Forecast Dry Bulk Earnings Show Light at the End of the Tunnel

The well documented trough in dry bulk earnings in 2020 are forecast to reverse. VesselsValue's new Forecast Earnings module shows an optimistic outlook from mid 2020 across the dry bulk sector.

Capesize earnings, in particular, are predicted to increase sixfold in the next 6 months, from $5,000 per day to $30,000 per day by October 2020.

Where are we now?

The past 12 months have seen weak dry bulk - and especially Capesize - market fundamentals.

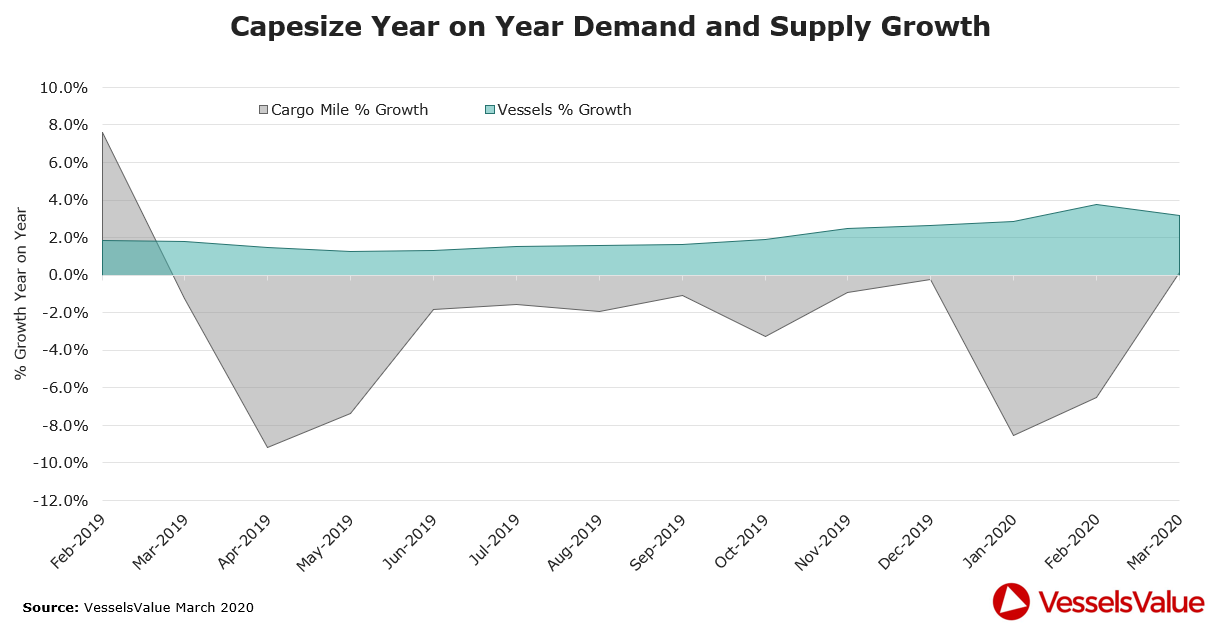

On the demand side, the Brazilian dam collapse of April 2019 and the reduction in demand for infrastructure and energy consumption due to COVID-19 have resulted in a sustained slump. The chart below shows the past 12 months of Capesize supply and demand growth. As can be seen, in 2019 and 2020 so far, fleet growth exceeded demand growth, leading to an excess of vessel supply and the recent poor markets.

Some good news is that removals from the Capesize fleet peaked in early 2020. Year to date, 25 Capesize vessels were sold for demolition compared to only 10 units in YTD 2019 and 7 units in YTD 2018. High levels of recycling has reduced tonnage supply, but current closures of breaking yards in the Indian subcontinent due to COVID-19 will temporarily freeze further removals. We expect to see a significant surge of removals on reopening of breaking yards in June – July 2020.

What do we forecast?

In the Capesize sector we predict earnings of $30,000 per day in Q3 of this year and earnings in a range of $20,000 - 35,000 per day over the next three years. These predictions are based on modelled analysis of VesselsValue AIS Trade, Fleet and Vessel utilization data.

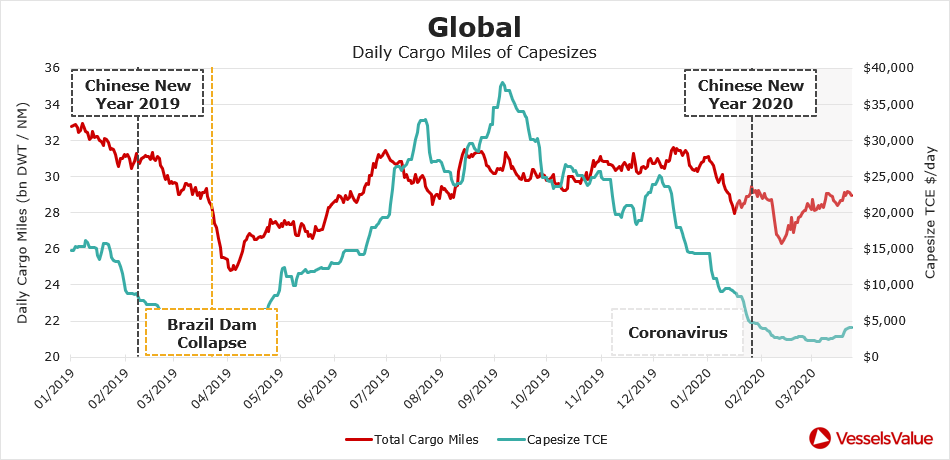

In terms of current demand trends, the chart below shows the cargo miles of Capesize in red, clearly showing the recent recovery in Capesize cargo miles to near levels seen in the previous year and continued upwards trajectory (for reference the Capesize TCE is also shown in green).

We expect a continuation of this global demand growth. At the end of February the Chinese provincial governments rolled out investment projects worth about 25 trillion yuan, roughly 25 percent of their 2019 GDP. This stimulus package will lead to increasingly strong demand for steel and energy and a tightening dry bulk supply demand balance. The stimulus package will continue to support dry bulk demand growth sufficiently to outpace supply growth over the next three years, and the dry bulk market and freight rates will continue to rise during 2021 and 2022.

that matters most

Get the latest maritime news delivered to your inbox daily.

Additionally, uncertainties surrounding the COVID-19 pandemic, the trade war and volatility in oil prices are governing business decisions being made in the first half of 2020 and caution will be taken. Shipyard demand, already facing challenges from upcoming regulations and geopolitics, will likely encounter a further blow given the vast current disruptions to economic growth and trade globally. As a result, the global orderbook has moved even lower, and we foresee a continuation of that development.

This post appears courtesy of VesselsValue and may be found in its original form here.

The opinions expressed herein are the author's and not necessarily those of The Maritime Executive.