The Evolving Market for LNG Bunker Vessels

Entering 2025, the prospects for LNG as a marine fuel appear a bit brighter than the previous year thanks to an expanding demand. The global orderbook for this propulsion has found new buoyancy in 2024 after retrenching somewhat in 2023. DNV assessed the jump at 103 percent from the previous year for a total of 264 vessels. Some eight percent of the newbuilds on order opted for LNG propulsion, while alternative fuelled ships represented 50 percent of all new orders placed in 2024 according to Clarksons. The LNG-fuelled fleet reached 1,248 units, accounting for 84 percent of the overall dual-fuelled fleet, which itself now represents 7.4 percent of the global fleet.

Some of the main global hubs reached new records for LNG bunkering during the year. Preliminary data for Singapore highlighted a total of 1,096,807 cbm (463,948 mt). In Rotterdam, a tally of the first three quarters suggests sales upwards of 639,848 cbm for the year. Shanghai Yanshan reached deliveries of 444,000 cbm, Shenzhen Yantian of 300,000 cbm, and Ningbo Zhoushan of 60,000 cbm.

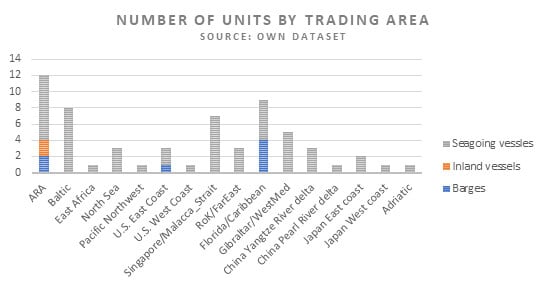

Against this backdrop, the niche shipping market for LNG bunker vessels (LNGBVs) has grown considerably reaching a fleet of 61 between seagoing vessels (52), barges (7), and inland vessels (2), with 60 percent of these units delivered between 2020 and 2024. Numerically, these units deployment at year’s end displayed a fair geographic distribution along the major sea lanes, though larger concentrations coalesced around five hotspots. The ARA-Baltic-North Sea continuum had the highest density, while also displaying the most diverse fleet with 23 between barges, seagoing, and inland vessels. Nine between barges and seagoing vessels traded in the Florida/Caribbean area, seven vessels in the Singapore/Malacca Strait, and five in Gibraltar and the Western Mediterranean.

A few movements and redeployments signaled evolving demand and supply patterns. Noteworthy among these was the redeployment to the UAE of NYK’s Green Zeebrugge announced at the end of December. After spending time in East Africa, it will trade there under a charter with Monjasa. In Singapore, the MPA launched a call for expressions of interest (non-binding) to award an additional LNG bunkering license. Fratelli Cosulich took delivery of its second LNGBV which is currently trading in Malaysia, while energy company Edison put the Adriatic Sea on the map by performing the first ship-to-ship operation there at the port of Trieste. Lastly, Seaspan received two of the three LNGBVs it ordered with Nantong CIMC shipyard. One of these will serve in the Pacific Northwest out of Vancouver; the other was deployed to the US West Coast but is expected to proceed to Panama and start trading there in March 2025.

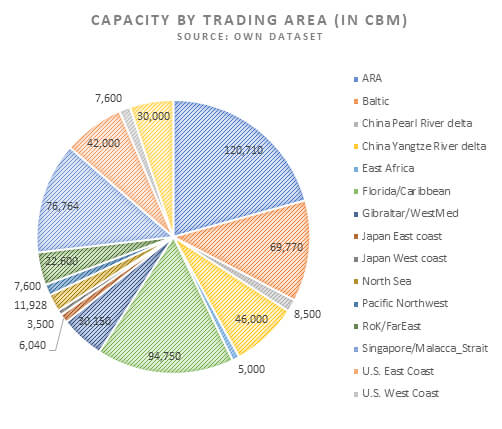

This budding fleet has a combined capacity of 582,912 cbm. Taking a closer look at how that capacity is distributed geographically can offer both commercial and operational cues, useful to asset managers, charterers, and voyage planners as well as LNG traders. To be sure, the distribution of volumetric capacity at year-end mirrors to a large extent the numerical one, highlighting heavier concentrations in the ARA / Baltic / North Sea space with 202,408 cbm combined (120,710; 69,770 and 11,928 respectively). This is followed by Florida/Caribbean with 94,750 cbm; and Singapore/Malacca with 76,764 cbm. China Yangtze with 46,000. Sizeable capacities can be found on the US East Coast with 42,000 cbm and, despite being served by a single unit, the Adriatic with 30,000 cbm.

that matters most

Get the latest maritime news delivered to your inbox daily.

Looking ahead, the outlook for the LNGBV segment looks positive. Prices for the fuel have eased considerably overall, and, despite upward European spot prices on the heels of Ukraine’s pipeline embargo, appear set to remain subdued into 2026 thanks to a slew of liquefaction plants and gas field projects due to come online. Shipping rates for the large-scale distribution of LNG remain low, though they may start firming up again with the addition of liquefaction capacity. Such conditions are favorable to the further rollout of the propulsion, and so far, the orders for alternatively fuelled tonnage placed by shipowners early this year seem to confirm that. All this suggests LNG ship-to-ship bunkering can grow more.

Nicola Contessi is a marine transportation advisor and a member of the Institute of Chartered Shipbrokers

The opinions expressed herein are the author's and not necessarily those of The Maritime Executive.