3rd Quarter Transatlantic Container Market Collapse Worse Than COVID Crash

July and August saw rates in freefall as capacity deluge swamped weak cargo demand, writes Daniel Richards, Containership market analyst, MSI

[By: MSI]

Within container freight markets one of the most striking recent developments has been on the Transatlantic trades, where spot freight rates have collapsed to below levels seen even in 2019.

MSI had forecasted a gradual return back to the normal pre-pandemic levels of around $2,000/FEU on the Europe-USEC WB trade - and indeed rates hovered just above this level throughout June. But the abrupt nature of developments in July and August caught us by surprise, as rates tumbled from $2,082/FEU on 2/7/2023 to $1,100/FEU on 27/8/2023, according to Freightos. Rates have held at a similar level over the course of September.

This is a staggering 45% decline in a period of less than two months. And even more strikingly, this level is over 40% lower than in the same date back in 2019.

To better understand the changes the drivers behind it, it makes sense to break this rate collapse down into two distinct phases. The first period covers the first six months of 2023 in which rates declined from $5,724/FEU on January 1 2023 to $2,082/ FEU on June 25, 2023. This was a predictable process and there were two main drivers that led to this.

The first was the significant decline in cargo demand which registered a 13.1% decline ytd in the first six months of 2023. The second - and we believe a lot more impactful – was the rapid decline in port congestion in USEC ports and, to a lesser extent, in Northern European ports as well.

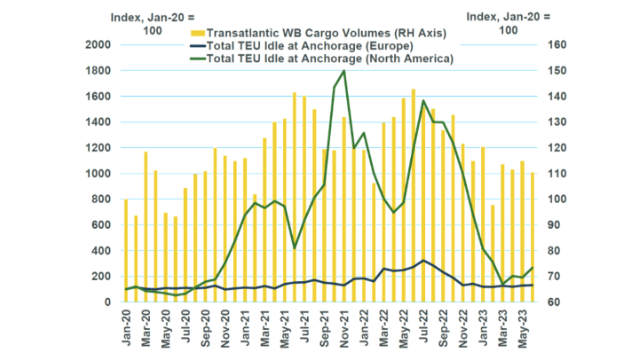

The Chart visualizes these trends. Our index for US port congestion measured in total TEU idle at anchorage stood at 359 in December 2022, plunged all the way down to 73 in March 2023 and then rose a little again to 140 in June.

The declines were much smaller in European ports from 142 in December 22 to a low of 118 in February 2023 and 131 in June.

The second period covers the past two months, during which rates fell unexpectedly, way below the 2019 levels. Although there is limited demand data available for August yet, we suspect that cargo volumes were very weak, continuing the trend seen over Q2. This in combination with notably higher capacity that has been deployed to this trade compared to the 2019 levels explains the rate collapse in the best way possible.

By comparing the total capacity deployed on the Transatlantic trade in July 2023 against July 2019 we can see that there was a surge of 135,000 TEU (+14.4%), at the same time when demand was practically stagnant or even potentially slightly reduced. Average loop durations increased only marginally by 0.6 days (+1.4%) over this period, meaning the extra capacity was not being absorbed by lengthening their sailing times.

This led to offered weekly capacity rising by around 6% compared to the same period in 2019, which although not as much as might have been expected given the inventive of carriers to capitalise on higher freight rates, if seen in combination with lower levels of landside port congestion constitutes a more significant increase in available capacity to the market.

More broadly, our outlook for the mainlane freight rates has remained broadly stable compared to our expectations in Q2 23. We expect the recent spike in the Asia-Europe Westbound and the Transpacific Eastbound trades to run out of steam quickly, within the next month or two. From then on, we expect rates to deteriorate further in the first half of 2024, although the pre-Lunar New Year period might bring about temporary respite.

The magnitude of the deterioration thereafter will be defined by how aggressive and coordinated the carriers will be in their capacity management. The Transatlantic Westbound rates are not expected to fall any further, since they already stand at a level equal to the worst years in container shipping history, 2016 and 2017. The most likely development in the coming months is a stabilization or a slight uptick if enough excessive capacity is removed.

Later in 2024, however, we expect a rebound in rates, likely coinciding with what should be a firmer peak season next year. We also anticipate rates to increase again in 2025 as the global economy picks up pace. In general, however, the coming 12 months are likely to be challenging for liner companies, and risks to the outlook are weighted to the downside. A multi-year slump remains a distinct possibility.

The products and services herein described in this press release are not endorsed by The Maritime Executive.