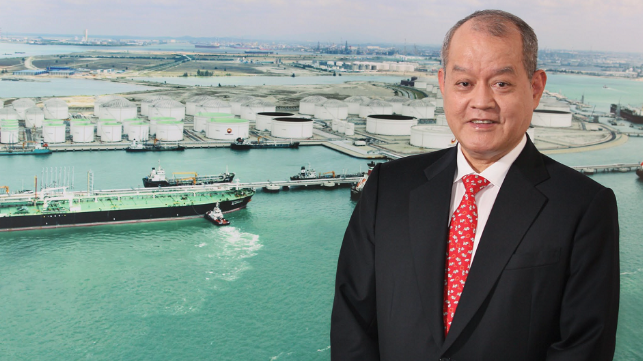

Shipowner O.K. Lim Faces an Additional 105 Charges of Fraud

Shipowner and oil trader Lim Oon Kuin, better known as O.K. Lim, now faces an additional 105 charges in connection with an alleged fraudulent scheme at his now-defunct trading house, Hin Leong Trading Pte Ltd.

Lim already faces 25 charges related to allegations that he instructed a Hin Leong executive to forge sales orders in order to fraudulently apply for letters of credit and accounts receivable financing. The new charges include 36 counts of conspiracy to commit forgery, 68 counts of cheating and one charge of conspiracy to forge a valuable security.

According to the Singapore Police Force (SPF), 35 of these charges relate to Lim's alleged efforts to deceive eight financial institutions into providing Hin Leong with accounts receivable financing totaling $1.2 billion. Lim allegedly informed his lenders that Hin Leong had loaded oil onto tankers to fulfill contracts for the sale of oil to BP and Unipec. One financial institution is still awaiting payment of $55 million in connection with one of these charges.

Another 33 charges relate to an alleged effort to deceive nine banks into providing letters of credit worth $1.1 billion, based on a false representation that Hin Leong was purchasing oil from BP. Four financial institutions are awaiting repayment for $180 million out of this amount.

The remaining 36 charges relate to allegedly forged certificates of quality from a third-party laboratory, Amspec Testing Services Pte Ltd. Lim allegedly conspired with an employee to falsify the certificates and provide them to the buyer, BP, to make it appear that independent testing had been carried out to certify the quality of the oil in a transaction.

Lim's bail amount has been increased to $3 million because the new charges involve more banks, larger sums loaned out and larger sums still outstanding.

Hin Leong has been under judicial administration since it collapsed under the weight of a massive debt load earlier this year. According to PricewaterhouseCoopers, the court-appointed manager, the Lim family manipulated the firm's books through irregular accounting entries in order to hide trading losses. The methods allegedly included overstating inventory and accumulating more debt by deceiving lenders. The misstatements made Hin Leong look profitable, and the company racked up about $3.5 billion in debt that it ultimately could not repay.

With creditors in control of Hin Leong and two related firms, Ocean Tankers and Xihe Capital, liquidation of Lim's businesses is under way. However, creditors of Hin Leong have been able to recover just a fraction of the total $3.5 billion owed. A civil court has given the company's lenders authorization to freeze the personal assets of the Lim family up to the total amount of the company's debt in hopes of enabling a larger loss recovery.