Op-Ed: In 2024, LNG Solidified Its Role in Shipping's Decarbonization

Over the past few months we have seen a resurgence of investment in vessels fuelled by LNG. The IMO's targets for 2030, and furthermore 2050 have placed increased urgency on the shipping industry to find accessible, viable, and commercial alternatives to the VLSFO of today.

With its ability to reduce greenhouse gas emissions today and tomorrow, liquefied natural gas along with its bio and synthetic derivatives have rapidly cemented their role in shipping's decarbonization efforts. And its compatibility with existing transportation and storage infrastructure means it is globally available - in contrast with other alternative marine fuels.

Global Orderbook: the current state of play

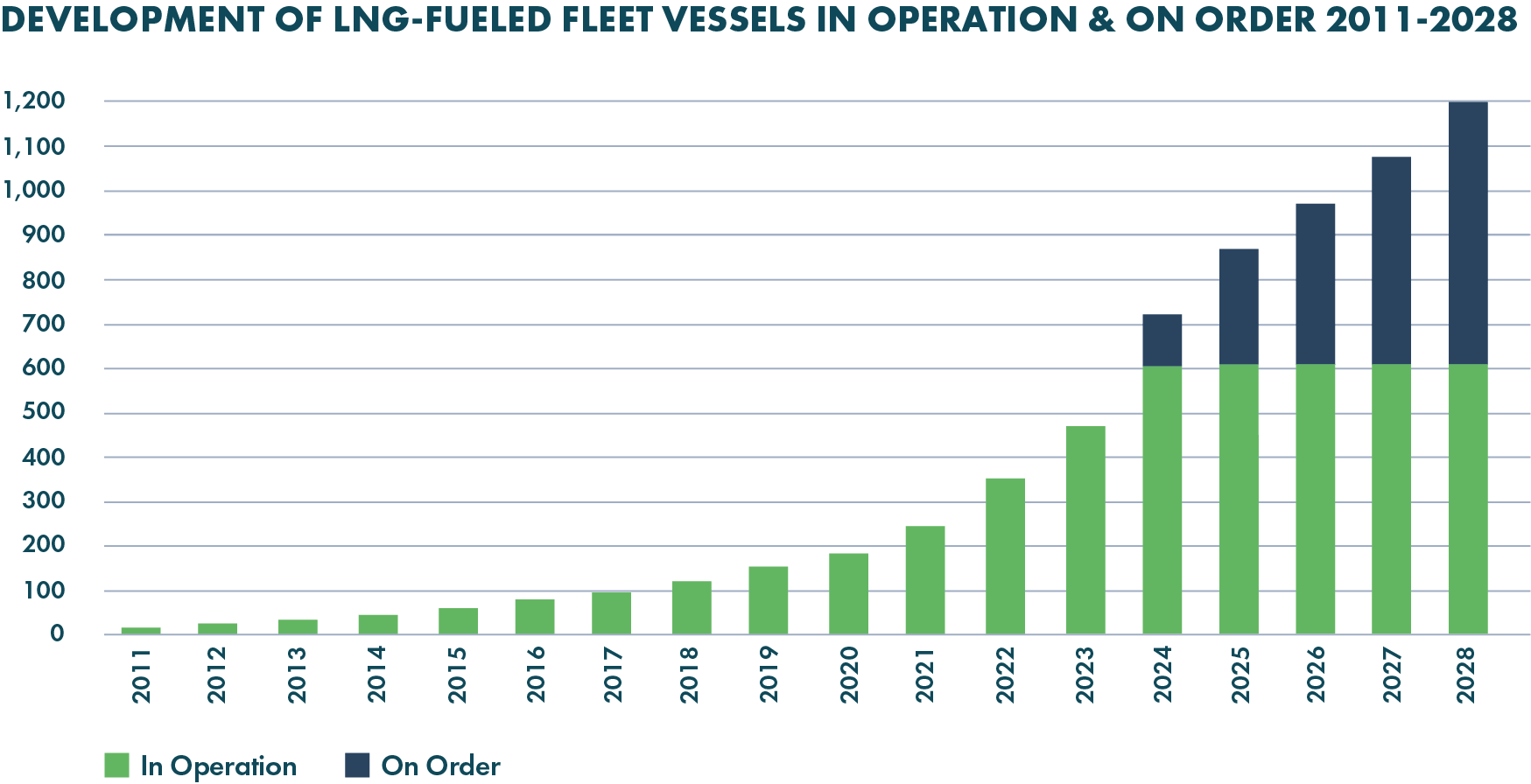

At time of writing, there are 609 LNG-fuelled vessels in operation worldwide, and a further 632 on order - excluding LNG carriers. If we were to look again at those figures including carriers, the number of vessels in operation drastically increases to 1,314, with 983 on order. By way of comparison in 2010, there were just 21 LNG-fuelled vessels in operation.

Not insignificant when looked at in isolation. But when you consider that LNG-fuelled vessels amount for some 4% of the global fleet (of around 60,000 vessels in total) the strength of LNG buy-in becomes even clearer.

It's likely that, given the most recent figures, this trajectory will continue. In October 2024, DNV reported a record-breaking month for alternative fuel orders amounting to 66 LNG-fuelled vessels, with 29 methanol and 2 LPG (liquefied petroleum gas).

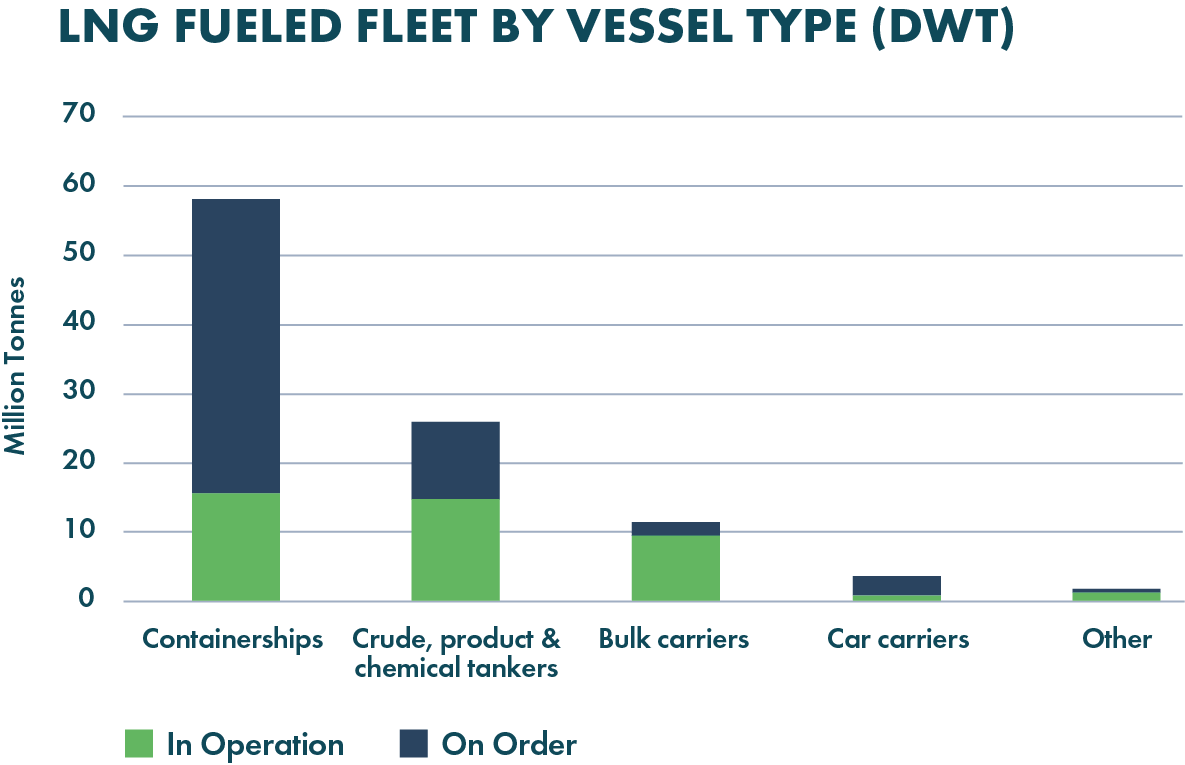

The container segment, the most fuel-intensive sector, is leading the uptake of LNG as a marine fuel. Key players include MSC and CMA CGM who are looking forward to taking delivery of an additional 92 and 34 LNG dual fuel vessels, respectively, from 2025 onwards. While AP Moller Maersk this year announced an investment of US$4.6bn on up to 22 LNG dual-fuel container ship newbuilds, and Hapag-Lloyd have signed a contract for 24 new LNG dual-fuelled container vessels.

So, what's driving this growth in investment?

LNG's immediate & future potential

When it comes to realizing net zero, long-term investments are key for owners and operators.

Shipping is up against stringent regulations and competitive markets. Meaning that any investment in an alternative fuel solution needs to move the needle on emissions now, and have the potential to achieve future targets without costly retrofits or the need for vast infrastructure change.

This is precisely where LNG can meet those very needs.

In its current form, the fuel option can reduce greenhouse gas emissions from marine propulsion by up to 23% in high-pressure engines - which are dominating the orderbook. Methane slip in these vessels (the most common counterargument in the fuel narrative) is minimized to a near undetectable level when operating at recommended power-loads. And technology to eliminate slip in other engine types is continuously evolving.

But LNG's draw is as much about its future potential as it is about its immediate impact.

By adopting liquefied biomethane - AKA renewable natural gas (RNG) or bio-LNG - owners and operators can realise GHG emissions reductions of up to 80%. When produced from anaerobic digestion of manure, these figures can be as high as 188% compared to traditional marine fuels.

Liquefied e-methane (or hydrogen-derived renewable synthetic LNG) takes the industry one step further. It's fully compliant with the IMO's 2050 regulations and can result in carbon neutral operations. Leading to a net zero future across the shipping industry.

The role of supply & demand

It's much like the chicken and the egg scenario.

The developments we've seen in recent years to make the fuel more globally accessible has spurred shipping companies towards adoption. Similarly, growing demand has accelerated the investments to ensure LNG bunkering is achievable in ports worldwide.

Today, LNG bunkers are available in ~185 ports worldwide, but that number is set to increase to 235 by 2025. Liquefied bio-methane bunkers are also available in ~70 ports across global trade routes in Asia, Europe and North America.

There are also rising concerns over the availability of some other commonly cited alternatives, such as bio- and e-methanol, and the rising cost of the fuel alternative. In 2023, methanol-fuelled vessels accounted for some 51% of new container ship orders, whereas 2024 saw that figure drop to just 21%.

The Future of LNG

The 'LNG pathway' can effectively achieve 2030 regulations and a net zero future by 2050 through liquefied biomethane and later e-methane. For an industry facing increased pressure to decarbonize, this offers a robust and incremental solution to achieving net-zero emissions.

The fuel's wider proposition of compatibility to existing infrastructure, growing availability, and commercial viability helps cement the alternative as a leading future fuel for shipping.

that matters most

Get the latest maritime news delivered to your inbox daily.

We see this reflected not only in shipping giants' long-term investment in LNG, but in the numbers displayed in the global orderbook, and the headlines which have dominated 2024. All of which are likely to continue in 2025.

Steve Esau is COO of SEA-LNG, a multi-sector industry coalition whose members work together to demonstrate the environmental and commercial benefits of LNG as a marine fuel and the pathway it offers for maritime decarbonization.

The opinions expressed herein are the author's and not necessarily those of The Maritime Executive.