Brexit: What's at Stake for U.K. Trade

If the U.K. leaves the E.U. Customs Union, it would be able to negotiate free trade agreements on its own terms with non-E.U. countries, and with the E.U. These agreements could take between four and 10 years to finalize, and until then the U.K. will trade on World Trade Organization terms which would mean higher tariffs, increased costs for intermediate outputs used in U.K. production and higher prices for consumers.

The E.U. currently has 43 free trade agreements (FTAs) in force, with more than 50 countries, and is currently negotiating 12 regional and bilateral trade agreements. Even if the U.K. and the current non-E.U. partners agree to sign bilateral agreements and keep the terms as in the E.U.-negotiated FTAs, there is still one significant issue that will affect U.K. exports: the rules of origin.

For every product included in a trade agreement, the rules of origin are specified: the percentage of that product that has to come from domestic activity in the exporting country, in order for the product to be eligible for duty-free access in the importing country.

Currently, for each U.K. product, the U.K. inputs and the E.U. partners intermediate inputs are cumulated to calculate the percentage of U.K. content. If the U.K. does not benefit from E.U. FTAs with other countries, the intermediate inputs incorporated in U.K. products will not count as U.K. content. As a result, many U.K. products will not qualify for duty-free access. This will make U.K. products less competitive compared to similar products of E.U. partners.

It is estimated the U.K. imports $80 billion worth of goods to use in production, excluding precious metals and stones (U.K. Trade Policy Observatory). The main U.K. sectors that use intermediate inputs are machinery and mechanical appliances, electrical machinery and vehicles.

U.K. Imports from Non-E.U. Countries

U.K. imports from non-E.U. countries in 2017 reached close to 129 million tonnes and had a value of over $291 billion. The main trading partners were Norway with a 20 percent share, the U.S. 14 percent, Russia 10 percent, China seven percent and Canada four percent.

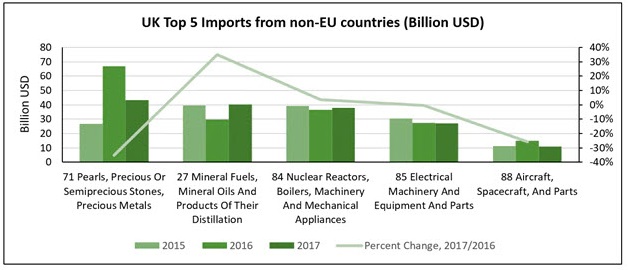

The U.K.'s top five imports from non-E.U. countries by value are precious metals, mineral fuels, machinery and mechanical appliances, electrical machinery and aircraft.

Source: IHS Markit © 2019 IHS Markit

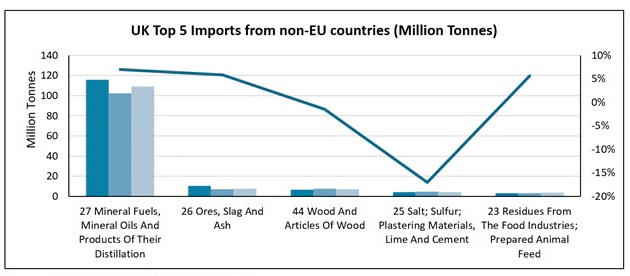

The largest volumes of U.K. imports from non-E.U. countries are mineral fuels, ores, wood, plastering materials and animal feed. Mineral fuels, ores and animal feed imports increased in 2017 compared to the previous year by around five percent, while imports of wood and plastering materials decreased.

Source: IHS Markit © 2019 IHS Markit

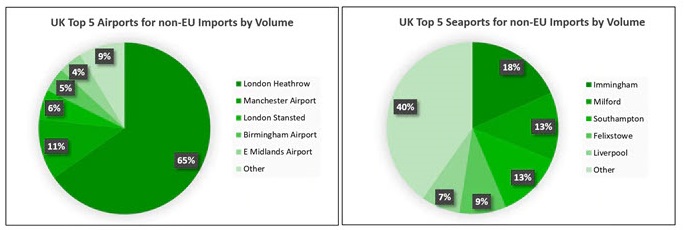

The airports and seaports with the highest volumes of U.K. imports from non-E.U. countries are presented in the figures below.

Source: IHS Markit © 2019 IHS Markit

Mineral fuels, wood, electrical machinery, plastics and steel are imported in high volumes across the five seaports. In addition, Southampton is the port of entry for vehicles; both Southampton and Felixstowe receive high volumes of furniture, while Liverpool is the entry for oil seeds, cereals, sugar and confectionery.

U.K. Exports to Non-E.U. Countries

In 2017, the total value of U.K. exports to non-E.U. countries reached over 53 million tonnes with a value close to $235 billion. The main partners by value are the U.S. with a 25 percent share, China nine percent, Switzerland eight percent, Hong Kong and United Arab Emirates each with four percent.

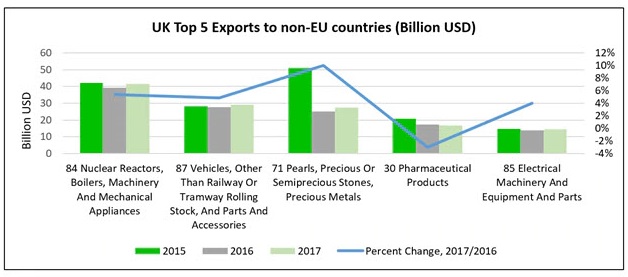

The U.K.'s top five exports to non-E.U. countries by value are machinery and mechanical appliances, vehicles, precious metals, pharmaceuticals and electrical machinery.

Source: IHS Markit © 2019 IHS Markit

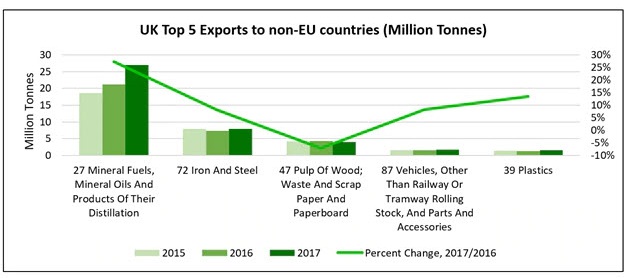

The largest volumes of U.K. exports to non-E.U. countries are mineral fuels, iron and steel, pulp of wood and scrap paper, vehicles and plastics. Mineral fuels exports increased in 2017 compared to the previous year at 27 percent, while iron, steel and vehicles volumes increased by eight percent.

Source: IHS Markit © 2019 IHS Markit

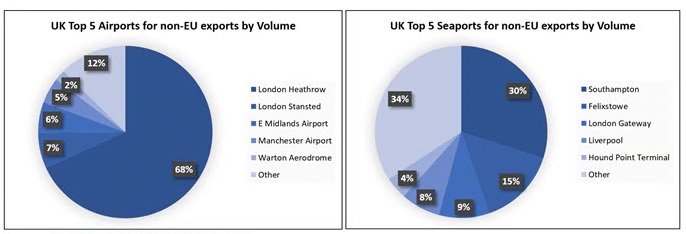

The airports and seaports with the highest volumes of U.K. exports to non-E.U. trade partners are presented in the figures below.

Source: IHS Markit © 2019 IHS Markit

U.K. trade with E.U. countries

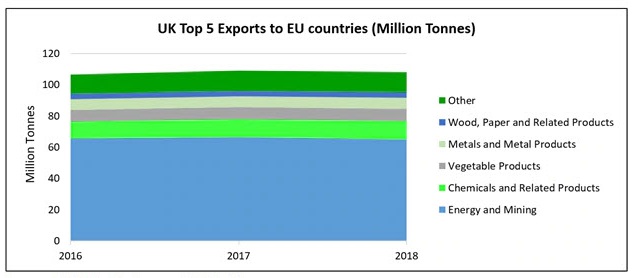

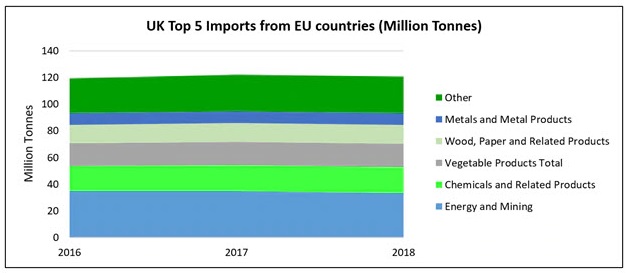

U.K. exports to the E.U. and imports from E.U. countries will be subject to tariffs and rules of origin checks, according to WTO rules. In 2018, imports reached 120 million tonnes and $364 billion. Exports totaled 108 million tonnes and $229 billion.

The largest volumes of U.K. exports and imports to/from the E.U. are in the energy and mining sector, chemicals, vegetables, metals and wood.

Source: IHS Markit © 2019 IHS Markit

Source: IHS Markit © 2019 IHS Markit

This column is based on data from IHS Markit Global Trade Atlas (GTA) and World Trade Service (WTS).

that matters most

Get the latest maritime news delivered to your inbox daily.

Daniela Stratulativ is Head of Global Trade Analysis at IHS Markit Maritime & Trade.

Source: IHS Markit

The opinions expressed herein are the author's and not necessarily those of The Maritime Executive.