Genting Hong Kong Files Bankruptcy to Prevent "Disorderly Liquidation"

Genting Hong Kong filed today for the provisional liquidation on the company after reporting that it had exhausted its negotiations and had no further access to liquidity. The company reported that it expects its cash balances to “run out” by the end of January and that it was taking these steps to protect against possible defaults and claims by creditors.

“As the company and the group have no access to any further liquidity under any of group’s debt documents,” Genting Hong Kong advised shareholders that “the board considers that the company will imminently be unable to pay its debts as they fall due.” This includes ongoing operational expenditure and potentially required payments of certain liabilities that are expected to be due this month.

Earlier in the day, Tan Sri Lim Kok Thay, Chairman and Chief Executive Officer, announced that the filing was imminent in order to maximize the chance of success of the financial restructuring and to provide a moratorium on claims while seeking to avoid a disorderly liquidation of the company by any of its creditors. They also reported that all the company’s independent directors had resigned and asked for a suspension in trading of its stock.

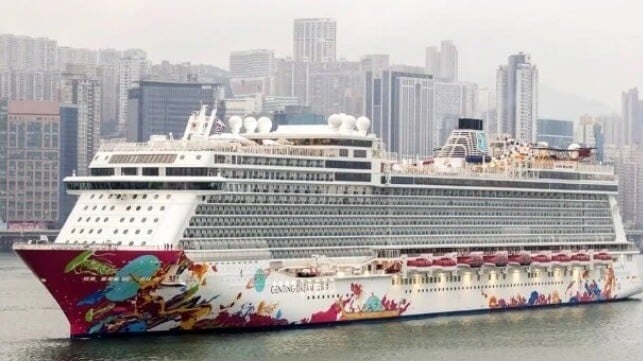

The filing made with the Supreme Court of Bermuda, where Genting Hong Kong is incorporated, calls for the “winding up of the company.” In a hearing scheduled for January 20, they are asking the court to approve the appointment of provisional liquidators who will be charged with developing and proposing any restructuring proposal in respect of the company’s debts and liabilities. Management asks to retain their positions for the day-to-day operations saying that “certain business activities of the group, including but not limited to the operations of cruise lines by Dream Cruises Holding Limited, shall continue .... however it is anticipated that majority of the group’s existing operations will cease to operate.” Genting Hong Kong is the parent company of U.S.-based Crystal Cruises as well as Dream Cruises and Star Cruises headquartered in Asia.

Genting Hong Kong’s recent financial troubles began in 2020 when the pandemic forced the suspension of global cruise operations and later led to stopping work at MV Werften. The company was able to restart Dream Cruises in Asia in 2020 and 2021 and Crystal in mid-2021. The German state provided bridge loans to resume work at the shipyard and an agreement was announced in June 2021 for a larger rescue loan from Germany’s Federal Economic Stabilization Fund (WSF). The fund required 20 percent participation from Genting and in late 2021 renewed negotiations over the package after a report indicated Genting’s declining financial strength and the potential inability to repay the loans.

Yesterday, a court in Germany refused Genting Hong Kong’s efforts to force the release of funds from a “backstop loan” set up in an agreement last summer with the state of Mecklenburg-Western Pomerania where the company’s MV Werften shipyard was headquartered. The company also attempted to access funds held in reserve and a progress payment related to the construction of the Global Dream cruise ship in Germany.

that matters most

Get the latest maritime news delivered to your inbox daily.

Last week, Genting Hong Kong warned after the insolvency filing for the German shipyards that it could in turn trigger cross-default under certain financing arrangements for its debts totaling approximately $2.777 billion.

The company started in the cruise industry in the early 1990s establishing Star Cruises based in Hong Kong. Despite several missteps and frequent changes in the operations, Star was viewed as a leader in the development of Asia’s modern cruise industry. Star surprised the cruise industry in 1999 making a bid that was ultimately successful to buy the U.S.-based Norwegian Cruise Line. Using a new approach to cruising similar to resort hotels, Star successfully contributed to the revival of Norwegian, which had been faltering. Star sold its investments in Norwegian after the company went public, acquiring Crystal Cruises in 2015, starting MV Werften in 2016, and launching the premium cruise brand Dream Cruises in 2016.