Latest Iran-China Oil Sanctions-Avoidance Ruse Detected

Bloomberg and the political pressure group United Against a Nuclear Iran have recently published a report suggesting that in the face of exposure to criticism, Malaysia has reduced its exports of crude oil to China. But Iranian-origin crude oil is now reaching China on replacement routes.

In 2024, Malaysia exported an estimated 1.4 million barrels per day to China, a huge increase over previous years. However, its own domestic production, mostly from Sabah and Sarawak, is only about 500,000 barrels per day. The mismatch can be accounted for by Iranian crude being labeled as Malaysian as it is transferred ship-to-ship in international waters off the coast of Johore - as dramatically illustrated by the explosion of the Iran-serving "dark fleet" tanker Pablo in 2023 (top).

In the wake of this discrepancy being highlighted, Malaysian exports of crude to China dropped more than 30 percent between July and August, with Malaysian authorities identifying more fraudulent mis-labelling of cargos.

But at the same time, ship-to-ship transfers off Johore have continued as before - and the slack has been taken up by a dramatic rise in Indonesian oil exports to China. Bloomberg estimates that shipments of crude from Indonesia to China rose sharply in August to 630,000 bpd from an average in 2024 of 580,000bpd - notwithstanding that Indonesian production from its oilfields in Riau, Sumatra and East Kalimantan is almost all consumed domestically.

Bloomberg suggests that the Indonesian crude for the Chinese ports of Qingdao, Rizhao and Dalian was supposedly loaded in Kabil, opposite Singapore, and identified VLCCs Yuhan/Baltic Commander I (Panama/IMO 9208112), Pola (Unknown/IMO 8690394) and Pix/Thea (Panama/IMO 9298284) plying the route.

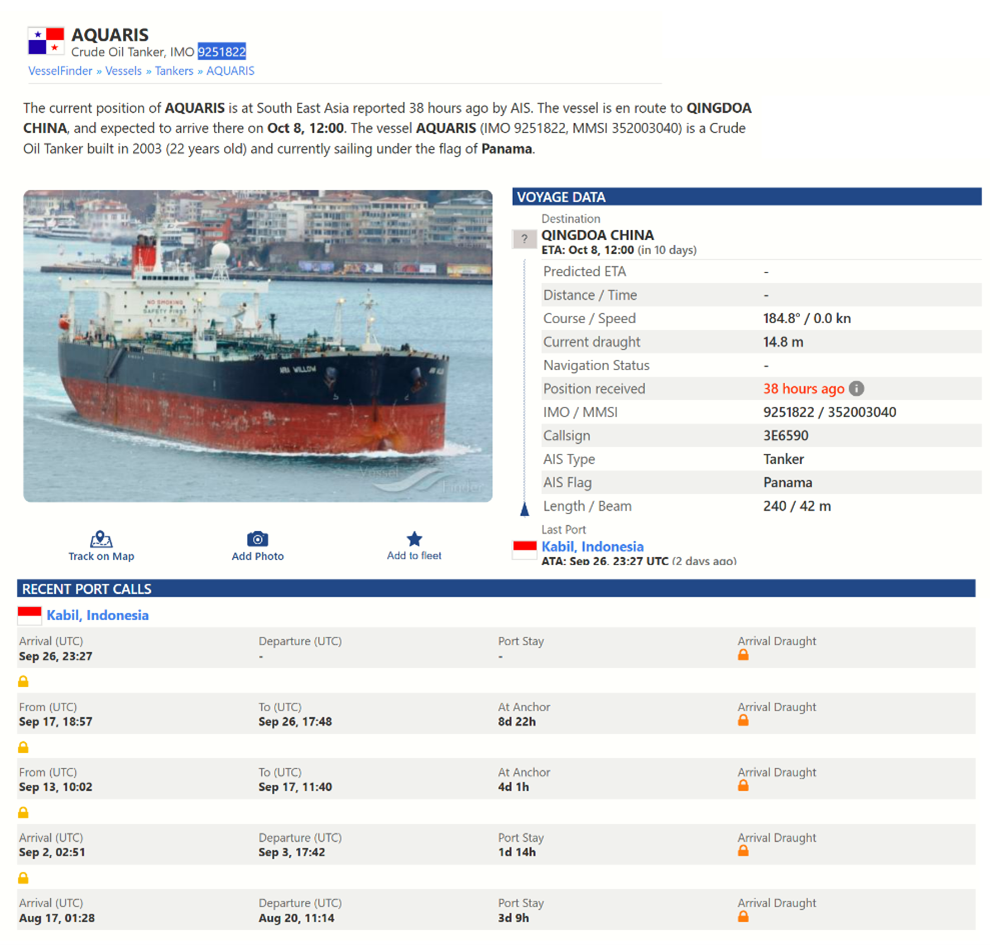

VesselFinder has identified that VLCC Aquaris/Afra Willow (Panama/IMO 9251822) apparently visited Kabil five times since August 17, on return shuttles to China.

VesselFinder has identified that VLCC Aquaris/Afra Willow (Panama/IMO 9251822) apparently visited Kabil five times since August 17, on return shuttles to China (VesselFinder / Cengiz Tokgoz)

However, the loading facilities at Kabil mostly handle LPG, and the loading terminals lie on a creek where tankers are limited to 35,000 dwt and a draft of 10.5 meters. Not only are these four VLCCs too big to dock at Kabil’s piers, they are too large even to anchor off. Moreover, no VLCCs have been spotted in satellite imagery close to the port, all suggesting that the Kabil origin of the Indonesian cargos received in China is fraudulent.

Proximity of Indonesian oil terminals to the Ship-to-Ship transfer box in international waters East of Johore (Maxar/Google Earth/CJRC)

Indonesia does however ship crude from the Duri oilfield in Riau Province via the port of Dumai, in tankers up to 150,000 dwt with drafts up to 17.7 meters. But shipping movements have not changed significantly over the past 12 months.

The implication is that fraudulent documents are being produced to cover the conversion of Iranian into Indonesian oil. Although the Indonesian parastatal Pertamina has suffered from corruption problems in the past, the fact that such issues are chased down and brought to court suggests that there is no official connivance, but that bills of lading are being produced without Pertamina’s knowledge.

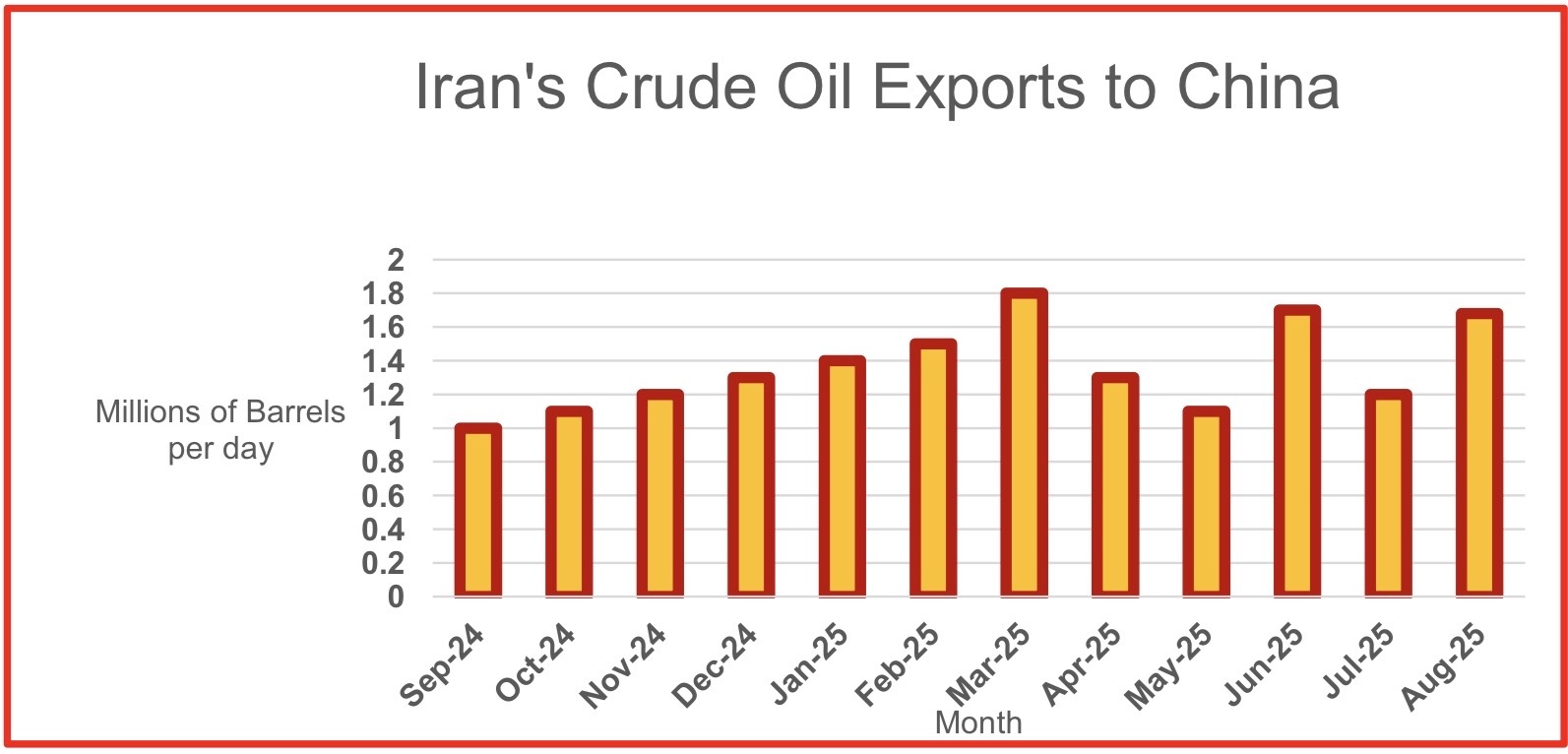

The likelihood is that the fraudulent bills of lading will be examined, and loopholes will be closed. The consequence will be that the Iranians find another spurious port of loading, and the ship-to-ship transfers will continue using the new fraudulent location - until that too is closed down in a few months’ time. Similarly, Chinese ports identified as having received dark fleet oil have this month been banning future deliveries - which will no doubt be delivered to nearby, untainted wharves instead. Whereas official data maintains that China imports no Iranian oil, figures from external analysts suggest that China received 1.45 million bpd of Iranian crude over the first eight months of 2025, slightly above the same period last year.

The sanctions-breakers act far more nimbly than government authorities. Hence China is likely to continue to receive 80 percent of Tehran’s heavily discounted 1.6 million bpd of exported oil - unless cargoes are seized at sea and the lost value inhibits further commercial transactions, creating a deterrent effect.

that matters most

Get the latest maritime news delivered to your inbox daily.

Iranian crude exports to China estimated from Kpler and Vortexa analysis (CJRC)