Non-Alliance Carriers are Losing Market Share After Years of Growth

After enjoying strong growth during the shipping surge experienced over the past two years, Sea-Intelligence reports that non-alliance carriers are again losing market share. With the current levels of overcapacity rising across most segments of the container shipping industry and possibly getting worse as more new tonnage enters the market, the analysis firm is predicting that the market share for the independent carriers will continue to decline.

“As the market strengthened after the initial Covid hit, there was a confluence of small carriers that started to deploy capacity, especially on the transpacific trade,” said Alan Murphy, CEO of Sea-Intelligence. He notes major carriers also started to introduce services outside the alliance networks. “The idea was to take advantage of the opportunity provided by the very high freight rate environment.”

Taiwan-based carrier Wan Hai for example in 2020 launched an independent transpacific route after its alliance with Pacific International Lines and COSCO ended. In addition, new specialized carriers emerged seeking to offer niche services and appealing to shippers that found it difficult to place smaller cargoes with the big carriers.

(source Sea-Intelligence)

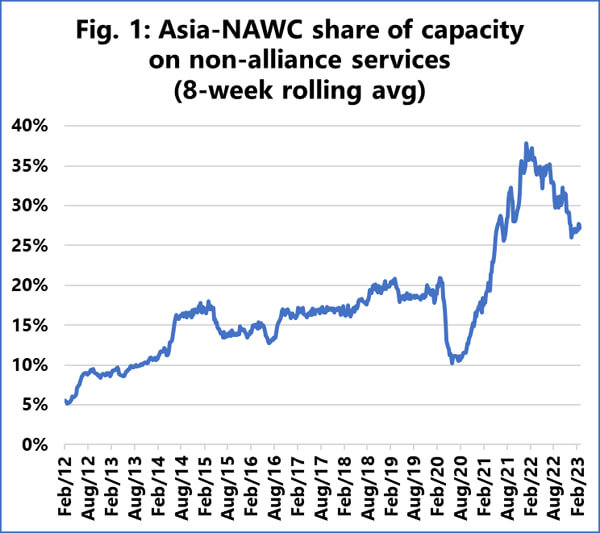

According to Sea-Intelligence’s data, non-alliance carriers were able to increase their share in the three key regions, including Asia to the West and East coasts of North America and Asia to Northern Europe and the Mediterranean.

For the West Coast trade lines, Sea-Intelligence calculates that non-alliance carriers rose from an average of just above 15 percent of capacity before the pandemic to approaching nearly 40 percent of capacity at the end of 2021 and the beginning of 2022. The addition of these non-alliance services Sea-Intelligence says meant that at the peak of the market, the market share of non-alliance carriers had essentially doubled.

“But as the freight rates began to drop in 2022, the share of non-alliance services also began to decline, and looking into 2023-Q1, they are poised to continue to decline,” predicts Murphy. “There is still more relative capacity operated by non-alliance services than before the pandemic, but if the rate of decline continues, this will revert back to pre-Covid levels before the end of 2023.”

On the Asia-North America East Coast routes, Sea-Intelligence reports there was a similar trend of increasing non-alliance capacity as the market initially strengthened. “However, even though there is a distinct decline coming into 2023, there is no sign presently that we are about to go back to pre-pandemic levels,” says Murphy.

that matters most

Get the latest maritime news delivered to your inbox daily.

On the Asia-Europe trades, the non-alliance capacity has increased, but not materially according to Sea-Intelligence. They calculate that the independent carriers represent between two and five percent of capacity. However, on the Asia-Mediterranean routes, there are no signs of non-alliance services reducing their market share in 2023-Q1.

The domination by the alliances has been a rising concern for regulators in many parts of the world. It was a major issue cited in the U.S. markets by the president and other elected officials driving the passage of the reforms to the Shipping Act in 2022. The World Shipping Council for example argued that the alliances create greater market efficiency while the White House cited the rapid growth in the three alliances. They contended that from 1996 to 2011 the major alliances grew from operating about 30 percent of global container shipping compared to 80 percent of global containership capacity and 95 percent of the east-west trade lines in 2022.