'High and Dry': For how long?

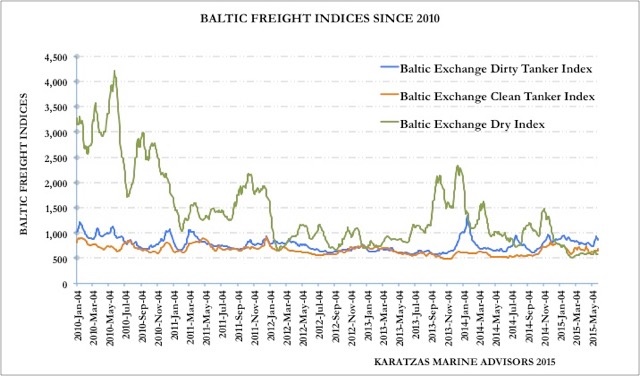

Since the Baltic Dry Index (BDI) established all-time lows in February this year, the ensuing negligible recovery has only driven deeper the belief that the dry bulk market (and likely other shipping sectors) may be in a structural market trough. Rates have marginally improved since February, but the truth of the matter is that most types of dry bulk vessels barely earn their variable cost (operating expense), not to mention financial cost, capital repayment and profit.

The market has been terrible for almost a year now, meaning that dry bulk shipowners are just bleeding cash; even at a small operating loss, let’s say at $1,000 pd, that’s $350,00 per annum per vessel, and for an owner of ten dry bulk vessels that’s $3.5 mil. This is before interest expense is factored in, repayment of the ship mortgage, etc. While quarterly reports casually over the computer screen as the Red Sea (or sea of numbers in red) for the publicly listed companies, it takes a ‘field trip’ to ‘feel their pain’ of the private owners.

There is telltale evidence of anxiety about the direction of the market. There is anecdotal evidence that many shipowners have been cutting down on their vessel maintenance expense, spare part inventory onboard, and warm lay-up of the vessels. For the vessels that are inspected, there has been an ever growing concern that many vessels have been neglected and that ‘cheap ships’ may just be that: ‘cheap ships’ in need of keep-up.

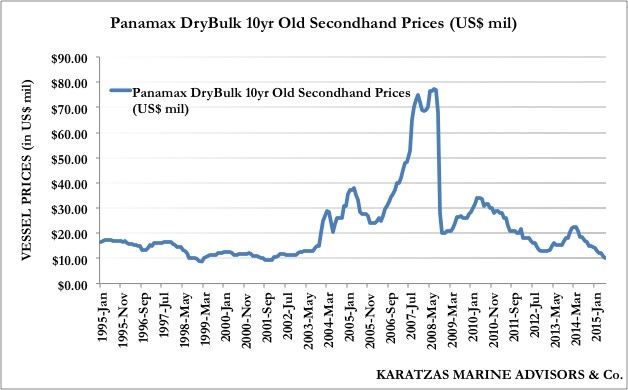

For the few shipping banks still open for business, the dry bulk market is a ‘do not touch’ market segment, irrespective of the prospects. Cyclical thinking and lack of liquidity has kept many buyers away from the market, further depressing asset prices, which in turn causes more owners to default in this death spiral. Asset prices for dry bulk vessels have declined by 20% to 50%; in a glaring example, a ten-year old panamax dry bulk vessel – as per graph herewith - has declined in value from appr. $21 mil in May last year to appr. $10 mil today, a precipitous drop and a halving on one’s net worth and economic value.

Looking back at data for more than two decades, this is as low as that this particular asset class has even been, so at least on absolute terms, this is close to the bottom of the market. It’s hard to fathom that a ten-year old dry bulk vessel was once valued at more than $70 mil in 2008, so, if the market ever returns to its previous glory, theoretically, buyers at today’s levels will make a killing. But again, even a small bounce in the market can be a generous return of capital. Asset prices and dry bulk freight rates move about fast, and if for some reason there is an improvement in a depressed market, a 10 percent or more improvement can take place very easily; at the very least, it will be completely unexpected.

Actually, there are ‘smart money’ out there that are thinking just about that. The dry bulk market is in very bad shape and the mood is terrible; not sure if the proverbial ‘blood in the streets’ describes the present bottom of the market, but definitely it’s a buyer’s market: bad prospects and confidence (for instance, almost nil interest for long term charters, indicating that charterers do not believe in a strong market recovery, etc), more sellers than buyers in absolute terms, more motivated sellers than buyers in ‘soft’ terms, consensus that prospects are terrible, no easily found debt financing or any type of financing, many institutional investors are putting their own pressure on the market as their premature investments in shipping are turning out badly.

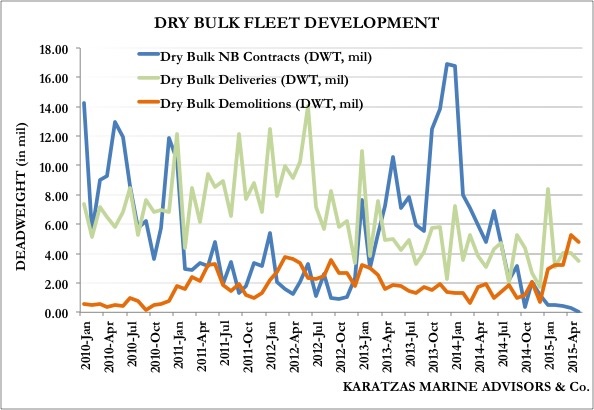

However, newbuilding orders have come to a screeching halt and fewer than thirty dry bulk vessels were ordered year-to-date. On the other hand, close to two-hundred bulk vessels were scrapped; as per attached graph, so far this year, the world’s dry bulk fleet has gotten smaller as more ships were scrapped than delivered, signifying that actually tonnage supply is contracting which is exactly what this market needs; and tonnage supply is one of the major drivers for asset pricing as we all know from Econ 101.

Tonnage demand and movement of cargo has been increasing all along; of course there have been revisions by OECD that world economic growth is slowing and that China has moved away from stock piling raw material inventories that used to spike the market on occasion. Volumes to be traded are still available and ton-mile is still increasing, thus demand is still there. Therefore, the underlying fundamentals are still positive, it’s only a matter of timing that there is a mis-match of tonnage supply and demand.

The smart money wonder whether the market swing has moved too much on the ‘half empty’ camp, with owners giving up on hope and charterers being too exposed to the spot market (with little long term coverage, thus making them trigger-happy once the market start moving the other direction). This can become a catalyst to magnify any market move to the upside as charterers will rush in to charter vessels (whether spot or short term) and driving artificially high tonnage demand with pent-up demand.

With every weekly report of high demolitions, one can almost feel the collective deep breath of relief as this definitely helps the market find an equilibrium sooner than later; the news that no newbuilding orders are placed is delightful news both in terms of actual constraining of tonnage supply, but also it has the ‘sentimental’ value that at a time of crisis, no new ships are ordered, which is what is supposed to expect in a situation like this (and in 2002-2013, of course, but then between the eco-design and structural recovery and institutional investors rushing in, it didn't happen).

While tonnage supply can definitely increase over long term, at least for the short term, one can see that vessel deliveries are well known and accounted for, and likely to surprise on the downside (as some owners delay accepting delivery or push backward to the delivery deadlines). With every passing week of weak freight rates, more and more owners are making the decision to scrap vessels instead of drydocking. And, scrapping is not a stigma and is more easily justified when the neighbors are doing it as well. Tonnage demand in the interim is constantly there and growing, providing a support for the market. The market has already been discounting bad news, thus leaving more surprises on the positive that can move the market upwards substantially in the next year, especially if there is an unforeseen event that can drive the market strongly.

Yes, the dry bulk market is terrible. As we mentioned in a previous post, this terrible shape of the market may actually be a good thing over the long term; the smart money have started thinking that this weak market is a good thing in the short term as well.

The opinions expressed herein are the author's and not necessarily those of The Maritime Executive.