Study: Russia's Black Sea Container Traffic is Down, But Not By Much

Informall BG, an Odesa-based cargo analytical and consulting firm, has studied a key Russian container port on the Black Sea to identify the influence of the ongoing war in Ukraine. The results suggest that Russian container traffic has declined, but not by much, and some carriers are increasing their market share.

Novorossiysk, located on the East side of the Black Sea, is connected by rail and highways to the main population and industrial centers of Russia, Transcaucasia, and states of Central Asia. The port is one of the biggest cargo hubs in Russia, serving the entire country´s geography as well as handling exports to the international market. The container side of the port consists of four terminals, including an inland terminal that used to be owned and operated by Maersk’s APM Terminals until a recent divestment move.

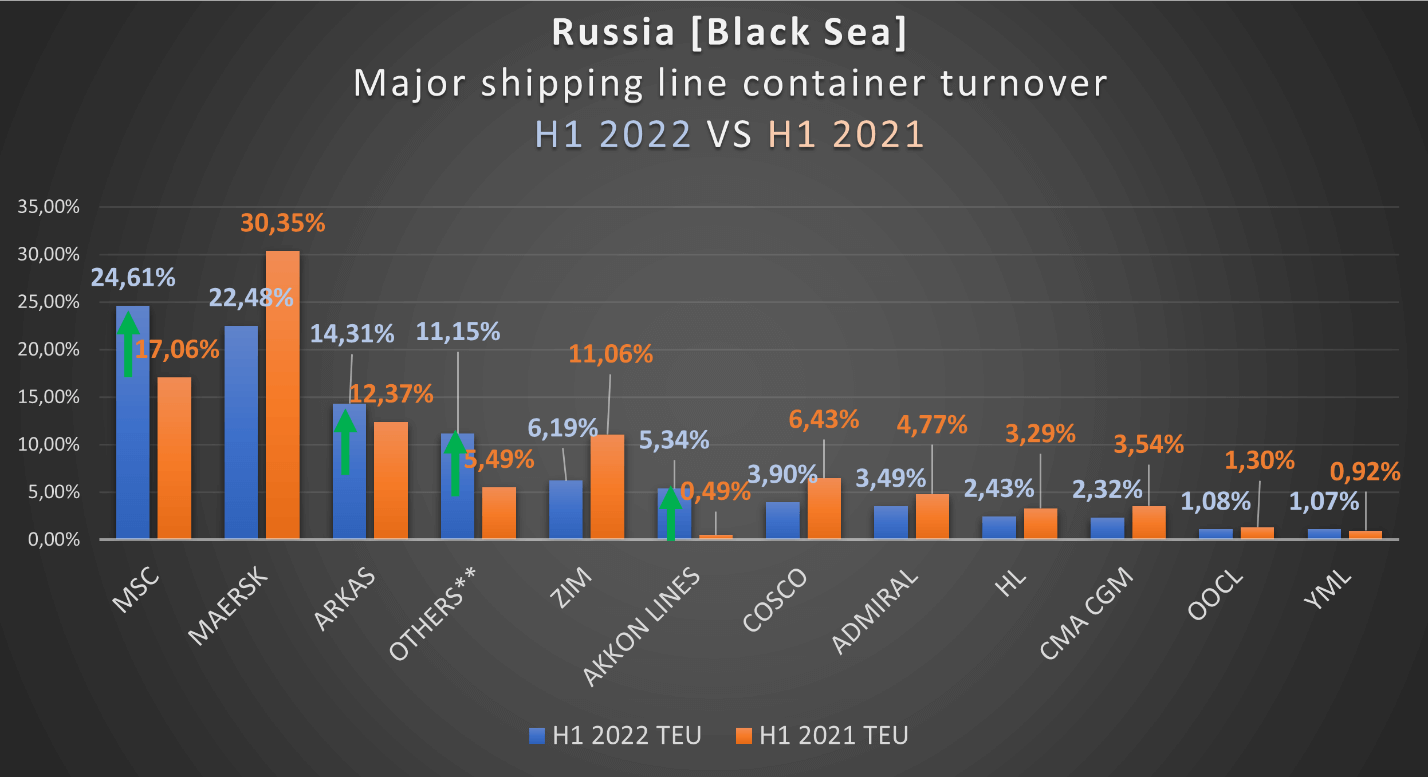

Total Russian container volume on the Black Sea in H1 2022 has shrunk by 7.7 percent year-on-year, while laden volume has dropped by 11.1 percent. Certain global shipping lines have been rapidly decreasing their activities since March 2022 in response to the Russian invasion of Ukraine. Some global shipping companies (like Maersk) made a decision to exit the Russian container market, suspending bookings fully or restricting activity to certain categories of goods.

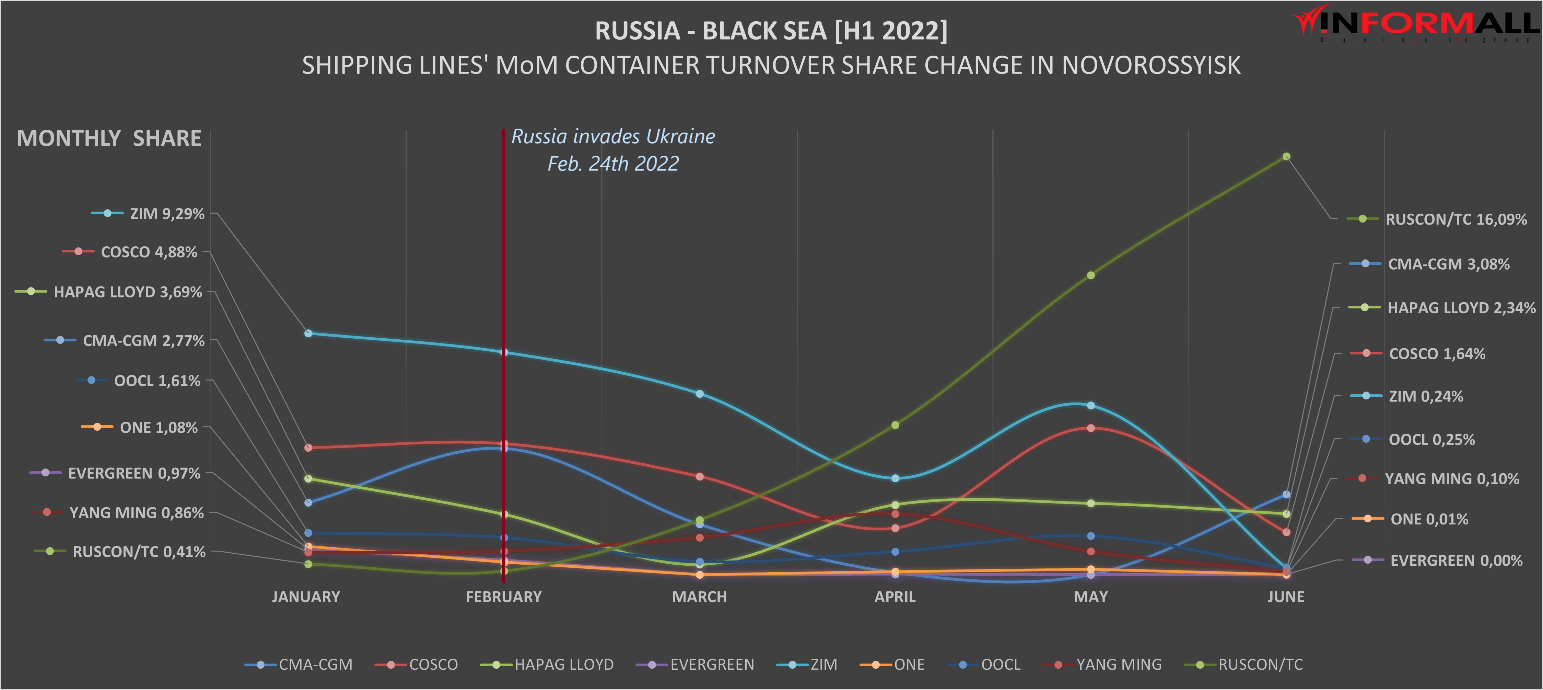

Most of the global shipping lines present in the port of Novorossiysk announced a booking suspension to and from the Russian ports in the first week of March, shortly after the invasion of Ukraine. The list of companies includes (but is not limited to) MSC, Maersk, ZIM, Hapag Lloyd, CMA CGM, ONE, Evergreen and Yang Ming. However, only a few actually suspended their activities in Novorossiysk.

Informall’s chart below shows how each shipping line’s monthly container turnover share was changing in the port of Novorossiysk from January to June 2022, comparing pre-war and current MoM volume change.

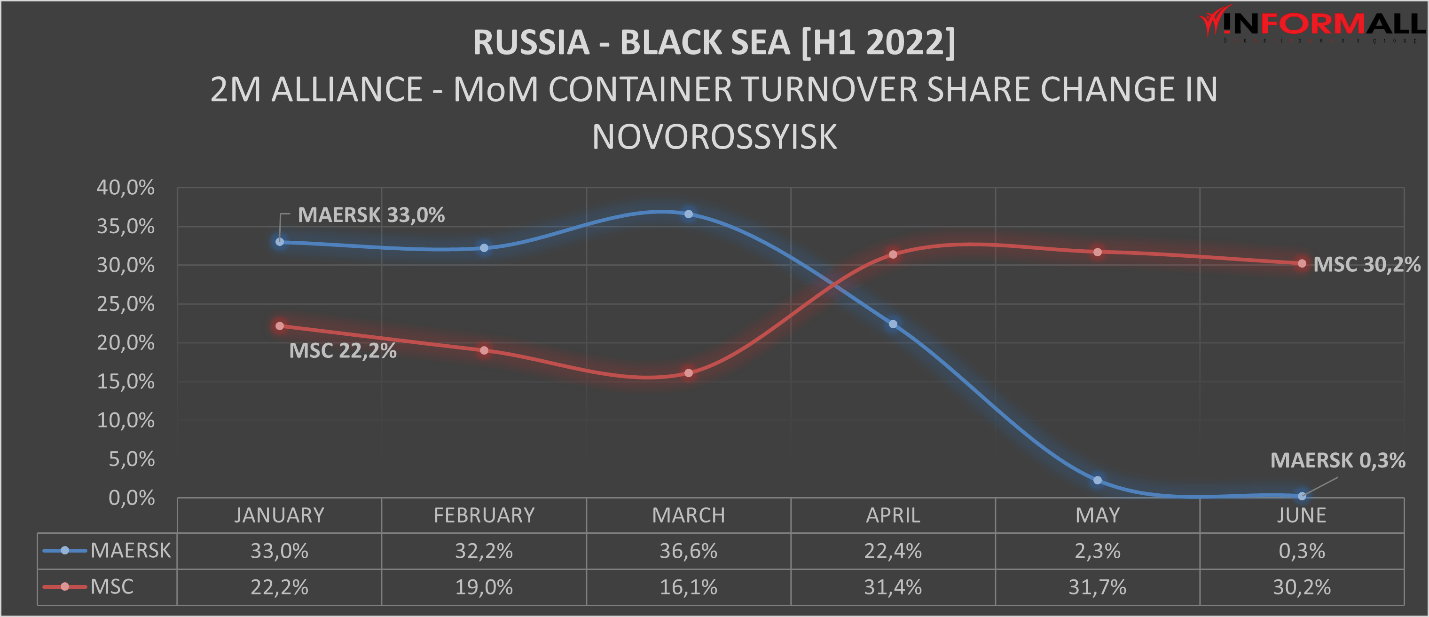

Maersk Line paused bookings to/from Russia in the days after the invasion of Ukraine, but operations to evacuate liner-owned empty containers from Russian ports continued. Many other ‘globals’ continued serving Russian container ports while adapting to the sanctions.

For example, MSC – which handled 22.2 percent of the total container turnover of the port in January - announced on March 1 that it would halt bookings for Russian cargo except for “essential goods such as food, medical equipment and humanitarian goods.”

MSC’s statement says that the company “…has been operating shipping and inland services to and from Russia in full compliance with international sanctions measures applicable to it.” As the data shows, MSC has considerably increased its market share in Novorossiysk during H1 2022. While Russian container volume on the Black Sea has been shrinking since the beginning of war, Informall’s numbers suggest that MSC gained 7.5 percent of total container turnover in Novorossiysk, accommodating now almost a quarter (24.6 percent) of all Russian container shipments on the Black Sea in H1 2022.

Who picked up the ball?

Along with global carrier MSC, other regional- and niche- scale carriers present in the Black Sea region have also benefited from the decreased activities of global shipping lines such as Maersk, ZIM, COSCO, Evergreen, ONE, Yang Ming and OOCL.

Admiral, Arkas and Akkon shipping lines have increased their presence in the Russian port of Novorossiysk since the beginning of the war in Ukraine, mainly because of the larger shipping lines deciding to exit the Russian container market. European sanctions on Russian goods and services provided a further boost to the bilateral trade between Türkiye and Russia, and transportation of goods for this trade lane is largely facilitated by Turkish and Russian shipping companies.

Although carriers in both Turkey and Russia are currently not able to fully compensate for all previously existing global liner services in Russia, the market conditions created opportunities for liner business growth and service development.

"While Russia explores alternative import/export cargo destinations willing to make up for the lost European market, there are liner operators ready to accommodate the demand despite international sanctions over Russia," says Daniil Melnychenko, data analyst of Informall BG. "The list of alternative Russian markets includes but not limited to the countries of Southeast Asia (Vietnam, Malaysia, Indonesia, Thailand), India, Bangladesh and Pakistan, which currently do not have well-established logistics connections with Russia."

Informall’s market study reveals that decreased activities of global shipping lines in the Russian container ports provided room for growth among domestic Russian shipping companies previously not extensively involved in international liner shipping operations. For example, Russian owned Ruscon (part of the Russian logistics firm Delo Group) burst into the container shipping market after Delo Group acquired Maersk’s stake in port operator Global Port Investments in Russia.

Informall’s market study reveals that decreased activities of global shipping lines in the Russian container ports provided room for growth among domestic Russian shipping companies previously not extensively involved in international liner shipping operations. For example, Russian owned Ruscon (part of the Russian logistics firm Delo Group) burst into the container shipping market after Delo Group acquired Maersk’s stake in port operator Global Port Investments in Russia.

Ruscon has priority access to the NUTEP container terminal in Novorossiysk, which is owned and operated by Delo Group. Having access to Delo Group’s logistics resources allowed Ruscon to quickly gain momentum in the port of Novorossiysk after global carriers reduced their volume.

Between January and June 2022, Ruscon has increased its container shipping volume via port of Novorossiysk by over 2900 percent, from a few hundred TEU per month to thousands, mainly owing to its new services from Russia to Türkiye, India, Israel and China.

“While some ‘globals’ are leaving the Russian container market, there is a real chance that the shortage of vessels capacity in Russian ports as well as deficit of container equipment will be compensated via regional- and niche-scale carriers and Russian private-owned shipping companies that began to actively utilize small- and mid-size chartered container vessels,” said Vassiliy Vesselovski, CEO of Informall BG.

Outlook

“If we compare Russian [Novorossiysk] laden container turnover H1 2021 period with H1 2022, the volume drop is not dramatic as some could expect – it’s only -11.1 percent. Considering the circumstances currently surrounding the Russian economy, we forecast that Novorossiysk’s laden container volume is due to drop by -35 percent by the end of 2022. Indeed, plunging laden container turnover is a looming threat to the Russian business, manufacturing and logistics sectors. However, geographical positioning of Russia allows them to diversify their cargo flows to those alternative countries [destinations] which preferred to not follow international sanctions imposed over Russia.”

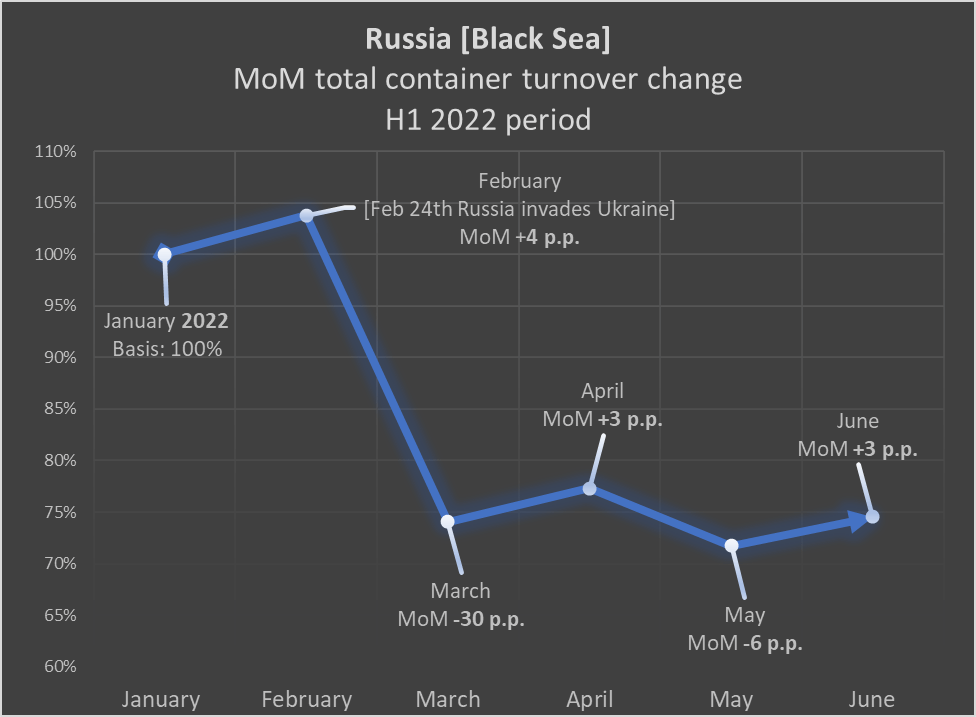

Informall points out that the real impact of shipping lines decreasing activities in the port of Novorossiysk can be seen from the drop in month-over-month total container turnover for H1 2022: actual volume drop from January through June was -26 percent (chart below). Over time, limited empty equipment availability, longer shipping and transit time, higher shipping rates, extra shipping costs and other sanctions-related obstacles will drag down the total container turnover of Russia on the Black Sea.

that matters most

Get the latest maritime news delivered to your inbox daily.

Informall BG is a consulting and private equity firm based in Odesa. Along with comprehensive container research in the Black Sea countries, the Analytical Department of Informall BG offers all types of analysis and forecasts for export and import cargo flows across Ukraine.

The opinions expressed herein are the author's and not necessarily those of The Maritime Executive.