Red Sea Diversions Surge Container Shipping Emissions Reports Xeneta

Carbon emissions from the container shipping industry are reaching record levels as ocean going vessels sail longer distances to avoid Houthi attacks in the Red Sea. The new data contained in Xeneta’s Carbon Emissions Index (CEI) highlights the adverse impacts on the industry’s efforts to curb emissions because of the conflict in the Middle East.

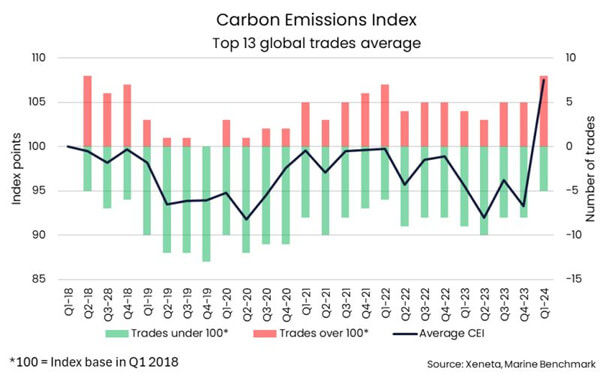

Xeneta calculates container shipping emissions hit 107.5 points in the first quarter of this year on its index. The CEI is based on average CO2 emissions per ton of cargo carried, with the baseline set in Q1 2018. Any reading below 100 indicates an improvement in carbon efficiency.

In addition to being the first time the average CEI has been above 100 at a global level, Xeneta reports it marks a 15.2 percent increase from the last quarter of 2023. They calculated that only five of the top 13 trade routes emitted less CO2 per ton of cargo this quarter, which is three fewer routes than in Q4 2023. It is also the lowest in any quarter since Q2 2018.

The most dramatic increase comes for containers being shipped from the Far East to the Mediterranean. Xeneta reports carbon emissions increased by 63 percent during the period compared to the same period last year. From the Far East into North Europe, carbon emissions increased by 23 percent.

The main cause of the significant increase in emissions is the Red Sea conflict that is forcing vessels to travel longer routes around the Cape of Good Hope. The diversion resulted in the average distance a container is transported via ocean on a global level increasing by 11 percent compared to the start of 2023.

The market analytics platform highlights ships sailing to the Mediterranean from the Far East traveled 9,400 nautical miles on average in the last quarter of 2023. Due to the escalation of the conflict, ships are now sailing an additional 5,800 nautical miles due to diversions around the Cape of Good Hope, a 60.7 percent increase with the inevitable consequence of burning more fuel. In actual terms, this means a shipping container on this trade is now being transported 15, 200 nautical miles on average.

“Ships are also being sailed at higher speeds in an attempt to make up time due to the longer distances, which again results in more carbon being burned,” said Emily Stausbøll, Xeneta market analyst.

During the quarter, average sailing speeds increased by 9.8 percent compared to the previous quarter. Average sailing speed reached 15.4 knots in January 2024 for containerships between 12,000 and 17,000 TEU, the highest speed since June 2022 when Covid-19 was also causing major disruptions.

Xeneta highlights that although speeds have fallen slightly since January, the global average was still above 15 knots in mid-April. This is expected to have a detrimental impact on carbon emissions performance.

Another result of the disruptions that is contributing to the increase in carbon emissions is a trend whereby shipping lines are resorting to using older vessels to maintain service schedules due to longer distances and increased time for voyages due to the rerouting around Africa. Xeneta reports on the route between the Far East and the Mediterranean, the average age of ships deployed has increased by one year to 7.4 years.

“Not only does this mean there are more ships burning more fuel, carriers have needed to bring in older, less efficient vessels to meet this additional demand,” reports Xeneta.

that matters most

Get the latest maritime news delivered to your inbox daily.

Besides being older, the ships being pressed back into service are also smaller, making them less efficient in terms of average CO2 emissions per ton of cargo carried. On the Far East to Mediterranean trade, the average size of ships deployed decreased by 5.1 percent to 15,160 TEU in the first quarter.

Xeneta concludes by saying the data showed the sensitivity of the supply chain and the impact of a disruption. They note that with a semblance of normality now returning to ocean freight container supply chains, it remains to be seen whether this will also contribute to an improvement in the carbon emissions performance.