 and 30 percent through June. Marking the one-year point in the surge the Global Port Tracker forecasts a modest increase of 6.5 percent in total TEU imports for July 2021 and possibly a one percent decline in August. If there is a decline in August, it would be the first decline in 13 months.