Sustainably Linked Sace-Guaranteed Financing Strengthen Financial Structure

The financing is linked to sustainability targets

[By: Fincantieri]

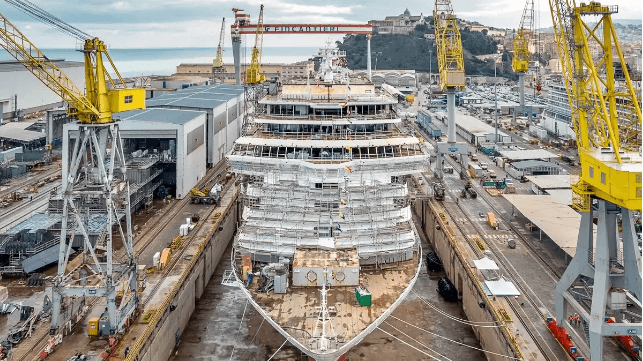

Fincantieri signed yesterday a EUR 800 million facility agreement, 5-year tenor with 3 years grace period, 70 per cent guaranteed by SACE, the insurance-financial group directly controlled by the Italian Ministry of Economy and Finance, in line with the SupportItalia Guarantee provided by the Legislative Decree No. 50 of May 17, 2022.

The pool of lending banks is composed by BNP Paribas CIB Italia - also acting as Bookrunner, Agent Bank, Structuring Bank and Sustainability Coordinator, and the Original Lenders Santander Corporate & Investment Banking (Santander CIB), CaixaBank, S.A. Italy Branch, Intesa Sanpaolo S.p.A. IMI Corporate & Investment Banking Division also acting as Sustainability Co-Coordinator, Banco BPM, BPER Banca, Deutsche Bank, Banca Monte dei Paschi di Siena, BNL BNP Paribas.

The financing is meant to address the funding needs linked to the Group's organic growth and the development of its backlog, in accordance with the provisions of the Legislative Decree No. 50 of May 17, 2022.

The financing is "sustainability linked", as it is intertwined with the achievement of three KPIs set in the 2023-2027 Sustainability Plan, namely the reduction of Scope 1 and Scope 2 Green House Gas (GHG) emissions, the development of high energy efficient cruise ships in Italy, and the attention to gender representation by promoting women in senior roles.

The guarantee by SACE and the portion of the loan to be granted by Banca Monte dei Paschi di Siena represent related parties transactions, respectively of minor and major significance, as per applicable laws and regulations. Both transactions benefit from the exclusion of the procedural regime provided for ordinary transactions and finalized at market conditions.

The products and services herein described in this press release are not endorsed by The Maritime Executive.