U.S. Container Imports Are Projected to Decline for the Remainder of 2025

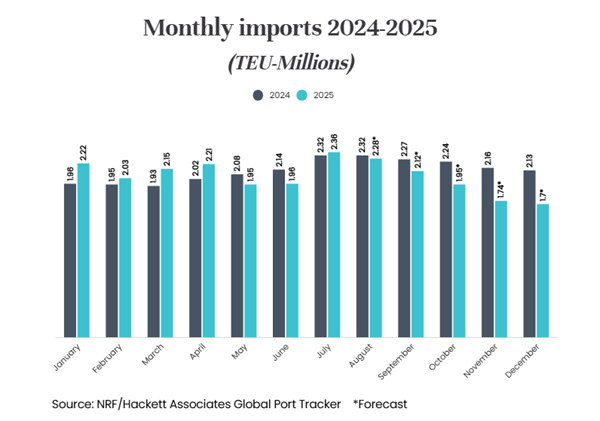

The start of the U.S.’s reciprocal tariffs and the continued uncertainty over longer-term trade policies have begun to weigh on imports, report both the National Retail Federation and Descartes Systems Group, a software provider for logistics-intensive industries. The latest monthly forecasts highlight a peak in July with a steady decline forecasted for monthly import volumes in the remainder of 2025.

“Retailers have stocked up as much as they can ahead of tariff increases, but the uncertainty of U.S. trade policy is making it impossible to make the long-term plans that are critical to future business success,” explains Jonathan Gold, the NRF’s Vice President for Supply Chain and Customs Policy. “These tariffs and disruptions to the supply chain are adding costs that will ultimately lead to higher prices for American consumers.”

The NRF, in its monthly Global Port Tracker, reports August volumes were likely down about 1.7 percent from a year ago and at a projected final total of 2.28 million TEU, off nearly 3.4 percent from the 2.38 million TEU in July. They note that July was up 20 percent over June, making it the second-busiest month on record as retailers brought merchandise in ahead of the August start of reciprocal tariffs and a looming deadline for tariffs on China.

Total container imports at U.S. seaports measured by Descartes were at 2.52 million TEU in August, which it says was up 1.6 percent year-over-year. However, it points to a nearly 4 percent year-over-year decline, highlighting the impact of “fast-shifting trade policy.”

The biggest year-over-year drops came in aluminum, apparel, and footwear, reports Descartes. It notes that furniture, toys, and electrical machinery imports also fell in August. It warns that “policy remains the wildcard.”

Imports are uncertain after Trump doubled the tariffs on India to a total of 50 percent at the end of August. Further, while the deadline for a trade deal with China was pushed back a further 90 days to November 10, it looms over imports.

With the delay coming as retailers head into the busiest season of the year, the NRF actually raised its forecast slightly from last month. The forecast for September calls for the strongest increase, with NRF forecasting 2.12 million TEU, up from its prior forecast of 1.83 million TEU. However, it sees an accelerating month decline as imports move into the fourth quarter of 2025. It expects volumes will level off at just over 1.7 million TEU per month in November and December.

that matters most

Get the latest maritime news delivered to your inbox daily.

For the full year, the NRF forecasts imports of 24.7 million TEU, which would be down 3.4 percent from 2024. It, however, will still be the fourth-highest year on record, following the peaks during the pandemic and in 2024.

The retailers also released their first forecast for 2026, projecting that January will be at 1.8 million TEU. They expect the new year to start at a level 19 percent below January 2025.