The Irish Backstop and Trade – What and How Much?

The Irish backstop solution for Brexit would ensure Ireland's border with Northern Ireland remains open. In November last year, the European Commission stated that the E.U. and the U.K. have committed that they will use their best endeavors to conclude and ratify an agreement by July 1, 2020 which would replace the backstop. On February 20, 2019, European Commission President Jean-Claude Juncker and British Prime Minister Theresa May said that the backstop provision is temporary.

What the backstop means: there will be a single E.U.-U.K. customs territory. There will be no tariffs, quotas, or rules of origin checks between the E.U. and the U.K.

If the backstop solution is not implemented, what does it mean for trade? All goods imported into the U.K. from Ireland and the other EU states will be subject to the World Trade Organization (WTO) rules on tariffs, quotas, and rules of origin. There would be customs checks and new administrative procedures. These can cause delays at the border, given the high volumes of trade.

What are the main products and volumes traded between Ireland and Northern Ireland, and Ireland and the U.K. (not including Northern Ireland)? Where does Ireland rank among the U.K.'s trade partners? How important trade with Northern Ireland and the U.K. is for Ireland?

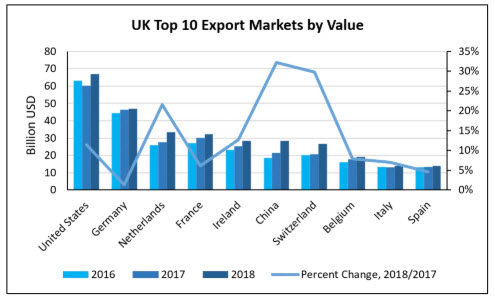

U.K. (including Northern Ireland) Trade - Ireland ranking among partners

Ireland is the fifth largest export market for the U.K. In 2018, U.K. exports to Ireland reached $28 billion, representing six percent of total U.K. exports of $492 billion. The top partners were the U.S. with a 14 percent share, Germany 10 percent, Netherlands and France seven percent each. The U.K. exports to China also reached $28 billion, close to the value of exports to Ireland. The next major market after China is Switzerland at $26 billion.

The highest increases in U.K. exports were to China at 32 percent compared to the previous year, Switzerland 30 percent, Netherlands 22 percent, Ireland 13 percent and the U.S. 11 percent.

Source: IHS Markit © 2019 IHS Markit

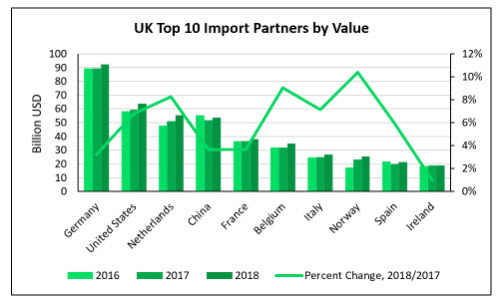

Ireland is the U.K.'s 10th import partner by value. In 2018, imports from Ireland reached close to $19 billion, a share of three percent of the total U.K. imports of $651 billion. The U.K.'s main import partner is Germany with a 14 percent share of total U.K. imports in 2018. Following are the U.S. with a 10 percent share, Netherlands nine percent, China eight percent, France six percent, Belgium five percent, Italy and Norway four percent each, and Spain over three percent.

The highest increases in U.K. imports by value in 2018 were for products from Norway 10 percent, Belgium nine percent, Netherlands eight percent; imports from Germany increased at three percent, while imports from Ireland registered a one percent increase compared to the previous year.

Source: IHS Markit © 2019 IHS Markit

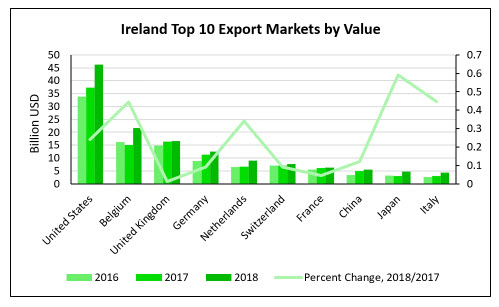

Ireland Trade - U.K. (not including Northern Ireland) and Northern Ireland ranking among partners

Ireland exports in 2018 reached over $166 billion, 20 percent higher compared to 2017. The main export markets by value were the U.S. with a share of 28 percent, Belgium 13 percent, and the U.K. (not including Northern Ireland) 10 percent.

Ireland exports to Northern Ireland represent 1.4 percent of Ireland's total exports by value. Exports to the U.S. increased by 24 percent, while exports to Belgium, the second largest export market for Ireland, increased at 44 percent. Exports to the U.K. (not including Northern Ireland) increased by one percent only, while exports to Northern Ireland increased by nine percent.

Source: IHS Markit © 2019 IHS Markit

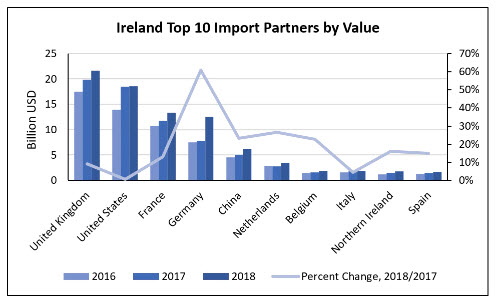

Ireland imports last year reached $106 billion, an increase of 19 percent compared to the previous year.

The U.K. (not including Northern Ireland) is the largest supplier at $22 billion, 20 percent of Ireland's total imports. U.K. exports to Ireland increased last year by nine percent%. Northern Ireland is the ninth largest supplier for Ireland at $1.7 billion.

Source: IHS Markit © 2019 IHS Markit

Ireland trade with Northern Ireland

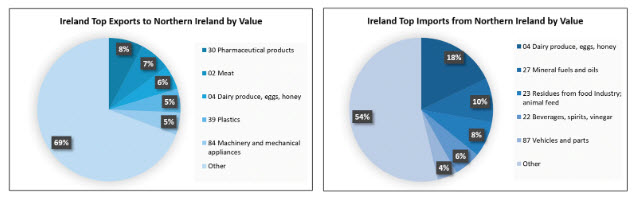

Ireland's exports to Northern Ireland in 2018 reached $2.3 billion, an increase of nine percent compared to the previous year. Ireland's imports from Northern Ireland in 2018 increased by 16 percent over 2017, reaching $1.7 billion. Top exports and imports are presented in the figures below.

Source: IHS Markit © 2019 IHS Markit

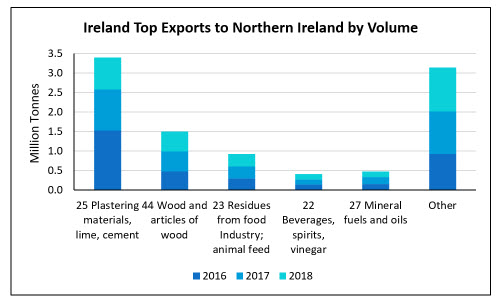

Ireland's exports to Northern Ireland reached three million tonnes last year, a decrease of seven percent compared to the previous year. The highest volumes traded were plastering materials, representing a share of 27 percent of Ireland's total exports to Northern Ireland by volume, and wood and articles of wood at 17 percent share. Plastering materials exports decreased by 23 percent last year, and wood by two percent.

Source: IHS Markit © 2019 IHS Markit

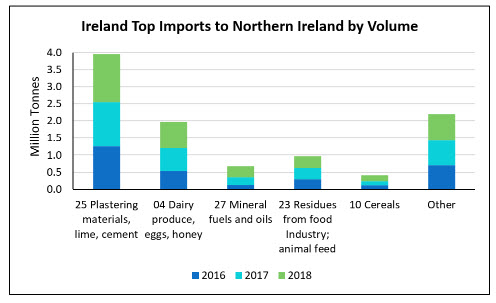

In 2018, Ireland's main imports from Northern Ireland by volume were plastering materials, dairy, and mineral fuels, followed by animal feed and cereals.

Total volume was 3.7 million tonnes, representing an increase of 10 percent compared to the previous year. Plastering materials account for a 37 percent share of Ireland's total imports from Northern Ireland, and dairy represents 20 percent.

Source: IHS Markit © 2019 IHS Markit

U.K. (not including Northern Ireland) trade with Ireland

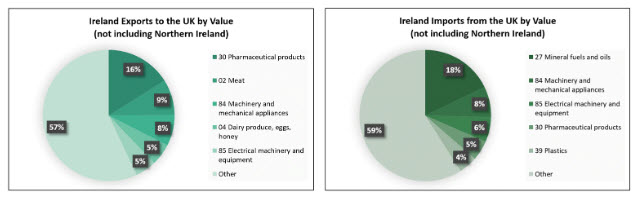

In 2018, Ireland's exports to the UK (not including Northern Ireland) by value reached $16.6 billion and increased by only one percent compared to the previous year. Imports were $21.6 billion, nine percent higher than in 2017. Top traded products by value are shown in the figures below.

Source: IHS Markit © 2019 IHS Markit

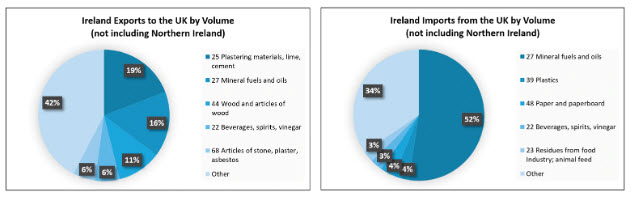

Ireland's exports to the U.K. (not including Northern Ireland) by volume reached close to seven million tonnes in 2018, an increase of five percent compared to the previous year. The volume of imports from the U.K. was close to 14 million tonnes, also an increase of five percent over 2017. The highest traded products are shown in the figures below.

Source: IHS Markit © 2019 IHS Markit

This column is based on data from IHS Markit Global Trade Atlas (GTA) and World Trade Service (WTS).

that matters most

Get the latest maritime news delivered to your inbox daily.

Daniela Stratulativ is Head of Global Trade Analysis at IHS Markit Maritime & Trade.

Source: IHS Markit

The opinions expressed herein are the author's and not necessarily those of The Maritime Executive.