Four Year Low in Retail Imports Hurts Port Volumes in US

The import of retail merchandise in 2020 is expected to fall to its lowest level in four years according to new data from the National Retail Federation (NRF). The world’s largest retail trade association reports that retailers' cautious approach is having a direct impact on the volumes at America’s largest container ports.

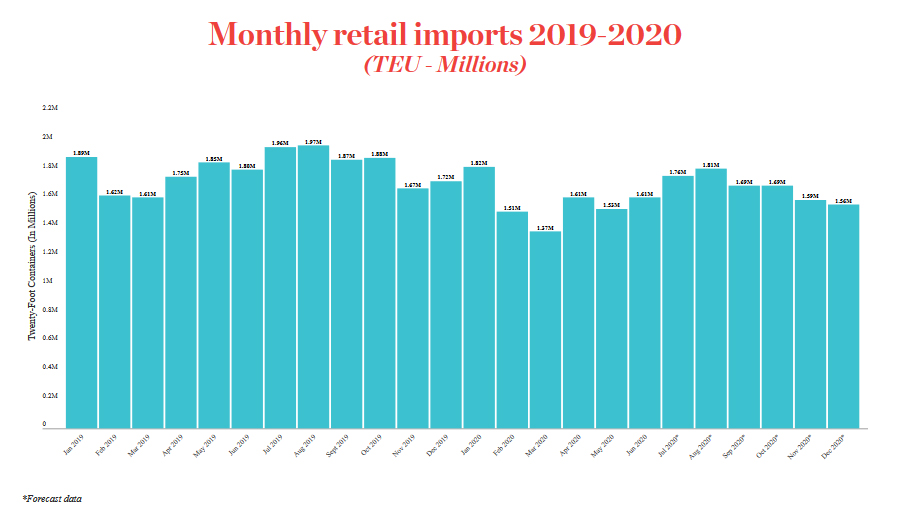

For the year, the monthly Global Port Tracker report released today by the National Retail Federation and Hackett Associates forecasts that container volume at the dozen major U.S. container ports used by retailers for imports will decline more than nine percent versus last year. The projected total of 19.6 million TEUs would be the lowest annual total since 2016.

“The economy is recovering but retailers are being careful not to import more than they can sell,” said Jonathan Gold, the NRF's Vice President for Supply Chain and Customs Policy. “Shelves will be stocked, but this is not the year to be left with warehouses full of unsold merchandise. The more Congress does to put spending money in consumers’ pockets and provide businesses with liquidity, the sooner we can get back to normal.”

Source Global Port Tracker prepared by the National Retail Federation and Hacket Associates

According to the data from the report, while the combined container volume rebounded nearly five percent in June versus May, overall volume was down more than 10 percent versus the year-ago period. For the first six months of the year, the NRF reports that volume at the ports used by retailers to import merchandise was down more than 10 percent to a total of 9.5 million TEUs.

During the next few months of the year, ports would typically see peak volumes as retailers import merchandise for the busy holiday retail season. This year, the Global Port Tracker however predicts that container volume will fall between six and 10 percent each month for the remainder of the year.

August is expected to be the busiest month of the July-October “peak season” when retailers rush to bring in merchandise for the winter holidays. However, with retailers ordering less merchandise, August’s total is expected to be the lowest peak for the season since 2016 and fall by more than seven percent versus 2019. Peak season usually includes the busiest month of the entire year, but this year that was likely January’s 1.82 million TEU according to the NRF's data.

“This year, peak season seems to have been thrown off by the coronavirus pandemic along with just about everything else we consider normal,” Hackett Associates founder Ben Hackett said. “We’ve probably already had our busiest month. With the pandemic taking a hit on the economy ever since then, peak season is likely to be a disappointment by comparison.”

Released every month, the Global Port Tracker provides historical data and forecasts for the largest U.S. ports. It includes Los Angeles/Long Beach, Oakland, Seattle and Tacoma on the West Coast; New York/New Jersey, Port of Virginia, Charleston, Savannah, Port Everglades, Miami and Jacksonville on the East Coast, and Houston on the Gulf Coast.