China Surpasses U.S. as Largest Crude Oil Importer

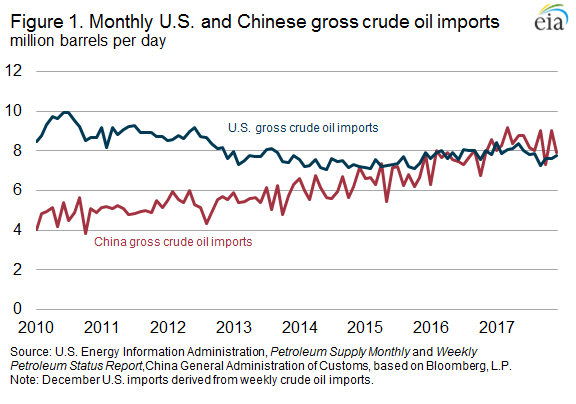

China surpassed the U.S. in annual gross crude oil imports in 2017 by importing 8.4 million barrels per day (b/d) compared with 7.9 million b/d of U.S. crude oil imports.

China had become the world's largest net importer (imports less exports) of total petroleum and other liquid fuels in 2013. New refinery capacity and strategic inventory stockpiling combined with declining domestic production were the major factors contributing to its recent increase in imports.

Figure 1. Monthly U.S. and Chinese gross crude oil imports

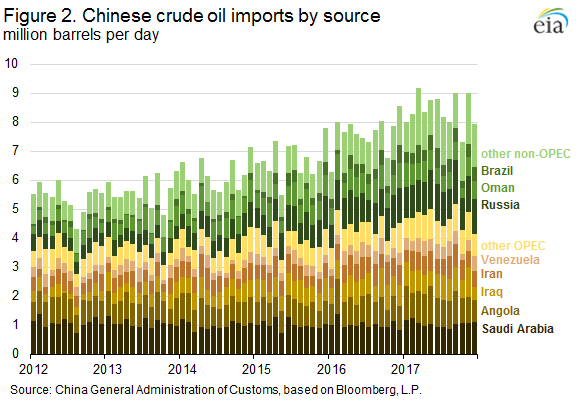

In 2017, an average of 56 percent of China's crude oil imports came from countries within OPEC. This declined from a peak of 67 percent in 2012, while Russia and Brazil increased their market share of Chinese imports more than any other country, from nine to 14 percent and from two to five percent respectively. Imports from Russia, which passed Saudi Arabia as China's largest source of foreign crude oil in 2016, totaled 1.2 million b/d in 2017, while Saudi Arabia accounted for 1.0 million b/d. OPEC countries, and some non-OPEC countries, including Russia, agreed to reduce crude oil production through the end of 2018, which may have allowed other countries to increase their market share in China in 2017.

Figure 2. Chinese crude oil imports by source

Several factors are driving the increase in Chinese crude oil imports. China had the largest decline in domestic petroleum and other liquids production among non-OPEC countries in 2016, and the U.S. Energy Information Administration (EIA) estimates it will have had the second-largest decline in 2017. EIA estimates that total liquids production in China averaged 4.8 million b/d in 2017, a year-over-year decline of 0.1 million b/d (two percent), and expects the decline to continue through 2019.

In contrast to declining domestic production, EIA estimates that Chinese growth in consumption of petroleum and other liquid fuels in 2017 was the world's largest for the ninth consecutive year, growing 0.4 million b/d (three percent) to 13.2 million b/d.

Crude oil import growth has been larger than consumption growth because of inventory building for strategic petroleum reserves. In addition, China has reformed its refining sector through liberalizing import and export restrictions. Since mid-2015, China granted crude oil import licenses to independent refineries in northeast China, which have since increased refinery utilization and crude oil imports.

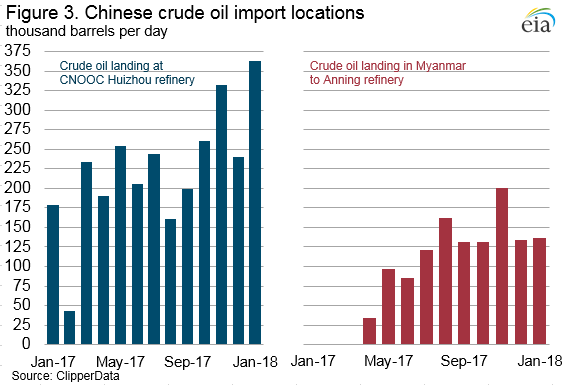

Another factor contributing to increased Chinese crude oil imports is higher refinery runs, which increased by an estimated 0.5 million b/d in 2017 to 11.4 million b/d, driven in part by two refinery expansions in the second half of the year. A 260,000 b/d refinery in Anning in Yunnan province started operating in the third quarter of 2017. This refinery had been delayed several times because of tariff disputes with Myanmar, where crude oil primarily from Saudi Arabia first lands and is then piped to the Anning refinery. In Guangdong province, China National Offshore Oil Corporation (CNOOC) expanded capacity of its Huizhou refinery by 200,000 b/d, increasing its imports from various sources in the third and fourth quarters of 2017.

Figure 3. Chinese crude oil import locations

Infrastructure expansions will likely contribute to further increases in Chinese crude oil imports. In January 2018, China and Russia began operating an expansion of the East-Siberia Pacific Ocean (ESPO) pipeline, doubling its delivery capacity to approximately 0.6 million b/d. According to trade press reports, as much as 1.4 million b/d of new refinery capacity is planned to open in China by the end of 2019. Given China's expected decline in domestic crude oil production, imports will likely continue to increase during the next two years.

that matters most

Get the latest maritime news delivered to your inbox daily.

Source: U.S. Energy Information Administration