Low E-Fuel Production Slows Europe's Decarbonization

Europe’s ambitions to decarbonize the shipping industry face obstacles due to the fragile state of the alternative fuel supply chain, an analysis by the activist NGO Transport & Environment (T&E) shows.

Though Europe is setting the pace in efforts to cut down on shipping emissions, the review shows that production of green hydrogen and other e-fuels remains significantly low, with the largest e-fuel plant serving the maritime sector only becoming operational this year. For many other projects, a lack of regulatory certainty is preventing advancement beyond the planning stage.

T&E examined 80 green hydrogen and e-fuels projects that could potentially serve the maritime sector in Europe. While the listed projects could produce 3.6 million tonnes of oil equivalent by 2032, less than five percent are dedicated primarily to shipping, and only a small portion is linked to operational projects.

The NGO says that while some projects have progressed in their development, total shipping e-fuels production appears unlikely to reach targeted levels unless new policy incentives are implemented. The low production means that Europe is unlikely to meet its own target of at least one percent of e-fuels uptake by 2031 and two percent uptake by 2034 under the FuelEU agreement.

The analysis comes just weeks after the European Commission adopted its Sustainable Transport Investment Plan (STIP) that sets out the roadmap for accelerating the energy transition for both maritime and aviation sectors. To meet the fuel targets, Europe needs significant volumes of around 20 million tonnes of sustainable alternative fuels (13.2 tonnes of biofuels and 6.8 tonnes of e-fuels) by 2035. To drive production, investments amounting to $120 billion are required by 2035.

T&E says that while the majority of the investments are expected to come from the private sector, public funding is essential to de-risk first-of-a-kind projects and steer the market toward fuels that align with Europe’s priorities. And although STIP is a positive step to support the e-fuels industry, the fact that it relies on tools such as the European Hydrogen Bank auctions or the Innovation Fund could hinder its effectiveness.

Currently, Norway has the largest quantities of fuels dedicated primarily to the maritime sector, followed by Spain, Finland and Denmark. For Norway, nearly one-quarter of projected volumes target shipping as their main end user primarily through e-ammonia.

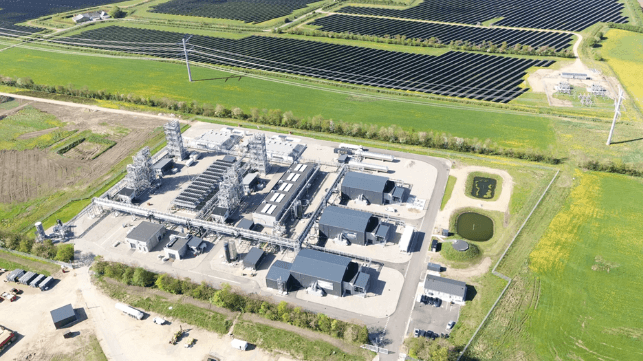

The Kassø e-methanol project in Denmark, which became operational in May this year, remains as the largest operational e-fuel project serving the maritime sector. Developed by European Energy, the plant has an annual production capacity of 42,000 tonnes and is supplying e-methanol to Maersk, the LEGO Group and Novo Nordisk, among others.

that matters most

Get the latest maritime news delivered to your inbox daily.

“The biggest maritime e-fuels project went online this year. This shows what is possible, but scaling up projects remains a challenge. Current shipping targets just aren’t ambitious enough to get investors to put money on the table. As well as demand incentives, fuel producers need hard cash,” said Constance Dijkstra, T&E maritime policy manager.

Dijkstra added that for Europe, fostering a strong e-fuels sector can bolster the continent’s industrial leadership and reduce the dependence on imported fossil fuels.