EU Operators Brace for Cost and Complexity of FuelEU Carbon Regs

The European Union's FuelEU Maritime regulation takes effect on Jan. 1, 2025, and it is expected to give European shipping interests a big compliance challenge - or opportunity, depending on how they operate. The regulation is highly technical and is driven more by math than text, opening the door to strategization - but many owners do not like the game, believing it will make them less competitive on the global market.

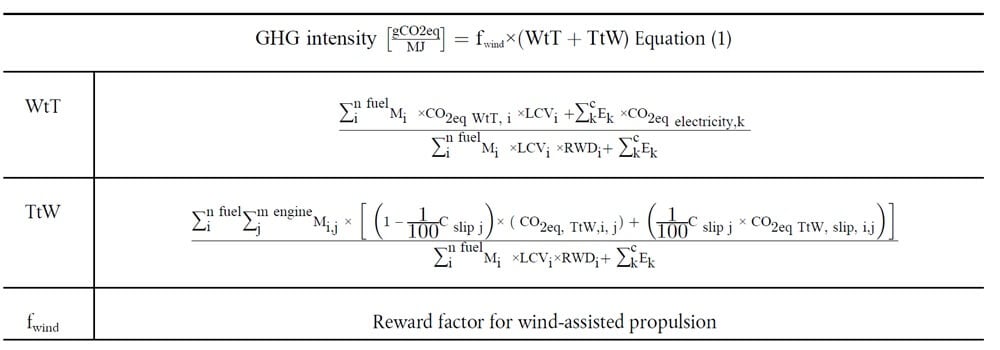

FuelEU Maritime requires operators to calculate the well-to-wake greenhouse gas intensity of each ship's fuel consumption, then reduce it over the course of a 25-year ratchet-down schedule, starting with a two percent cut next year.

Noncompliance is a law-abiding strategy for this regulation, but it is an expensive choice. The penalty for high carbon operation will be €2,400 per tonne of VLFSO energy equivalent - about triple the price of bunker fuel - for emissions over the limit. Repeat noncompliance in sequential years increases the penalty, though operators can also pool their emissions or borrow from future year compliance in order to reduce cost. The other cost-saving alternative is compliance, whether by improving vessel efficiency, adding wind propulsion or buying green fuels.

FuelEU Maritime's greenhouse gas intensity formula (EU Consilium)

At least a dozen consultants and class societies offer solutions for navigating this sophisticated ruleset, and some go further to attempt to monetize the regulation for finance-minded shipowners. Veson, NAPA, StormGeo, BV, DNV, Normec, BSM, LR, Wilhelmsen, OrbitMI, ABS, OceanScore and countless others have developed compliance assistance services for this new market.

Owners are paying close attention, and some are reprioritizing to take action, according to a recent qualitative survey by consultancy Houlder. "[The Emissions Trading System] is not a particularly big deal. It’s small penalties compared to FuelEU. What [FuelEU] has done is shocked businesses into realizing the penalties they are going to have to pay if they don’t act on energy efficiency . . . and then eventually future fuels," one industry member told Houlder. "From an R&D point of view, these have helped secure support and budget."

that matters most

Get the latest maritime news delivered to your inbox daily.

FuelEU Maritime is opposed by the German Shipowners' Association (VDR), whose chief executive recently called the regulation "terrible." The association is worried that it will make EU owners uncompetitive, and it wants to see international, IMO-led rules as fast as possible.

"Well-intentioned is not always well done. Shipping is international, and emissions know no borders. Regional regulations such as FuelEU Maritime create a patchwork of rules. They distort international competition and are ineffective in the fight against climate change," VDR said in a statement. "The mandate from shipping to the new European Commission is clear: the EU rules and above all FuelEU Maritime must be integrated into the IMO's international measures as quickly as possible."