Posidonia 2024: Decisions, Decisions, Decisions

Posidonia 2024: once more, the global maritime community gathered in Athens to celebrate the shipping industry’s achievements and discuss its outlook (and party incessantly) amid extremely healthy markets across all segments. Smiling faces dominated all events, though there was a clear understanding that the colossal liquidity amassed during the last few years - even after the significant debt prepayments - should stay largely intact within each respective company’s balance sheet.

But the industry is also perplexed: Where should all this liquidity be invested? Granted, it is better to be perplexed when the Clarksea index hovers around $27,000 rather than when it is stuck at $7,000, but the reasons to worry about the day after are very good indeed.

Simply put, the investment strategy seems largely dominated by the decarbonization process. But the path to 2050 net-zero level is not only extremely narrow, but also needs to be coordinated holistically. No single industry, shipping included, is an island, and no single industry can become a net-zero contributor on its own. Progress in shipping depends on advances in other sectors, with shipping being on the receiving end rather than on the controlling one.

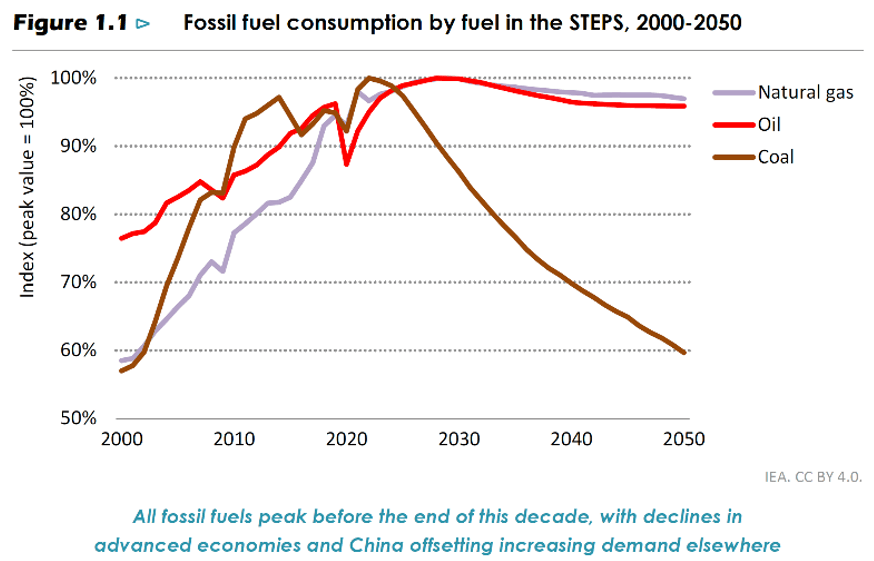

And here lies the first challenge: global decarbonization is progressing dramatically slower than people may think. For every Denmark-like success, energy consumers elsewhere manage to more than counter it by increasing their fossil fuel consumption. IEA’s forecast for coal consumption in 2050, based on current policy settings (below), barely brings it back to about 2000 levels. In this projection, natural gas and oil consumption remain at about today’s levels for decades to come.

If we want to stick to the 2050 zero carbon goal, we need annual investment in clean energy of about $10 trillion a year. Every year [1]. Until 2050. This represents about 10% of the current global GDP, maybe 7.5% if growth is taken into consideration. This is a colossal amount of money to be spent in an internationally coordinated way. One can see why one could be sceptical of the chances of the world getting there within schedule.

The second problem lies with the financiers: there is certainly enough capital around to finance all decent shipping projects (though it is still important to pick the right financing counterparty). But despite some modest initiatives, financiers do not seem overly keen to finance the excess cost of new technology, or to offer materially more competitive terms to the shipping companies that are brave enough to be at the sharp end of the technological spectrum, unless there are significant and tangible benefits from the expected cashflows.

Which leads to the third problem: the market has neither universally recognized the value of most new technologies nor -even more critically - decided how to split it between the charterers and the owners (not to mention that no one has asked the end consumers how much they are willing to contribute).

These three challenges significantly affect the pace of change both at a global level and at the microcosm of shipping, leaving investors in a trilemma:

- Do they “bite the bullet” and order some expensive newbuild vessels (adopting technically and commercially untested technologies), deliverable just in time for the Los Angeles Olympic Games?

- Do they focus on currently available vessels and use the healthy markets’ revenues to finance either the acquisition of more modern ones or the enhancement of the ones they already own, to keep abreast of the current regulations?

- Do they simply keep milking their existing vessels and wait for a regulatory arbitrage, expecting that “something’s got to give” and hoping that that “something” will be the pace of implementation of these regulations?

Most people are aware of - and agreeable to - the strategy of the guy who wore running shoes for a savannah trip (“I don’t need to outrun the lion; I just have to outrun you!”). I am not sure whether everyone agrees on what the “running shoes” in this case are. In fact, different shipping companies may come to different conclusions, each one relevant in their case. What is for sure is that different pairs of running shoes will lead to significantly different outcomes, especially since no one knows yet what kind of terrain the shipping industry will need to run on. Or even if it will have to run, jog or simply walk.

that matters most

Get the latest maritime news delivered to your inbox daily.

Dimitri G. Vassilacos is a Partner at Ship Finance Solutions (SFS), a boutique financial consulting firm specializing in the shipping sector. Prior to that, he held a variety of positions during a 20-year-long career in the banking sector, including Managing Director & Head of Greek Shipping at Citibank and Manager of the Shipping Division at National Bank of Greece.

[1] McKinsey and Company (2022). The Net Zero Transition: What It Would Cost, What It Could Bring.

The opinions expressed herein are the author's and not necessarily those of The Maritime Executive.