Shippers Warned of Surcharges and Delays Due to Pending ILA Strike

Carriers are taking further steps to prepare for the increasing likelihood of a strike at U.S. ports along the East Coast and Gulf Coast. With no apparent progress to break the impasse between the International Longshoremen’s Association and the US Maritime Alliance, carriers are announcing surcharges to help address potential disruptions while they expect continued strength in the peak season and warn of congestion already at ports around the world.

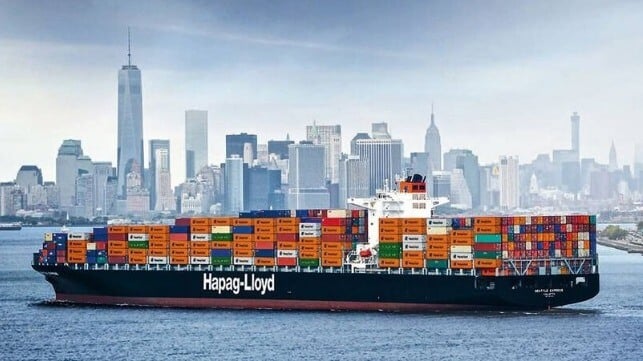

Both CMA CGM and Hapag-Lloyd followed an earlier notification by MSC Mediterranean Shipping Company informing customers of their intent to start charging surcharges for both imports and exports from the impacted ports. The Federal Maritime Commission requires a 30-day notification to customers of any additional fees.

MSC is calling it an “Emergency Operations Surcharge,” and has timed it to start on October 1 the expected first day of the coastwide strike. It applies to containers coming from Europe and ranges from $1,000 for a standard 20-foot box to $1,500 for a larger 40-foot box. CMA CGM did not give it a fancy name but in a Customer Advisory dated yesterday announced charges ranging between $800 and $1,500 for exports depending on the specifications of the box and a flat $1,500 per TEU for all imports bound for the U.S. East/Gulf Coast ports. CMA CGM’s surcharge is effective starting October 11.

Hapag introduced a new nomenclature warning a “Work Disruption Surcharge (WDS)” is coming up. They told customers the charge would go into effect on October 18 and it amounts to $1,000 per TEU on all imports.

Hapag is telling export customers that it will continue to accept bookings “as long as rail providers and terminals are accepting containers.” For importers, they are encouraging them to expedite documentation and customs clearance to “facilitate the prompt retrieval of your cargo from the terminal before any potential work stoppage.”

These warnings come as Maersk in a new market update said “there is considerable uncertainty attached to Q4 volumes,” while highlighting that its last full-year forecast was for demand growth in the range of 4 to 6 percent range. They reported global container volumes grew by 6.6 percent year-over-year in Q2 2024, supported by robust imports to North America and Latin America, and continued strong exports from the Far East Asia region.

Maersk continues to warn customers of pockets of port congestion around the world, especially impacting services in the Mediterranean and East Asia.

The carriers are universal in saying that the supply chain remains fragile and that a U.S. strike could have significant impacts. Maersk has said, “Even a short disruption could require weeks to fully resolve, leading to significant backlogs and delays.”

that matters most

Get the latest maritime news delivered to your inbox daily.

Analytics firm Sea-Intelligence in its analysis said that it believes the U.S. ports could have 13 percent excess capacity for October beyond the projected 2.3 Million TEU. Sea-Intelligence calculated that a 1-week strike at the beginning of October, would not be cleared until mid-November. They said a 2-week strike, would mean that U.S. ports would not be back to normal operations until 2025.

The carriers in announcing their new surcharges called them “indefinite” in their duration.