Breakbulk's Top Ten

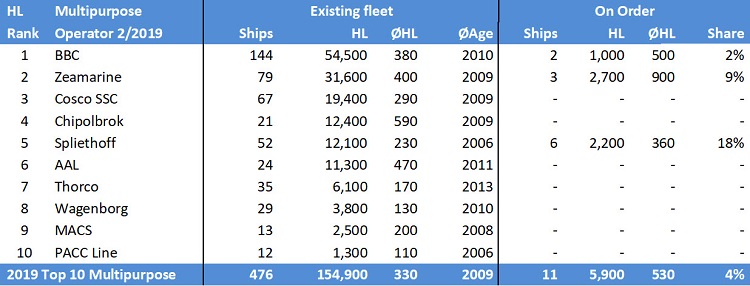

As of early March 2019, the 10 largest operators, by deadweight, of multipurpose-project-heavy-lift tonnage deployed a combined fleet of 476 ships with a total deadweight of 8,220,000 million tons and an aggregate lifting capability of 155,000 tons. The ships’ average age was 10 years.

Dynamar B.V., publishers of DynaLiners, collated the figures in its latest biennial “BREAKBULK - Operators, Fleets, Markets” publication.

The top 10 operators currently have a combined order book of 11 vessels with 175,000 dwt and 5,900 tons heavy-lift.

BBC Chartering regained the number one position in the top 10 ranking, a place it lost to Cosco Shipping Specialized Carriers early last year. It did so with two ships less then it operated last year, meaning that the average deadweight capacity of its fleet increased from 11,500dwt to 12,800dwt. BBC’s current 144 ships make up for 30 percent of the Top 10. It has two vessels on order, each to be delivered still this year.

Last year Cosco Shipping Specialized Carriers took delivery of 23 newbuilds including some 38,000dwt ships, among the largest multipurpose ships in the world.

Dutch Spliethoff bought five ships from defunct Hansa Heavy Lift. While the average hoisting capacity of the Dutch operator’s vessels ranges between 160 and 300 tons, one of these vessels has a heavy-lift of 800 tons. Recently, the company purchased another four former Hansa Heavy Lift ships, each with a heavy-lift capability of 1,400 tons.

In May 2018, Zeaborn and Intermarine formed a 75/25 joint venture Zeamarine that had the stated purpose of operating around 100 multipurpose ships by early 2019. That goal has not yet been achieved, but Dynamar believes the company is interested in the growing availability of distress tonnage. Some 30 percent of the world multipurpose fleet it not able to pay its debts, the company says. Zeamarine consists of the brands Intermarine, Rickmers Line and Zeaborn. The latter incorporates the commercial management of part of the Carisbrooke fleet and the chartering activities of the HC Group, MCC Marine and NPC Projects, among others.

Zeamarine currently operates the fourth largest fleet having quite a variety of vessels: age varying between one and 20 years, deadweight between 6,300 and 30,000 tons and heavy-lift between 30 and 1,400 tons. It has currently three, soon to be delivered, ships on order.

Singapore-based AAL, in corporation with HMM (four ships), combines a system of two liner services (Far East-Middle East and Far East-Australia) with four semi-liner routes (Asia-North America-Europe - Europe, Asia-Red Sea - Middle East, Asia/Australia - Intra-Asia). In doing so, if operates a core fleet of 14 owned (by parent Schoeller Holdings) ships with each 700 tons heavy lift capability, plus 10 vessels with between 80 and 240 tons crane capacity each.

The Chinese/Polish Chipolbrok fleet includes that of its associate Shanghai Hongfa Shipping. Combined, they take the sixth place in the ranking due to an additional ship deployed by Shanghai Hongfa. The latter company has added Australia/New Zealand to its core Far East-South Africa-South American East Coast route. Operating 15 vessels, Chipolbrok’s longstanding main routes are, unchanged, the Europe-Asia and North America-Asia corridors.

Thorco Projects continues reducing its fleet, this time by 13 units/221,000dwt to 35 vessels/533,000dwt. Thorco Projects currently operates the youngest fleet: six years on average.

that matters most

Get the latest maritime news delivered to your inbox daily.

The early March 2019 combined heavy-lift capability ranking of the same 10 multipurpose operators slightly differs. The 476 vessels have an aggregate on board lifting capability of 154,900 tons (up five percent) with a rounded average of 330 tons per ship, ranging between 30 tons (Zeamarine) and 1,400 tons (both BBC and Zeamarine).

With total 54,500 tons, average 380 tons, a share of 35 percent, BBC Chartering remains the top carrier. Zeamarine, the joint venture between Intermarine and Zeaborne including Rickmers Linie, comes second with 31,600 tons, a share of 20 percent, but with a higher individual average of 400 tons. Lifting capacities per vessel range between 30 and 1,400 tons, constituting the widest capability spread of all top 10 operators.