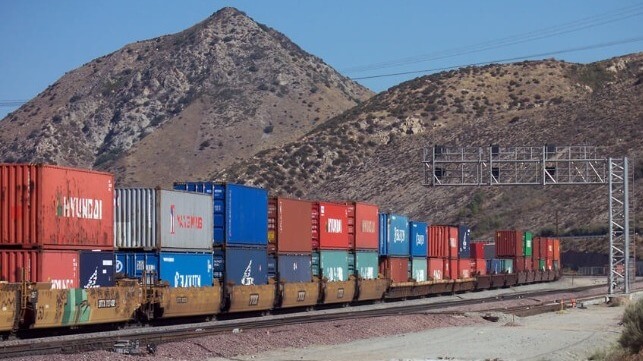

Intermodal Connectivity

“Connectivity” is not just a satcom mantra. It’s also the key to smooth-running supply chains.

(Article originally published in Nov/Dec 2022 edition.)

The logistical challenges in global trade over the last three years rubber-stamp the need for efficient intermodal connectivity between every link in the global supply chain. Of course, that’s easier said than done. The disruption caused by the Covid-related shutdown of manufacturing plants in China recently is just the latest example of how the supply system can bog down.

The port of Prince Rupert on Canada’s West Coast transitioned from mainly a breakbulk port to containers in 2007, so it’s a relatively new kid on the block in the container world. However, its intermodal approach to moving boxes has been aggressive and effective.

Making It Work

It’s been a three-pronged effort among the Prince Rupert Port Authority, terminal operator DP World and CN Rail.

“The port had some real strategic advantages as a gateway,” says Brian Friesen, Vice President of Trade Development & Real Estate. “We felt we could be well-served in terms of getting into the intermodal business given our northern location. We also had an advantage in terms of marine transit times, being the closest North American port to Asia, and we’re blessed with the deepest natural port in North America (17 meters or 56 feet at the dock) and the third deepest in the world.”

Being located in a rural setting allows the port room to expand. DP World has taken advantage of this and invested heavily, increasing container capacity from 850,000 TEUs (twenty-foot equivalent units) to 1.6 million. There are plans to further increase capacity to 1.8 or 2 million TEUs. The port now handles approximately 1.1 million TEUs annually.

The second major component to expanding the port’s intermodal capacity is on the rail side. CN has been building out its northern main line from Prince Rupert to Edmonton with new sidings and siding extensions up to 14,000 feet. CN has also invested in the busy Edmonton-to-Winnipeg corridor and continues to make progress in essentially twinning that component of its network.

“Where the port authority has been focused is essentially building out what we call an intermodal integrated ecosystem, and a key component has been the Fairview Ridley Connector Corridor that was finished earlier this summer,” adds Friesen. The $100 million project connects the Fairview Terminal at the port with Ridley Island and south Cain Island where there are port lands and indigenous communities plus intermodal logistics and transload operations.

“The idea here was to connect the terminal with the rest of the port land to avoid having to run container trucks through the community but also shorten the route between export and import transload facilities, cutting drayage time by 75 percent,” Friesen says. “Before this project was completed, CN had a main line and a siding. Now we have a corridor of four tracks and a two-way private-haul road.”

Dwell Fees

Container backlogs at the port of Houston have caused logistical issues and forced the Port of Houston Authority to introduce its first container dwell fee, designed to reduce long-dwelling import containers sitting at the port’s two terminals.

Houston joins other ports such as Oakland, which reduced the free time for containers, and the Port of New York/New Jersey, which is planning a container imbalance fee if carriers do not remove more containers than they offload. The southern California ports of Los Angeles and Long Beach, however, never implemented their long-dwell fee despite its being authorized a year ago.

Port Houston has yet to experience any let-up in import loads.

Executive Director Roger Guenther said staff had evaluated several options to improve Houston's cargo movement including practices implemented by other U.S. ports to improve cargo fluidity. Import containers had seven-and-a-half days of dwell during the last quarter versus an historical average of three-and-a-half days.

Effective December 1, a sustained import dwell fee was scheduled to be implemented and an optional excessive import dwell fee has also been authorized for both the Barbours Cut and Bayport Container Terminals. The added fee will remain in place for at least 60 days with all loaded imports incurring a fee of $45 per day beginning on the eighth day after the expiration of free time – in addition to any demurrage charges incurred.

Barge Berth Project

The Guangzhou Port Group (GPG) in southern China has invested in a new berth in the Nansha port area to create additional capacity of half-a-million TEUs. The berth will add another intermodal dimension to the port and will be able to accommodate six inland container barges at a time, processing 15.5 million tons of bulk and general cargo per year.

The goal is to bolster the economic and social development of the hinterland, speed up capacity-building and accelerate the development of the port’s main business. The new berth joins four other berths that were opened in November 2021 and June 2022.

In August, Nansha began operations at its fully automated terminal, the first of its kind in the Guangdong–Hong Kong–Macau Greater Bay Area and part of the fourth phase of the modernization project at Nansha, combining multi-modal services related to sea, river and railway transportation. The company has set up a wholly-owned subsidiary with paid-up capital of more than $200 million to invest in the construction and operation of the project.

On-Dock Rail

The port of Long Beach plans an expenditure of approximately $1.5 billion for on-dock rail projects to speed the movement of cargo through the harbor – a vital part of the port’s overall intermodal model. Last December, the port was awarded a $52.3 million grant from the U.S. Department of Transportation's Maritime Administration to move ahead with the first stages of the program’s centerpiece – the Pier B On-Dock Rail Support Facility. Construction is scheduled to start in 2024 with final completion scheduled for 2032.

Other on-dock rail projects are also proceeding.

“The $25 million fourth track at Ocean Boulevard project has begun and will add another line to a crucial rail route in the port,” says Executive Director Mario Cordero, “and the $40 million Terminal Island Wye Realignment project – scheduled to start in late 2023 – will reduce switching conflicts by adding a new lead track on Pier T and two new storage tracks on Pier S.” The projects are designed to maximize the port’s ability to handle the rail traffic that comes through now and in the future.

In an effort to reduce dwell times and speed cargo flow, both Long Beach and the neighboring port of Los Angeles introduced dwell fees last October. The two San Pedro Bay ports have since seen a reduction of 50 percent in long-dwelling import cargo without having to actually start charging the fee.

A new CSX express service is already reducing logistical issues at Port Tampa Bay in Florida.

Wade Elliott, Senior Vice President of Marketing & Business Development, says the port is working with several customers who are using the new CSX Greenway expedited intermodal service for reefer cargo: “This is a premium express service offering four-day transit with daily departures from the CSX Tampa Terminal to the northeastern U.S. Perishable containerized cargoes arriving from Central America are transloaded at the port’s on-dock cold storage facility into CSX’s dedicated fleet of 53-foot refrigerated trailers for fast delivery to customers in New York/New Jersey, Pennsylvania, Maryland, Connecticut and beyond.”

Software Solutions

While ports and terminals deal with intermodal logistical challenges, there are companies like Tideworks Technology, headquartered in Seattle, that are fully involved in creating solutions for marine and intermodal terminal operating systems (TOS).

“As an intermodal TOS provider, we offer software that helps rail operators improve the efficiency and visibility of how and where they move containers on and off the terminal and throughout their yards,” explains Mark Bromley, Vice President of Rail Client Services. “Our intermodal TOS includes extensive reporting, integration and management features that inform planning, enable automation and improve yard efficiency.”

Bromley says one of the biggest challenges for terminal operators is organizing and planning their yards based on when containers are scheduled to be picked up. But the process of manual or even digitized planning can be tedious and slow. Tideworks’ TOS solutions help operators address these challenges and introduce automation through several features that reduce or remove planning time from the equation.

Another significant way the company helps operators drive efficiency at terminals is through access to data collected across multiple facets of the terminal’s operations. Tideworks’ TOS and its data visualization and reporting tools enable this access.

“We’ve all become aware of the impact disruptions in the normal flow of goods can have on the supply chain,” Bromley adds. “TOS solutions can help address and mitigate terminal congestion that impacts the ability to store and move cargo.”

that matters most

Get the latest maritime news delivered to your inbox daily.

Tom Peters is the magazine’s ports columnist.

The opinions expressed herein are the author's and not necessarily those of The Maritime Executive.