Price Fixing Case Will Not Be Resolved Quickly

The outcome of the European Commission’s latest accusation of price fixing against ocean carriers is far from clear based on the information circulated to date.

Although the European Commission wants to stamp out the danger of ocean carriers using GRI announcements to signal pricing strategy to competitors rather than to notify customers of future price increases, the conclusion to its formal antitrust proceedings brought against several of the lines last week is far from obvious.

On the one hand ocean carriers will argue that they are only doing what they have always done, namely notifying customers of future price increases in good faith, which was even a statutory requirement for conference carriers under the old UNCTAD code. Moreover, the way that they have been carrying out the function, rightly or wrongly, hasn’t got them anywhere, as evidenced by the overall downward spiral in freight rates over the past four years – although failing to rob a bank successfully doesn’t make the intended act of theft any more acceptable.

And on the other hand, the EC can counter that since the historical practice of announcing GRIs started, the lack of financial justification for them has become more evident, suggesting that the targeted increases now being implemented are only motivated by supply and demand, so should be less ‘orchestrated’. Its evidence is understood to have been gathered during the dawn raids made on several ocean carrier offices in Europe during May 2011, including those of APL, Cosco, Evergreen, Hanjin, Hamburg Sud, OOCL, Maersk Line, MOL, NYK and MSC. Cost increases that could explain why everyone wanted to raise their rates in particular tradelanes by similar amounts at the same time may have been being sought, but not found.

The reasoning for this stems from the fact that the raids could have been initiated by the British Shippers Council, which claims to have voiced concerns to the EC over the way ocean carriers appeared to be using GRI’s to orchestrate big freight rate increases in the first half of 2011. Be that as it may, shippers have since not let up on the issue, as made clear by this publication at the beginning of July in ‘Follow the price leader?’.

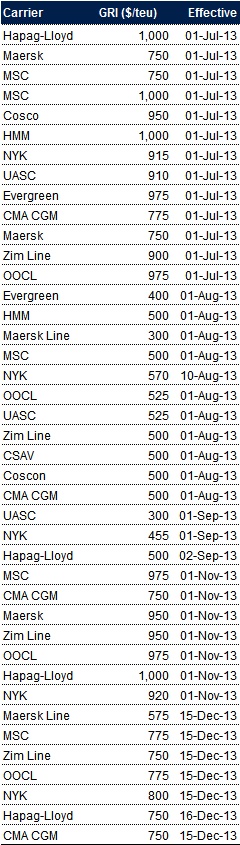

In summary, the ocean carrier practice of openly publishing GRIs is not new, only the scale and intention of it might have changed, as indicated in Table 1. There have been recent cases where some lines have even announced GRI’s, then amended their levels in the light of bigger increases subsequently publicised by competitors. Moreover, the latest increases from Asia to Northern Europe, which are being introduced on virtually the same day (15 December), were publicised within days of each other.

Source: Drewry Maritime Intelligence

The EC can also point to its revised guidelines on horizontal cooperation agreements issued in May 2011, which encompasses communication of information among competitors that could constitute an agreement, a concerted practice, or a decision with the object of fixing prices. In other words, it can be claimed that ocean carriers were warned against ‘price signalling’ over two years ago, but may have subsequently chosen to ignore it.

The problem with this supposition is that the EC’s guidance was only issued at the same time as its dawn raids, although the way that ocean carriers have since escalated the use of GRI’s might have tipped the balance in favor of further legal action. There was also much guidance on horizontal cooperation given in the EC’s old maritime guidelines.

Either way, it is hard to see EC’s legal case against ocean carriers’ GRI intentions being quickly concluded. Regulators outside of Europe do not yet seem to see the need for change, and ocean carriers will surely want to appeal against any adverse ruling, given past precedent. However, that would all change were the EC to table evidence of ocean carriers actually talking to each other over GRI levels, or deliberately orchestrating price increases via GRIs. Much is at stake from such a smoking gun, with the EC permitted to issue fines up to a maximum of 10% of a company’s revenue for antitrust activity.

The EC’s legal proceedings are certainly badly timed for the P3 alliance because Maersk, MSC and CMA CGM need to be seen as responsible carriers in the eyes of industry regulators. Innocence should always be presumed until guilt is proven, but it cannot help to be in the public eye over suspected price fixing when legal acceptance to a deal that requires good customer faith is being sought.

Overview

The legal case against ocean carriers appears to be blown out of all proportion. Based on the information released so far, clearer guidelines on price signalling would seem to be sufficient, that is all. More damming evidence may yet be produced, however.

that matters most

Get the latest maritime news delivered to your inbox daily.

---