Enthusiasm for Newbuild Orders Starting to Wane

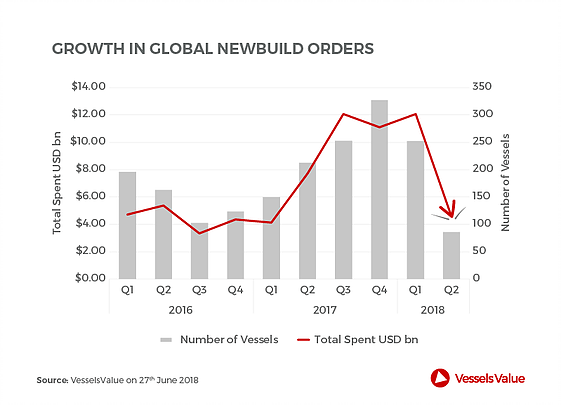

The enthusiasm for newbuild orders across most shipping markets has started to wane after over $10 billion was committed in the first quarter of 2018. The total committed to new deliveries is now the lowest since the start of 2016.

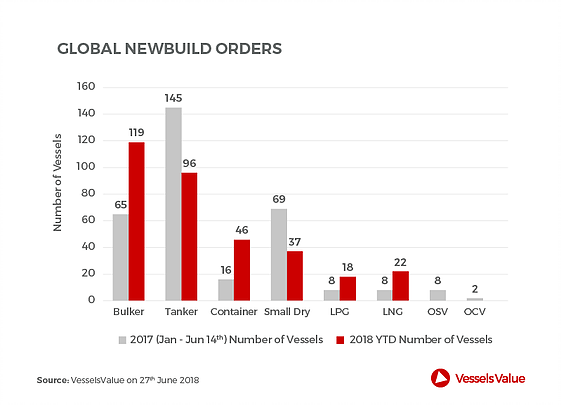

Ordering trends in the start of the year were highest in the markets that were seeing the highest returns. This includes the dry bulk and LNG carrier markets, while interest in the low earnings environment tanker markets was softer. In one sense this highlights the short-term view that some investors take of the market. It still appears to be easier to secure financing for ships in a strong market as opposed to those that are suffering in the doldrums.

Rising asking prices from shipyards are partially to blame in the downturn in new orders. Higher steel prices, smaller workforces, and less willingness by the yards creditors to accept low margins are contributing to lower buyer interest.

The slowdown in newbuilds is an encouraging sign that over-ordering may not be a significant issue. Some of the market segments have a large outstanding orderbook, but most of these are offset by an equal number of ships on the water which are equal to their recycling value. If orders remain between the $4-$8 billion dollar level through rest of the year it should support the asset values of younger ships as well.

that matters most

Get the latest maritime news delivered to your inbox daily.

The headwinds to global trade may give some owners pause in fleet renewal plans, especially in the container and dry bulk markets which would be directly impacted by the higher prices for consumer goods which would result from tariffs. However, most shipping markets appear to be at their trough level or improving, which should encourage more investor interest in newbuilds going forward. The shift in money being committed to the ships is a good reminder that the cyclical nature of the business remains intact.

Court Smith is an analyst at VesselsValue.

The opinions expressed herein are the author's and not necessarily those of The Maritime Executive.