BDI Hits 500, But Bulker Overcapacity Remains

On Wednesday, the Baltic Dry Index broke the 500 mark once more, the highest level achieved yet this year. Rates are not yet back into the range of profitability, nor are they more than a small fraction of the levels seen in 2008, when the BDI approached 12,000 points, but Wednesday’s index value still represents a 70 percent increase over the record low of 290 points in February.

Dry bulk suffers under the dual burdens of weak demand – declining Chinese and Indian industrial commodity imports – and significant overcapacity.

Global bulker tonnage has been relatively resistant to change by scrapping, as scrap prices have been down, giving owners less incentive to sell old tonnage to shipbreakers (scrap steel hit a low in the range of $250 per LDT in February – less than half of the value in the first quarter of 2014). Prices have been rising in recent weeks, though, reaching the range of $300 per LDT in early April, and the latest demolition report from Seasure shows that the rate of shipbreaking has outpaced 2015 for the first quarter of the year, for all but the smallest bulkers. Nearly 100 panamaxes and capesizes have been demolished since January, the firm says.

However, Allied Shipbroking said that the recent improvements in scrap may prove to be fleeting. "There are . . . a lot of concerns over the recent rally, with many finding the rise to be still mainly based on the positive sentiment that was left over by the latest [Indian] import levy announced on Chinese steel products, as well as a belief that the Chinese government would do its part to revive its demand for commodities such as steel through . . . restructuring. There is a feel, however, that this market exuberance might have been too hasty and might eventually prove to be unfounded," the agency said.

Industry observers warn that sustained scrapping activity is required to return balance to the market. “The only solution is for shipowners to remove older capesize vessels from the fleet until the market recovers, otherwise the industry faces many more years of losses,” said Rahul Sharan, lead analyst for dry bulk shipping at Drewry, in a release in late January. “Any market correction resulting from inevitable insolvencies will not alone be sufficient to correct supply/demand imbalances.” Drewry called for the recycling of 20 million dwt worth of capesizes.

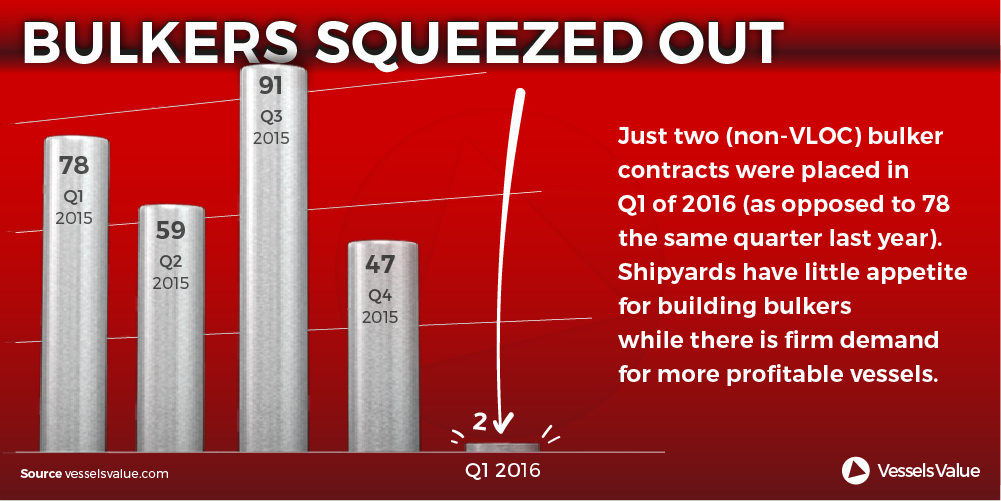

On the orderbook side, tonnage awaiting delivery remains excessive, Drewry says, representing about 15 percent of the present fleet – but it is not growing, at least for standard vessel classes. In a report Wednesday, VesselsValue.com suggested that only two contracts for capesize or smaller bulk carriers were signed in the first quarter, down from 78 in the same period last year. Even these two small additions to the books appear to have been negated by the many orders recently delayed or terminated, such as the five handymax contracts eliminated by Pioneer Marine in March and the Kamsarmax newbuild canceled by Scorpio on Monday. In February, Allied reported that fully half of the 200 bulker orders scheduled for the prior month were delayed or canceled, and predicted that a substantial fraction of the delayed contracts would never see completion – suggesting that the orderbook volume may be much smaller in reality than on paper.

that matters most

Get the latest maritime news delivered to your inbox daily.

But private shipowners’ restraint in ordering and in taking delivery may not be enough to avoid a future of oversupply, given massive state-owned purchases. Last month, COSCO Group, China Merchants and ICBC Financial jointly ordered 30 Valemax bulkers – equivalent to 60 capesizes, totaling 12 million dwt – for purposes of carrying iron ore from Vale's mines in Brazil to the Chinese market. Once delivered, the new Valemaxes alone will add back 60 percent of the dry bulk capacity Drewry has called on shipowners to remove.