Op-Ed: Baltimore's Bridge Collapse and the Making of a P&I Super Loss

From single-point failure to systemwide liability, what the Baltimore allision teaches shipowners and underwriters

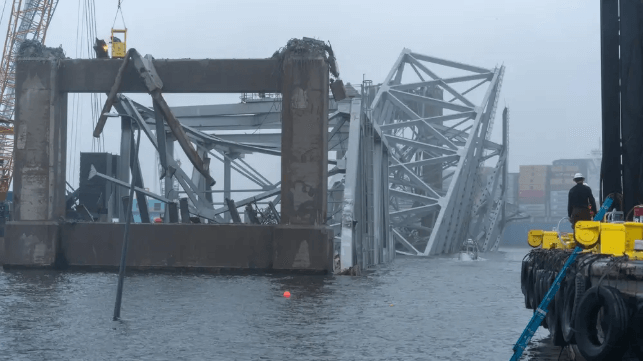

On a calm March night in 2024, a containership outbound from Baltimore lost electrical power, struck a main pier of the Francis Scott Key Bridge, and brought down a vital artery of the U.S. transport network in seconds. Six road workers died; the channel was choked for weeks; and the casualty's cost rippled from salvage crews to global supply chains. The proximate cause, investigators later concluded, was astonishingly small: an improperly installed electrical wire that loosened, starving critical systems and cascading into a blackout at the worst possible location. That 'needle-in-a-haystack' fault converted a routine departure into a national event—and a potential P&I super-loss spanning third-party property, life, environment, and prolonged economic damage.

The failure chain: engineering truth and timing

Investigators detailed how an improperly seated, labeled cable in the ship's electrical system contributed to power loss and loss of propulsion close to the bridge—leaving pilots with seconds, not minutes, to recover. The crew's response was timely; physics and proximity won anyway. The bridge itself lacked modern vessel-impact countermeasures—another weak link that turned an engineering malfunction into a structural collapse. Two lessons emerge. First, low-probability electrical defects are high-consequence maritime risks in constrained waters; they deserve the same board-level attention as fire. Second, safety is a system property: ship, pilots, VTS, and shore infrastructure succeed—or fail—together.

Why the P&I exposure scales so fast

P&I is built for third-party liabilities: loss of life and injury, pollution, wreck removal, cargo liabilities, and fixed-and-floating-object (FFO) damage. Baltimore compressed them into a single shock: compensation for fatalities; a major public bridge destroyed; obstruction and wreck-removal operations to reopen a strategic channel; and economic ripple claims as port closure diverted or delayed cargoes. Critically, severity—not frequency—now drives club volatility. The past decade shows fewer total losses but a changed risk shape: bigger ships, denser cargo, choke point navigation, and geopolitical overlays. One blackout or allision now carries balance-sheet energy far greater than earlier eras.

"Mega-claims are driven by consequence, not frequency."

The electrical blind spot

We lavish sensors and procedural rigor on engines and fire; we underinvest in predictive electrical integrity. The case highlighted avoidable failure modes: mislabeled conductors, connectors not fully seated, and maintenance that omits modern diagnostics (thermography, torque verification, heat-signature trending on switchboards). As vessels have grown in size and electrical complexity, the consequence multiplier has outpaced our inspection culture.

The infrastructure gap: where ship risk meets shore risk

Many critical spans at maritime crossings still lack robust pier protection, stand-off dolphins, or sacrificial structures sized for today's displacement and momentum. A thorough vulnerability assessment could have prompted mitigation; that finding is a global caution wherever legacy infrastructure meets modern tonnage.

Underwriting reality: pricing consequence, not comfort

Traditional rating inputs—tonnage, age, claims history—understate contextual risk in confined waters. If underwriting remains indifferent to impact energy (displacement × speed × proximity to critical infrastructure), clubs will continue to absorb losses misaligned with price. Baltimore should be a pivot: link cover terms to demonstrable controls against high-impact, low-occurrence electrical and navigational events.

What to change—now

For Shipowners and Operators:

- Electrical integrity as a safety-critical system: mandate post-maintenance thermographic scans, torque checks, label governance, and connector fit verification before departures through constrained waters; tie completion to pilot-boarding 'go' checks.

- Blackout-in-channel drills: simulator-validated anchor deployment, tug choreography, emergency steering, and communications—including pre-planned abort points.

- System-to-system port risk reviews: VTS response latencies, tug bollard-pull adequacy, bridge-strike energy envelopes, and contingency anchorages.

For P&I Clubs and Underwriters:

- Consequence-weighted pricing: adjust rates and deductibles for impact energy and infrastructure adjacency, not just GT and age.

- Conditional credits: premium relief for verified electrical integrity programs, channel-specific emergency drills, and joint port-infrastructure assessments.

- Pool stress tests: model combined scenarios—bridge strike, prolonged channel closure, salvage congestion, environmental liabilities—from a single blackout; align reinsurance and retentions with modeled PML.

- Crew-centric indicators: embed fatigue risk and emergency drill quality into risk scoring; seconds matter when systems fail.

Closing takeaway

Baltimore proved that a tiny defect could mobilize the full force of maritime liability. A ship's electrical integrity and a bridge's strike-resilience are part of the same safety system. If we continue to manage probability while underpricing consequence, the next allision will again become a headline—and a pool-buster. Owners should treat electrical failure modes like fire: test, inspect, and drill until recovery is reflex. Underwriters should reward those controls and demand system-to-system risk evidence before pricing a transit. That is how we turn an avoidable tragedy into durable safety and keep the next super-loss from being ours.

that matters most

Get the latest maritime news delivered to your inbox daily.

Priyatham Sanjeeva Reddy, Ramidi currently works in maritime technical and operational roles with a focus on the intersection of ship technical operations and risk management.

The views expressed in the article are presented independently and do not represent those of any employer or organization.

The opinions expressed herein are the author's and not necessarily those of The Maritime Executive.