DNV GL: Ammonia and Methanol are the Likeliest Future Fuels

In a new study, class society DNV GL has examined the future fuels landscape to look at the likeliest ways for shipping to cut its carbon output. The path is not easy: only 10 percent of the current orderbook will run on alternative fuel when delivered, and the proportion would have to rise sharply to meet IMO's target for a 50 percent cut by midcentury.

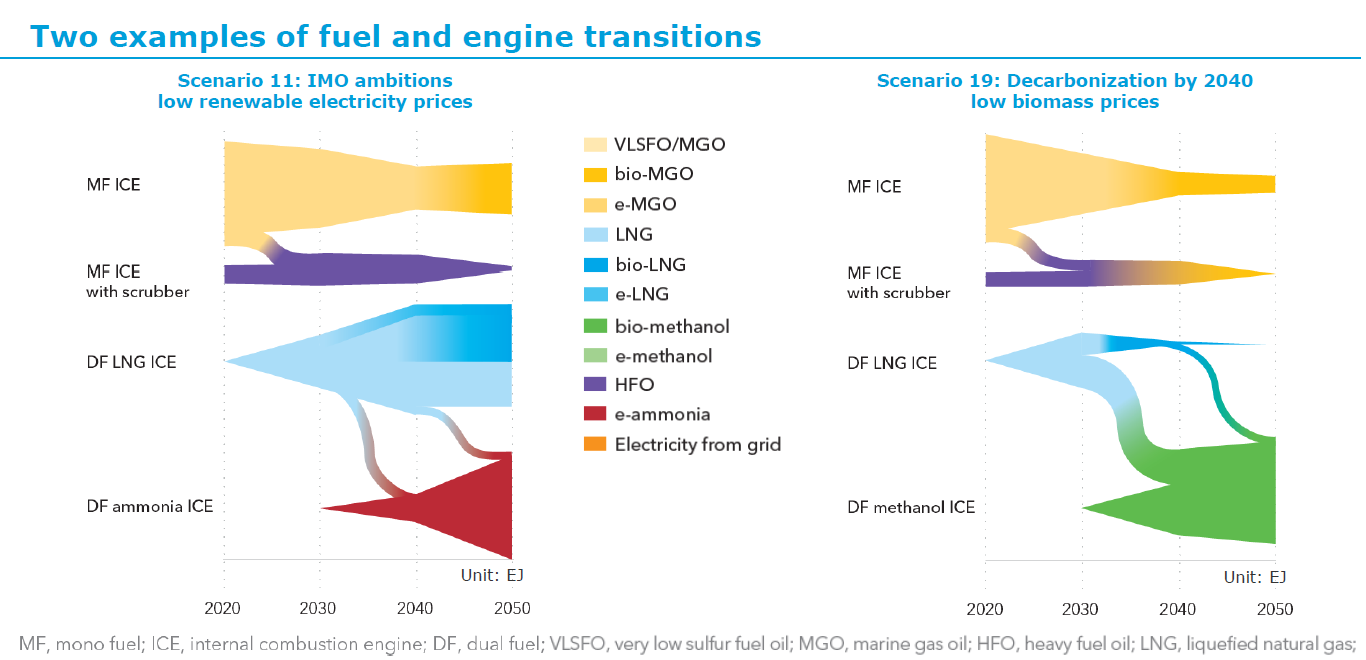

In the study, DNV GL's team looked at nearly a dozen different fuel types and examined them in the context of 30 hypothetical market and regulatory scenarios. The modeling shows a wide variation in potential outcomes by midcentury, based on changes in underlying assumptions - for example, an IMO-led 50 percent carbon reduction by 2050 versus a much more ambitious full decarbonization by 2040.

Illustration courtesy DNV GL

The key finding from this modeling study: ammonia and methanol appear to be the two dominant future fuels for deep sea shipping, and the choice between them depends upon input price. If sustainable electricity is less expensive, then e-ammonia (ammonia synthesized from nitrogen and hydrogen in an electrochemical process) makes the most sense; if biomass is less expensive, then bio-methanol comes out ahead. Both products are liquid fuels and are already widely carried as cargoes, making them relatively suitable for retrofit (though ammonia has its own special handling considerations). Methanol can be burned in a suitably-adapted marine diesel engine, and research on ammonia as a diesel-cycle fuel is under way.

that matters most

Get the latest maritime news delivered to your inbox daily.

In all scenarios, the study calls for supportive financing, cross-industry cooperation, risk-sharing among stakeholders and regulatory incentives in order to facilitate uptake.

For shipowners making investment plans today, DNV GL argues that dual-fuel LNG makes the most sense, as it reduces emissions and fuel cost in the near term while maintaining some flexibility for the future. The study suggests that beyond conventional LNG sources, e-LNG and bio-LNG are among the most promising transition fuels while the market is shifting to liquid low/no-carbon options.