CMA CGM is Back in the Black

Number three container line CMA CGM released its annual numbers for 2017 on Friday, and its results showed remarkable improvement. Revenue was up by 32 percent and profit rose to $730 million, putting the firm back in the black after a $430 million loss in 2016.

In 2017, CMA CGM carried nearly 19 million containers, an increase of 21 percent compared to the year before. The number includes the first full year of contribution from APL, which CMA CGM bought in late 2016. APL services carried more than five million TEU in 2017 and contributed $340 million to operating income.

CMA CGM attributed part of the strong group performance to the new Ocean Alliance network, which launched last April. The alliance covers 40 shipping services on the East-West trades. The firm said its business performed especially well on the transpacific routes, where its CMA CGM and APL brands have a strong presence.

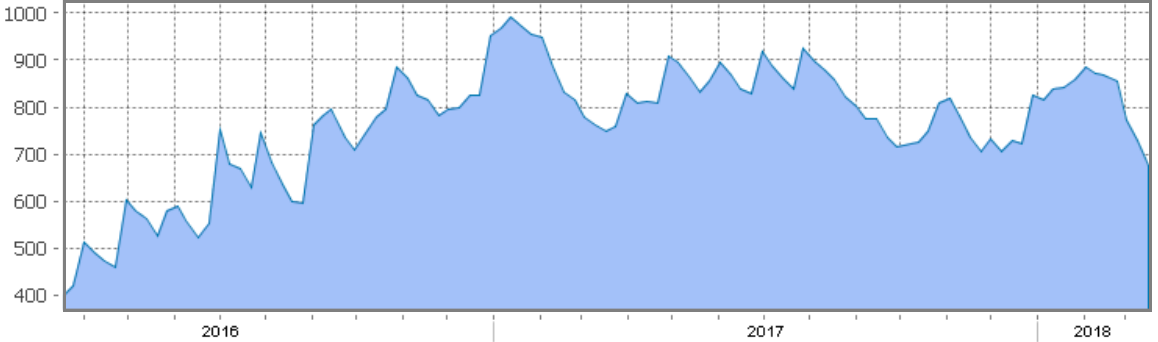

Shanghai Containerized Freight Index 2016-2018, U.S. dollars per TEU (Courtesy SSE)

On top of strong volume growth, increasing freight rates boosted revenue. Average revenue per TEU was up by nine percent relative to the year before, reflecting last year's significant market improvements over the sub-profitable rates seen in 2016.

that matters most

Get the latest maritime news delivered to your inbox daily.

With the revenue side of the equation showing good progress, CMA CGM's cost control measures helped to deliver strong earnings, the firm said. Despite rising fuel prices, it kept unit cost growth to just 1.6 percent. Its EBIT margin stood at 7.5 percent last year, the best in the industry.

Now that it is back to profitability, CMA CGM wants to invest in its future. It is buying nine new 22,000 TEU container ships, the largest in the world, in order to bring its unit costs down. It plans to expand its value-added services, including an integrated inland/logistics portfolio not unlike that championed by Maersk. It is also making significant investments in digital projects like NYSHEX, the new marketplace for ocean freight contracts.