USTR Fees Could Cost Top 10 Carriers $3.2B in 2026, says Alphaliner

There continues to be a lot of speculation in the industry over the full extent of the looming U.S. port fees for Chinese-owned, operated, or built vessels calling at U.S. ports. Industry analyst Alphaliner presented a potentially worst-case scenario based on current deployments that shows the 10 largest container carriers could be confronted with approximately $3.2 billion in fees in 2026 to the U.S., if the USTR program proceeds as planned.

The U.S. Trade Representative published its fee schedule in April, but it was put on hold for six months to give the industry time to prepare and time for revisions based on feedback. Experts highlight that the USTR and U.S. Customs and Border Protection have promised additional guidance to the industry, which is yet to be released, and the deadline is looming, set for October 14. Details on the payment mechanism and other aspects remain unclear, as is what impact the closing overnight of the U.S. federal government due to a budget dispute could have on the rollout of the fee program.

Alphaliner calculates, however, that the main container carriers could be subjected to $3.2 billion in fees in 2026 as the U.S. seeks to “reverse Chinese dominance” on the shipping industry and to “restore American shipbuilding.” However, it also points out that the impact could vary greatly on the individual carriers before they work to decrease the impact by shifting vessel deployments and other mitigation steps.

The fees, as defined in April 2025, target vessels owned or operated by Chinese companies. (The exact definition of a “Chinese company” based on the level of investment is one of the issues that the industry is seeking further clarity from USTR.) These vessels will face a flat fee of $80 per net ton per voyage with a maximum of five fees per year.

China’s COSCO Group, which operates both COSCO and OOCL vessels, however, is clearly the one to receive the greatest impact. Alphaliner calculates it would incur more than half the fees generated under the USTR program, or a likely total of $1.53 billion in 2026.

The second category in the USTR program is for vessels built in China, which nearly all the major carriers have, and are operated by any foreign-owned company. These fees apply both to owned vessels and those chartered by the major carriers. The fee is set at the higher of either $23 per net ton or $154 per TEU capacity, again with a maximum of five fees per year. The World Shipping Council, in its comments to the USTR, argued against using net tonnage, saying that it would disproportionately penalize larger, more efficient vessels that deliver essential goods, including components used in U.S. production lines.

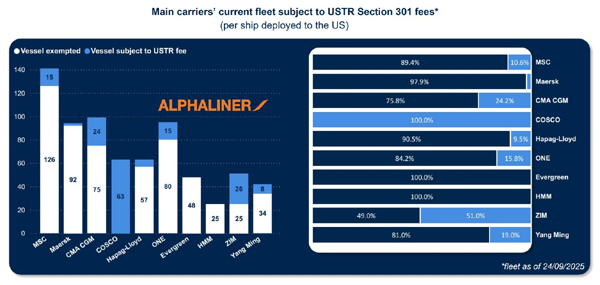

While most of the carriers have said they are working to switch deployments to reduce the impact of the fees, Alphaliner concludes based on current deployments, Maersk and Hapag-Lloyd are the best positioned of the large carriers. Maersk, it says, would “only” be charged $17.5 million and Hapag $105 million, which also benefits the two companies’ Gemini Cooperation.

Reflecting a large number of vessels chartered from Chinese owners, carriers Zim, Ocean Network Express (ONE), and CMA CGM will likely be treated as Chinese-owned ships and incur the higher fees. Alphaliner calculates Zim will feel it the most with $510 million, while ONE has $363 million of exposure, and CMA CGM could incur $335 million in fees.

Other large carriers fall into the category of non-Chinese owned containerships, that however were built at Chinese yards. MSC Mediterranean Shipping, for example, could face $73 million in fees due to its fleet being predominantly built in China. However, with a total fleet of nearly 1,000 ships (676 owned), it may well redeploy to reduce the fee. CMA CGM could incur an additional $50 million for its Chinese-built ships on U.S. routes and Yang Ming fees of $48 million, reports Alphaliner. A carrier such as Yang Ming with just 100 ships is at a disadvantage to redeploy versus the larger MSC or CMA CGM.

Two carriers on the list appear to be in the best position. South Korea’s HMM and Taiwan’s Evergreen, Alphaliner says, have no vessels that will be subjected to the U.S. fees.

Despite the looming fees, the major carriers have continued to place orders for new vessels with Chinese shipbuilders. Some shipbuilder orders, however, have reportedly been shifted to South Korean yards.