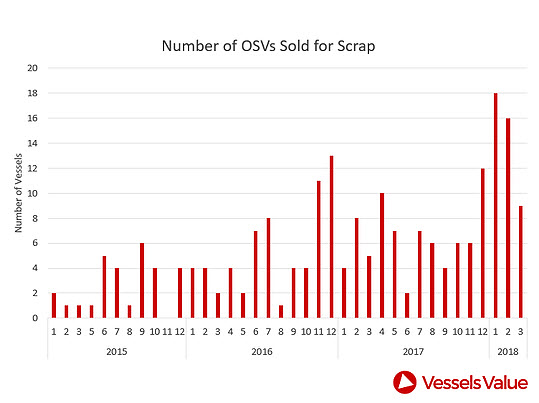

Offshore Support Vessel Scrapping Rates Jump

Offshore support vessel scrapping rates have jumped by over 150 percent, with Tidewater topping the list of companies offloading vessels by selling 13 vessels for scrap so far in 2018.

“In this current period of downturn, critics of offshore shipowners say they have been guilty of not scrapping older tonnage in order to maintain a young and advanced fleet. Though this is justified, rewind to pre-downturn, these debt free older vessels were able to get work on a fairly regular basis and were a cashflow generator for owners,” says VesselsValue Head of Offshore, Charlie Hockless.

No one knew the downturn that started in 2014/15 would be so severe, he says, but analysts and market commentators were quick to point to the high number of idle vessels as one of the principle problems. During the first years of the downturn (2015-2016), owners resisted scrapping vessels, but as its severity increased, and the likelihood of these older vessels returning to work began to diminish, they slowly came round.

that matters most

Get the latest maritime news delivered to your inbox daily.

So far this year, 43 offshore support vessels have been sold for scrap, compared to 17 in the first three months of 2017. “This increase shows owners are biting the bullet and realizing that if they are to survive these poor market conditions, they need to think of the future market rather than the market of the past,” says Hockless.

Despite the low scrap value of old offshore support vessels, owners are putting faith in restructuring and emerging as a leaner entity on the other side, he says, citing Tidewater as an example. Tidewater has increased its pace of scrapping and recently cut its debt significantly through a Chapter 11 restructuring.