PALFINGER on Target for New Record Year

[By: PALFINGER]

The positive global economic environment is reflected in the results of the first three quarters of 2021: in terms of revenue and earnings, they represent a new record in PALFINGER’s corporate history.

Record Order Intake

PALFINGER continues to benefit from the economic upswing and the positive market environment. The company has achieved record order intake in almost all product lines and regions. In the third quarter, PALFINGER also won a major follow-up order in Thailand for the delivery of 148 loader cranes to the state-owned Provincial Electricity Authority. Following the acquisition of an innovative technology for Offshore Passenger Transfer Systems, PALFINGER is also expanding its position as a full-service provider in the offshore sector.

Supply Chain Task Force Implemented

The worldwide material bottlenecks and negative effects on supply chains also affect PALFINGER’s production which has led to increased effort in capacity management. "PALFINGER has deployed its own Supply Chain Task Force to proactively manage any upcoming constraints to secure maximum production volume,” emphasizes PALFINGER CEO Andreas Klauser. Due to the increase in raw material costs, PALFINGER raised its prices significantly in several steps this year. This did neither negatively impact the strong demand, nor did we lose orders.

Key Financials

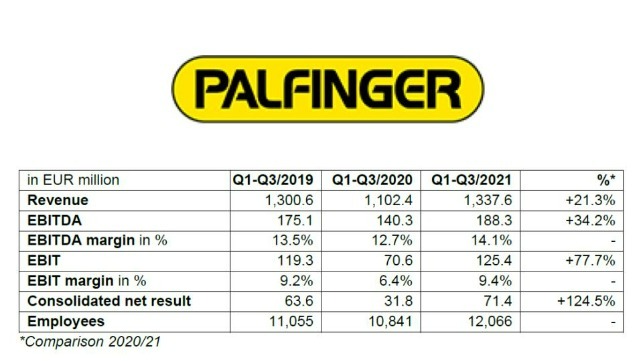

Revenue of PALFINGER AG amounted to EUR 1,337.6 million in the first three quarters of 2021 against EUR 1,102.4 million for the same period in the previous year. This represents an increase of EUR 235.2 million, or 21.3 percent.

EBITDA increased by 34.2 percent to EUR 188.3 million compared to the same period in 2020. The operating result (EBIT) increased from EUR 70.6 million at the end of Q3 2020 to EUR 125.4 million, while the consolidated net result amounted to EUR 71.4 million, up from EUR 31.8 million, as at 30 September 2020.

Net debt has been reduced from EUR 459.0 million to EUR 421.0 million. The net debt/EBITDA ratio of 1.78 is at a remarkably low level.

Outlook

In order to secure capacity for future growth and further efficiency, PALFINGER invests around EUR 130 million in 2021, the highest amount in the company’s history. This also includes the acquisition of the global headquarters in Bergheim. Despite the shortage of materials and components, Andreas Klauser gives a positive outlook: “Our order books provide us with good visibility and utilization of capacity until the 2nd quarter of 2022”.

For the full fiscal year 2021, PALFINGER aims to reach revenues in excess of EUR 1.75 billion and an EBIT of more than EUR 150 million. As a result, the medium-term financial targets for 2024 have been increased. By 2024, EUR 2.3 billion in revenue should be achieved through organic growth, with an EBIT margin of 10 percent and 12 percent ROCE.

The products and services herein described in this press release are not endorsed by The Maritime Executive.