How North Korea Could Impact Energy Markets

North Korea fired a missile over Japan yesterday signalling "the first step" of military operations in the Pacific and with plans for more launches.

Any further tension or launches could potentially impact its neighbors who are the world's largest energy importers – China, Japan and South Korea, which accounts for 34 percent (13.6 Mb/d)of seaborne oil trade flows, 55 percent (143 MT) of LNG trade, and 46 percent (551 MT) of seaborne coal trade globally in 2016.

In the event of any conflict, China could more readily tap into its domestic coal and gas resources, but Japan and South Korea could be left wanting given their large dependence on imports and their usual practice of not maintaining large stockpiles. The threat of conflict could help drive restarts in Japan's flailing nuclear industry.

Oil markets would also be severely affected. Around 65 percent of Asia's refining capacity is located in Japan, South Korea and China.

Oil markets would also be severely affected. Around 65 percent of Asia's refining capacity is located in Japan, South Korea and China.

Oil demand in Japan and South Korea could still be met for at least 90 days by the emergency stockpiles mandated for OECD countries. China could dip into its Strategic Petroleum Reserves for the first time since it started building these three or four years ago, in a worst case scenario.

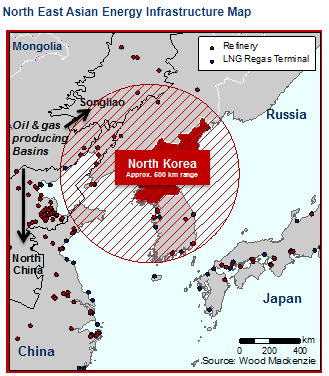

Like with coal and gas, China has domestic oil production options, although up to 58 percent of this could be at risk of shut-in in the event of escalating tensions. Around 1.5 million b/d of China's 3.95 million b/d crude production comes from the North China basin, with the nearest field just 200 kilometers from the North Korean border. Another 0.8 million b/d is produced from the Songliao basin, approximately 400 kilometers from the border.

that matters most

Get the latest maritime news delivered to your inbox daily.

Escalating security risks on the Korean Peninsular will drive increased price volatility across the commodities. A demand-side risk of this scale could put downward pressure on price globally, but regional stockpiling and increased logistics costs could equally lead to a short-term price premium.

Chris Graham is Product Suite Director, Gas and LNG, at Wood Mackenzie.

The opinions expressed herein are the author's and not necessarily those of The Maritime Executive.