Cefor: Total Losses Continue to Decline

The Nordic Association of Marine Insurers (Cefor) has published its latest statistics noting the frequency of total losses reached so far in 2018 is at its lowest level since 1996.

Over the last eight years there has been a stabilization in the total loss frequency at low levels, with some oscillation between 0.05 and 0.10 percent. In the first half of 2018, three losses exceeding $10 million were reported. This compares to five such losses in the first six months of 2017 and two in the first six months of 2016.

Since 2015, no losses have been reported exceeding $30 million. The largest loss since 2015 occurred in 2017 and had a cost of $26 million, the second largest in the first quarter of 2018 had a cost of $25 million.

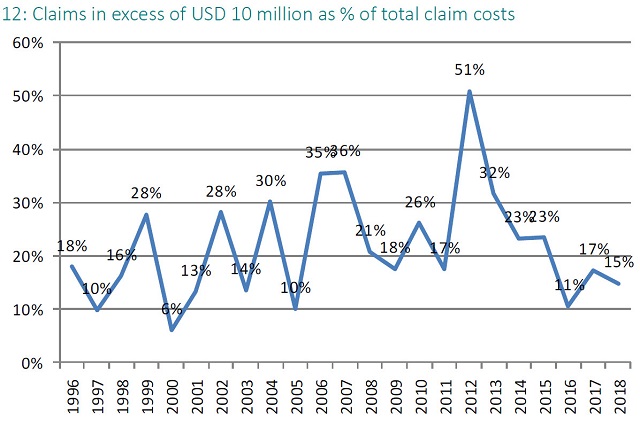

The 2018 claim cost per vessel, excluding total losses, was similar to that for 2016 and 2017. While major losses represented an increasing share of the total claims cost in the years up until 2015, this trend has reversed in recent years. In 2016, losses exceeding $10 million accounted for only 10.6 percent of the total claims cost, in 2017 for 17.3 percent and in 2018 for 14.8 percent.

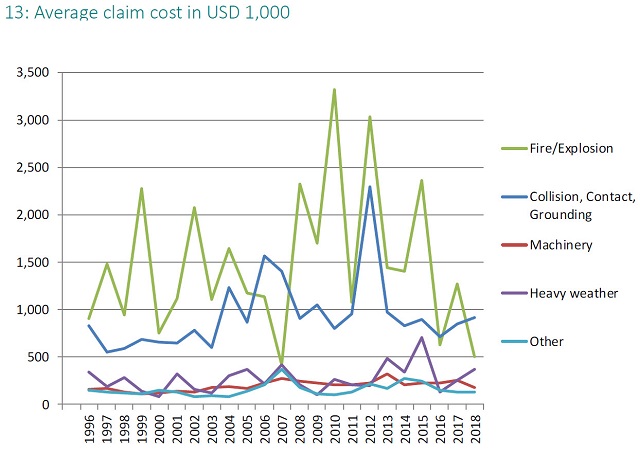

In 2016 and 2017, there was only one fire/explosion claim exceeding $10 million per year, and none have been reported as of June 2018. Conversely, each year since 2011 has seen machinery claims in excess of $5 million, and machinery claims exceeding $10 million are no longer an exception. In 2013, three such claims were reported, one in 2016 and three in 2017. In 2018, the largest machinery claims reported by end of June was slightly below $10 million.

The overall claims frequency has been very stable around 22 percent since 2012, and this positive trend continues into 2018.

Cefor says that the devastating category 4+ hurricanes in 2017, like Harvey, Irma and Maria, barely had any impact on commercial hull & machinery policies. This indicates that shipowners handled the hurricanes with a high degree of care to avoid potential damage. (Yachts and pleasure boats were not considered in Cefor's reporting.)

While the average size of vessels has been constantly increasing over the past 10 years, this was not reflected by the average insured value in recent years. On the contrary, the average insured value in the Cefor portfolio has declined since the 2008 financial crisis until today.

Cefore statistics are obtained from a database of approximately 433,000 registered vessel and 95,000 claims.